Introduction: The Allure of Options Trading

In the ever-evolving world of financial markets, options trading has emerged as a captivating strategy, offering traders the ability to navigate market volatility and potentially amplify their returns. Options, as financial instruments, provide the right, but not the obligation, to buy (in the case of call options) or sell (put options) an underlying asset at a predetermined price within a specified period. Saxo, a leading provider of online trading and investment services, has established itself as a vanguard in the realm of options trading, empowering traders with an array of innovative tools and resources.

Image: www.brokersview.com

A Journey into Options Trading: Unveiling the Basics

Options trading involves two parties: the option buyer and the option seller. The buyer of an option acquires the right to exercise the option, while the seller assumes the obligation to fulfill the contract. Intrinsic value and time value are crucial concepts in options trading. Intrinsic value represents the difference between the strike price (predetermined price) and the current market price of the underlying asset. Time value, on the other hand, reflects the premium paid for the option’s remaining life. Understanding these concepts is pivotal in assessing the potential profitability of an options trade.

Navigating the Types of Options: Calls, Puts, and More

A fundamental aspect of options trading lies in discerning the different types of options available. Call options grant the holder the right to buy an underlying asset, while put options provide the right to sell. Long positions involve buying options, conveying the right to exercise this option at a later date. Conversely, short positions necessitate selling options, obligating the seller to deliver if the buyer exercises their right.

Leveraging Options Strategies for Versatile Trading

The versatility of options trading extends beyond the basic types of options, offering traders a plethora of strategies to align with their risk tolerance and market outlook. Some popular strategies include:

-

Call Spreads: Involves buying one call option and selling another call option at a higher strike price to reduce risk and enhance profit potential.

-

Covered Calls: Enables traders to generate income from stocks held in their portfolio by selling call options against these underlying assets.

-

Put Spreads: Consists of buying one put option and selling another put option at a lower strike price to hedge against potential losses or speculate on market declines.

Image: brokerchooser.com

Empowering Traders with Saxo’s Cutting-Edge Platform

Saxo’s comprehensive platform empowers traders with a suite of advanced tools designed to streamline options trading. SaxoTraderGO, a cutting-edge trading solution, offers user-friendly charting capabilities, real-time market data, and comprehensive risk management features to assist traders in making informed decisions. The platform also grants access to Saxo’s extensive research materials and educational resources, furnishing traders with a robust knowledge base to enhance their trading acumen.

Expert Insights: Unraveling the Nuances of Options Trading

To further illuminate the nuances of options trading, let’s delve into insights from renowned experts in the field. Dr. John Hull, a leading authority on options and derivatives, emphasizes the importance of understanding market risks and volatility in options trading. According to Dr. Hull, “Volatility is the key to understanding options pricing and the potential rewards and risks involved.”

Tips for Enhanced Options Trading

-

Define Your Objectives: Clearly establish your investment goals and align your options trading strategy accordingly.

-

Due Diligence is Paramount: Thoroughly research the underlying asset and market conditions before executing any trades.

-

Risk Management Matters: Implement comprehensive risk management strategies to minimize potential losses and safeguard your capital.

-

Learn from the Experts: Seek guidance from credible sources and experienced traders to refine your trading skills.

Options Trading With Saxo

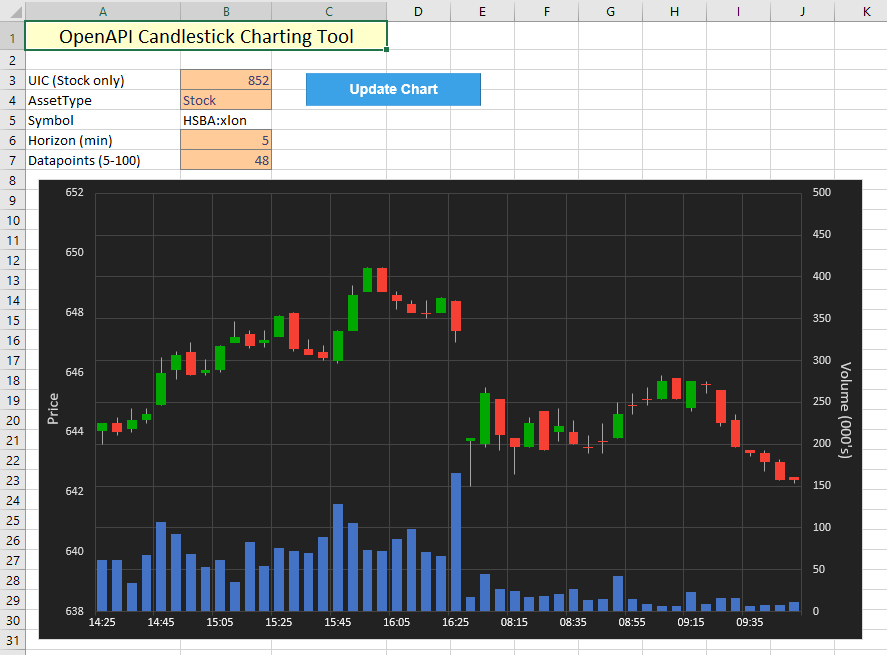

Image: www.developer.saxo

Conclusion: Unveiling the Path to Trading Empowerment

Options trading with Saxo empowers traders with an unparalleled opportunity to navigate market volatility and augment their returns. By harnessing the platform’s advanced tools and resources, traders can delve into the realm of options with precision and confidence. Remember, a prudent approach, coupled with a comprehensive understanding of market risks and opportunities, is key to maximizing your trading potential. Embrace the knowledge provided in this guide and embark on your options trading journey with Saxo, the trusted partner for discerning traders seeking success in the financial markets.