Introduction

Options trading has gained immense popularity among investors seeking to enhance their portfolio returns and manage risk. Saxo Bank, a leading provider of online trading services, offers a robust platform for options trading, catering to the needs of both novice and experienced traders. This in-depth guide delves into the intricacies of Saxo options trading, providing a comprehensive overview for aspiring traders.

Image: torodemotrading.com

Understanding Options Trading

Options are derivative contracts that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) on or before a predetermined date (expiration date). Options trading provides traders with versatility, enabling them to speculate on market movements and hedge against portfolio risks.

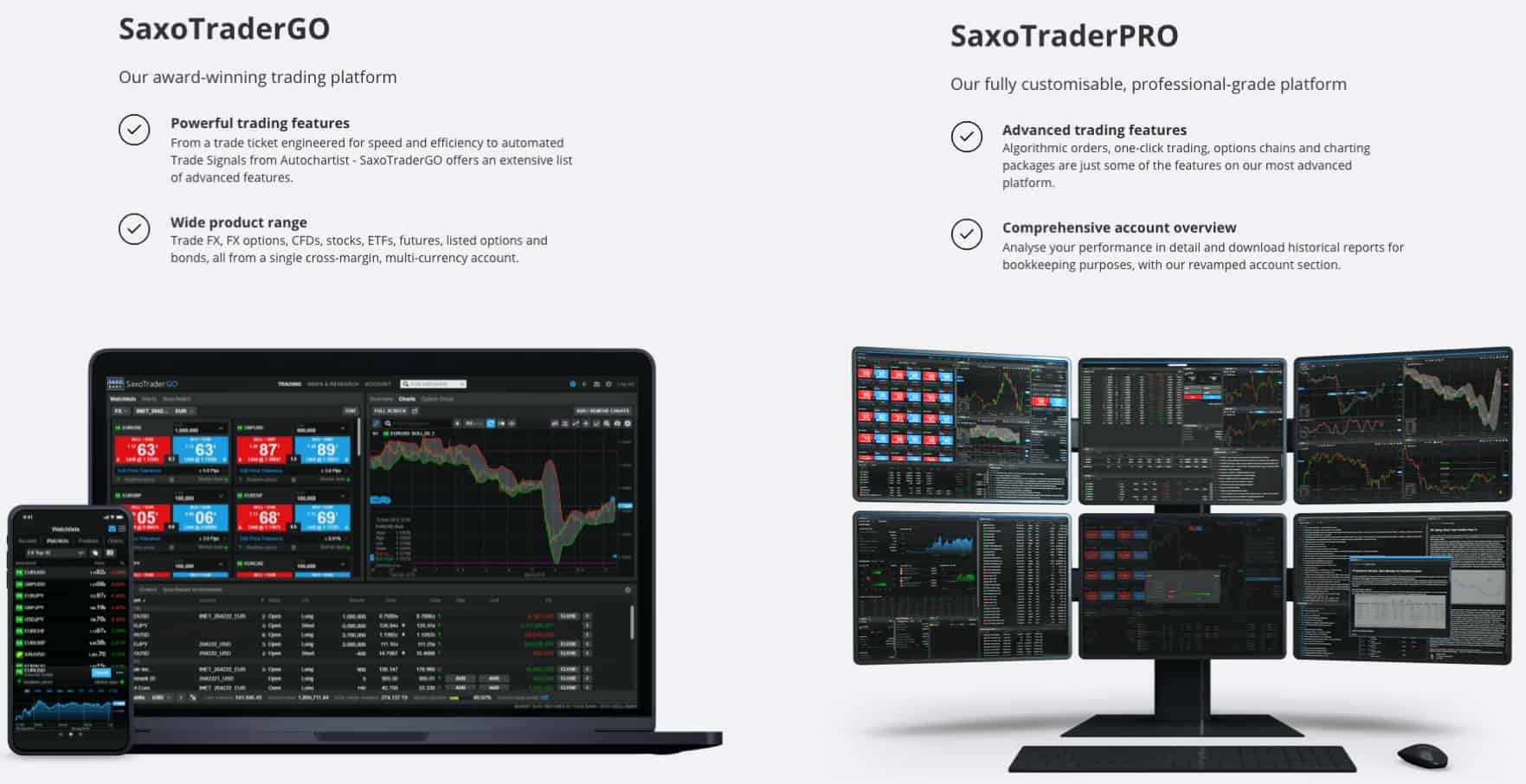

Saxo’s Options Trading Platform

Saxo’s advanced trading platform empowers traders with a suite of powerful tools and resources. The intuitive interface allows for seamless order placement and management, while real-time market data and customizable alerts ensure traders remain up-to-date with market developments. Moreover, Saxo provides educational materials and personalized support, enabling traders to enhance their knowledge and trading skills.

Types of Options Strategies

Saxo offers a vast array of options strategies, catering to diverse trading objectives and risk appetites. Covered calls and protective puts are popular strategies for generating income and hedging against potential losses. Iron condors and straddles are more complex strategies that offer opportunities for increased returns. Traders can tailor their strategies based on market conditions and their own risk tolerance.

Image: www.compareforexbrokers.com

Factors Influencing Options Pricing

The pricing of options is determined by a complex interplay of factors, including the underlying asset’s price, volatility, time to expiration, strike price, interest rates, and supply and demand. Understanding these factors is crucial for traders to make informed decisions and maximize their trading potential.

Tips for Successful Options Trading

-

Define Trading Goals and Risk Tolerance: Determine your investment objectives and risk tolerance before entering the options market. This will guide your strategy selection and position sizing.

-

Understand Options Greeks: Greek letters (delta, gamma, theta, etc.) measure the sensitivity of an option’s price to changes in underlying factors. Comprehending these metrics enhances trading precision.

-

Manage Position Size and Risk Exposure: Calculate your position size carefully to align with your trading capital and risk tolerance. Consider using stop loss orders to mitigate potential losses.

FAQs on Saxo Options Trading

Q: What are the advantages of trading options with Saxo?

A: Saxo provides access to a global market, advanced trading platform, comprehensive educational resources, and personalized support.

Q: What is the minimum deposit for options trading?

A: The minimum deposit may vary depending on your account type and currency.

Q: Are there any fees associated with options trading?

A: Yes, traders are subject to trading fees, platform fees, and potential regulatory fees.

Saxo Options Trading Guide

Image: uk.stockbrokers.com

Conclusion

Saxo options trading offers an accessible and versatile approach to enhancing portfolio returns and mitigating risk. By understanding the fundamentals, employing effective strategies, and managing risk prudently, traders can harness the potential of options trading to unlock financial opportunities. Are you ready to dive into the world of options trading with Saxo and experience the benefits firsthand?