In the realm of options trading, calculating the maximum profit potential is crucial for informed decision-making. Options, financial instruments that convey the right but not the obligation to buy or sell an underlying asset at a specified price and time, present traders with an array of opportunities for profit. Understanding how to calculate the maximum potential profit empowers traders to optimize their strategies and maximize their returns.

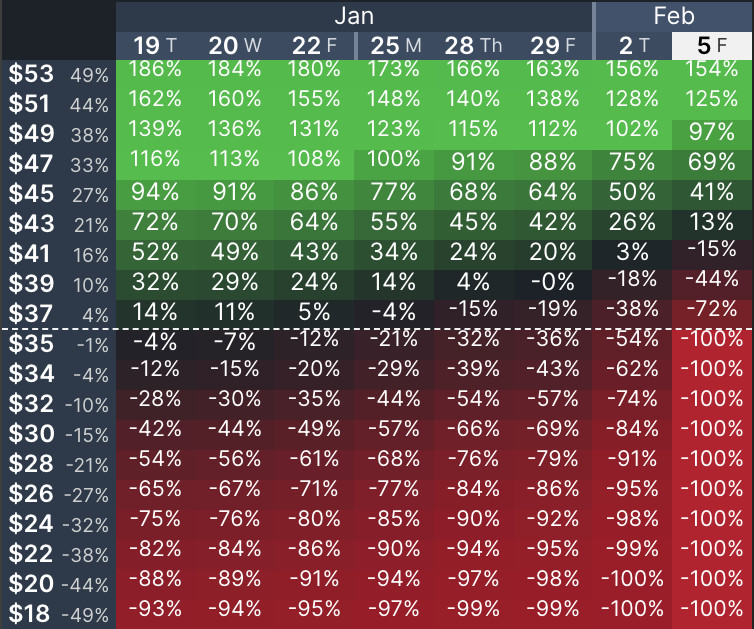

Image: optionstrat.com

Unveiling the Mechanics of Option Premiums

At the heart of options trading lies the concept of premiums, the financial consideration paid by a buyer to the seller of an option contract. These premiums represent the option’s potential value and are determined by a multitude of factors, including the underlying asset’s price, the time to expiration, and the volatility of the underlying asset. Options can either be call options, granting the buyer the right to buy, or put options, bestowing the right to sell, at a predetermined price known as the strike price.

Calculating Maximum Profit: Step-by-Step

-

Determine the Break-Even Point: Calculate the breakeven point by adding the premium paid to the strike price for call options and subtracting the premium from the strike price for put options. This value represents the price at which the option expires worthless, yielding neither profit nor loss.

-

Identify the Maximum Profit Zone: Maximum profit is realized when the underlying asset’s price moves far enough in the desired direction. For call options, this implies a price rise above the breakeven point; for put options, it necessitates a price decline below the breakeven point.

-

Max Profit Formula: The formula for calculating maximum profit is straightforward:

- Call Option: Maximum Profit = [Underlying Asset Price at Expiration – Strike Price] – Premium Paid

- Put Option: Maximum Profit = [Strike Price – Underlying Asset Price at Expiration] – Premium Paid

Understanding Maximum Profit Boundaries

It’s important to note that maximum profit potential is finite and varies depending on option type and market conditions. Call options with a low breakeven point have a higher probability of achieving maximum profit when the market moves favorably, but they also come with a lower maximum profit cap. Conversely, call options with a high breakeven point have a lower probability of attaining maximum profit but offer a potentially higher reward if the market aligns perfectly.

Image: www.optionsbro.com

Risk Management Considerations

Options trading involves inherent risks, and it’s crucial to exercise sound risk management practices to safeguard against potential losses. Calculate maximum profit with a realistic understanding of market volatility and the underlying asset’s price movement history. Volatility is a key determinant of option premiums, and higher volatility往往 means higher potential profits but also increased risk.

Leveraging Technology for Enhanced Profitability

In today’s digital age, traders have access to a plethora of online platforms and software that can assist in precise profit calculations. These tools provide real-time data, advanced charting features, and sophisticated algorithms that can aid traders in making informed decisions and maximizing their returns. Utilizing such technology can sharpen your edge and enhance your profitability.

How To Calculate Max Profit Of Option Trading

Image: www.youtube.com

Conclusion

Calculating the maximum profit of option trading is a fundamental skill for traders seeking to maximize their returns in the options market. By understanding the intricacies of option premiums, applying the appropriate profit calculation formulas, and practicing sound risk management, traders can optimize their strategies and capitalize on market opportunities. Remember, knowledge is power, and the ability to accurately calculate maximum profit is an invaluable asset in the pursuit of financial success.