In the realm of financial markets, the allure of day trading option premiums beckons many aspiring traders with its potential for exponential returns. As an experienced blogger, I’ve witnessed firsthand the transformative power of this adrenaline-pumping endeavor. With the right knowledge and strategy, day trading option premiums can unlock a path to financial empowerment.

Image: www.viperreport.com

Unveiling the Enigmatic World of Option Premiums

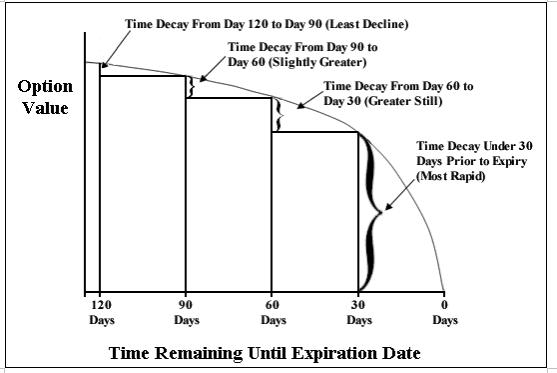

An option premium represents the monetary value paid by a trader to acquire an option contract. Intrinsic value, which stems from the difference between an option’s strike price and the underlying asset’s price, dictates the core value of the premium. However, the time value, reflecting the option’s time decay as it approaches its expiration date, adds another dimension to the premium’s worth.

Diving Deeper into Time Value

Time value plays a crucial role in option premium pricing. As an option nears its expiration, its time value erodes, diminishing the premium’s overall value. This decay rate is influenced by factors such as volatility, interest rates, and the underlying asset’s historical price movements.

Mastering the Art of Day Trading Option Premiums

Day trading option premiums requires a multifaceted approach, encompassing a deep understanding of market dynamics, technical analysis, and risk management. By harnessing these elements, traders can improve their odds of success.

Image: investgrail.com

Technical Analysis: A Trader’s Rosetta Stone

Technical analysis involves deciphering historical price patterns and trends to predict future price movements. By scrutinizing charts, traders can identify trading opportunities, set price targets, and manage risk. Indicators such as moving averages, support and resistance levels, and momentum oscillators provide valuable insights into price behavior.

Risk Management: Navigating Market Volatility

In the ever-shifting landscape of financial markets, risk management is paramount. Prudent traders define risk tolerance and implement strategies like position sizing, stop-loss orders, and hedging to mitigate potential losses. These measures help preserve capital and prevent substantial financial setbacks.

Expert Insights and Time-Tested Tips

Drawing upon my experience, I’ve compiled invaluable tips and insights to empower your day trading journey:

- Thrive in Volatility: Embrace market volatility as an opportunity rather than a hindrance. Options thrive in volatile environments, allowing traders to capture substantial premiums.

- Harness Leverage: Options provide built-in leverage, amplifying returns but also magnifying risks. Exercise caution and manage leverage judiciously.

- Time Decay Master: Recognize that time decay is an inexorable force. Monitor the time value component of your premiums and plan exit strategies accordingly.

- Embrace Shorting Strategies: Don’t limit yourself to bullish positions. Explore shorting options to profit from downward price movements.

- Seek Continuous Education: The financial markets are in a perpetual state of evolution. Continuously expand your knowledge through books, seminars, and mentorship.

FAQs: Illuminating the Path

Q: What factors should I consider when selecting an option premium?

A: Strike price, expiration date, volatility, and underlying asset price are key considerations.

Q: How do I minimize risk while day trading option premiums?

A: Implement risk management strategies such as position sizing, stop-loss orders, and hedging.

Q: What are the advantages of using technical analysis in option premium trading?

A: Technical analysis empowers traders to identify trading opportunities, set price targets, and manage risk.

Day Trading Option Premium

Image: tradethatswing.com

Call to Action: Embark on Your Day Trading Adventure

Day trading option premiums is a thrilling and potentially lucrative endeavor, but it requires preparation and discipline. Whether you’re a seasoned trader or a novice eager to break into the market, I invite you to delve deeper into this guide. Embrace the knowledge, sharpen your skills, and unlock the potential of day trading option premiums. Are you ready to embark on this extraordinary financial journey?