Introduction

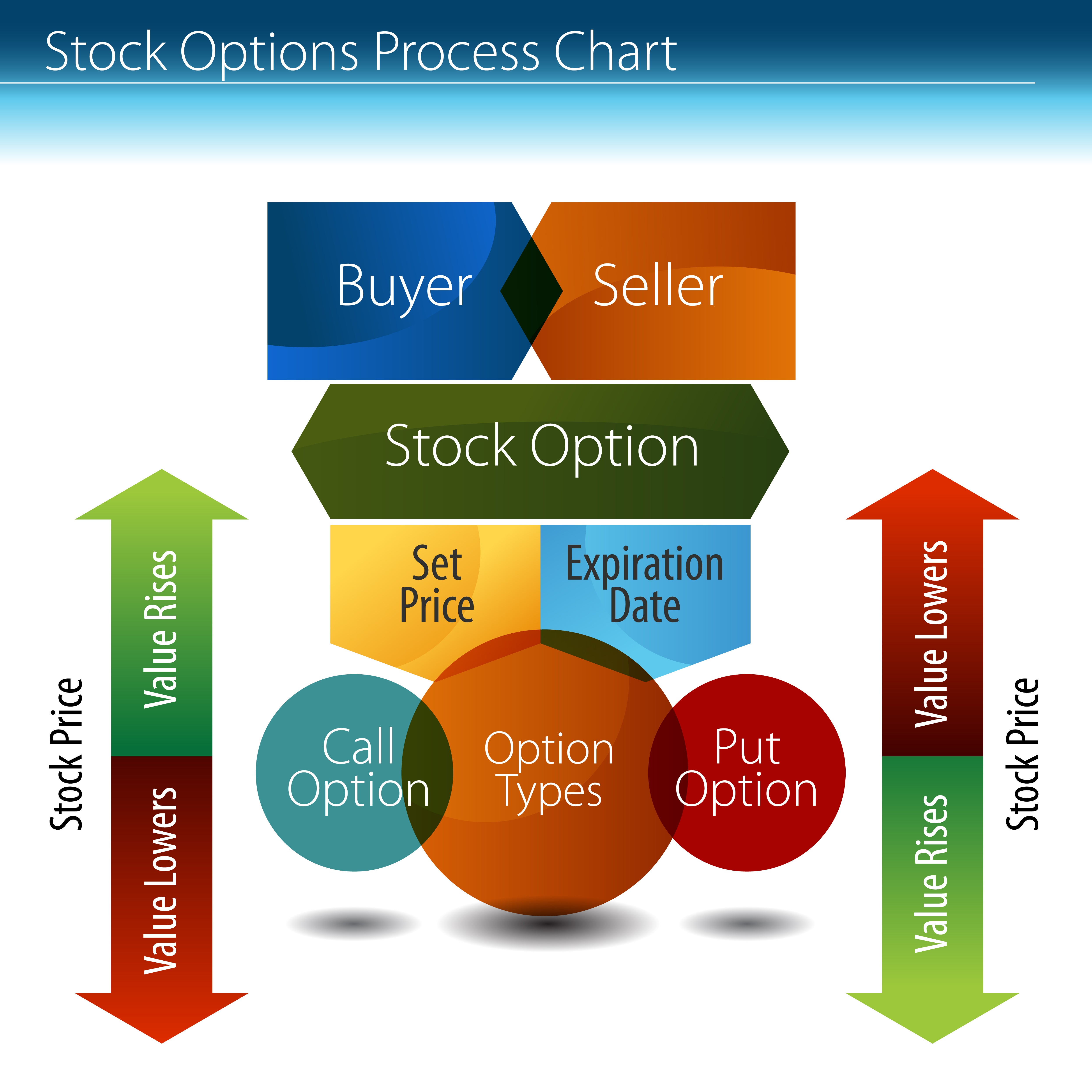

Options trading, a sophisticated financial instrument, has emerged as a powerful tool for investors seeking to optimize their portfolios and generate substantial returns. Options contracts provide traders with the right, not the obligation, to buy or sell an underlying asset at a predetermined price and time. Understanding the vast array of options trading types is paramount to effectively navigate the complexities of this dynamic market. This comprehensive guide will delve into the fundamental concepts, strategies, and various types of options trading, empowering you to make informed decisions and harness the full potential of this financial vehicle.

Image: www.investopedia.com

Options trading has a long and illustrious history, dating back to the 17th century. Today, options contracts are traded worldwide on various exchanges, facilitating risk management, speculation, and advanced trading strategies. The versatility and leverage offered by options have made them an indispensable tool in the financial landscape, enabling traders to tailor their investments to specific risk appetites and market conditions.

Call Options

Call options grant the right to buy an underlying asset at a specified price (strike price) before a predetermined date (expiration date). The buyer of a call option has the expectation that the underlying asset’s price will increase, potentially generating a profit if the prediction holds true. Call options are often employed when investors anticipate a bullish trend in the underlying asset’s value.

Put Options

Put options, on the other hand, provide the right to sell an underlying asset at a predetermined price before the expiration date. Here, the buyer of a put option speculates that the underlying asset’s price will decline, presenting the opportunity for potential profit. Put options are commonly utilized in hedging strategies or when investors foresee a bearish market sentiment.

Covered Calls

Covered calls involve owning the underlying asset and simultaneously selling a call option against that asset. This strategy generates income from the premium received from selling the call option while limiting the potential upside in the underlying asset. Covered calls are generally executed when investors anticipate sideways or moderate upward movement in the underlying asset’s price.

Image: blog.dhan.co

Protective Puts

Protective puts serve as a form of insurance for investors who already own the underlying asset. By purchasing a put option, investors aim to protect their holdings from potential price downturns. The premium paid for the put option offsets some of the potential losses incurred if the underlying asset’s price plummets.

Straddles

Straddles are a combination strategy involving the simultaneous purchase of both a call and a put option with the same strike price and expiration date. This strategy benefits from significant price volatility in the underlying asset, whether in an upward or downward direction. Straddles are often employed when investors are uncertain about the future price direction of the underlying asset.

Strangles

Similar to straddles, strangles involve purchasing a call and a put option with the same expiration date but different strike prices. The strike price of the call option is set higher than the current market price, while the put option’s strike price is set below. Strangles are employed when investors anticipate moderate price fluctuations in either direction.

Options Trading Types

Conclusion

Options trading offers a diverse range of strategies, each tailored to specific investment objectives and market conditions. By understanding the fundamental concepts and different types of options contracts, investors can harness the potential of this financial instrument to optimize their portfolios, manage risk, and achieve their financial goals. As with any investment, thorough research, careful analysis, and sound risk management are crucial for success in options trading. Consult with financial professionals and refer to credible resources to gain a deeper understanding of this dynamic and rewarding investment arena.