Are you ready to venture into the world of options trading? If so, understanding maximum loss is crucial. Options trading, while offering potential gains, also carries significant risk. In this article, we delve into the world of options trading, shedding light on maximum loss and equipping you with the knowledge to navigate this complex arena.

Image: fabalabse.com

What is Maximum Loss in Options Trading?

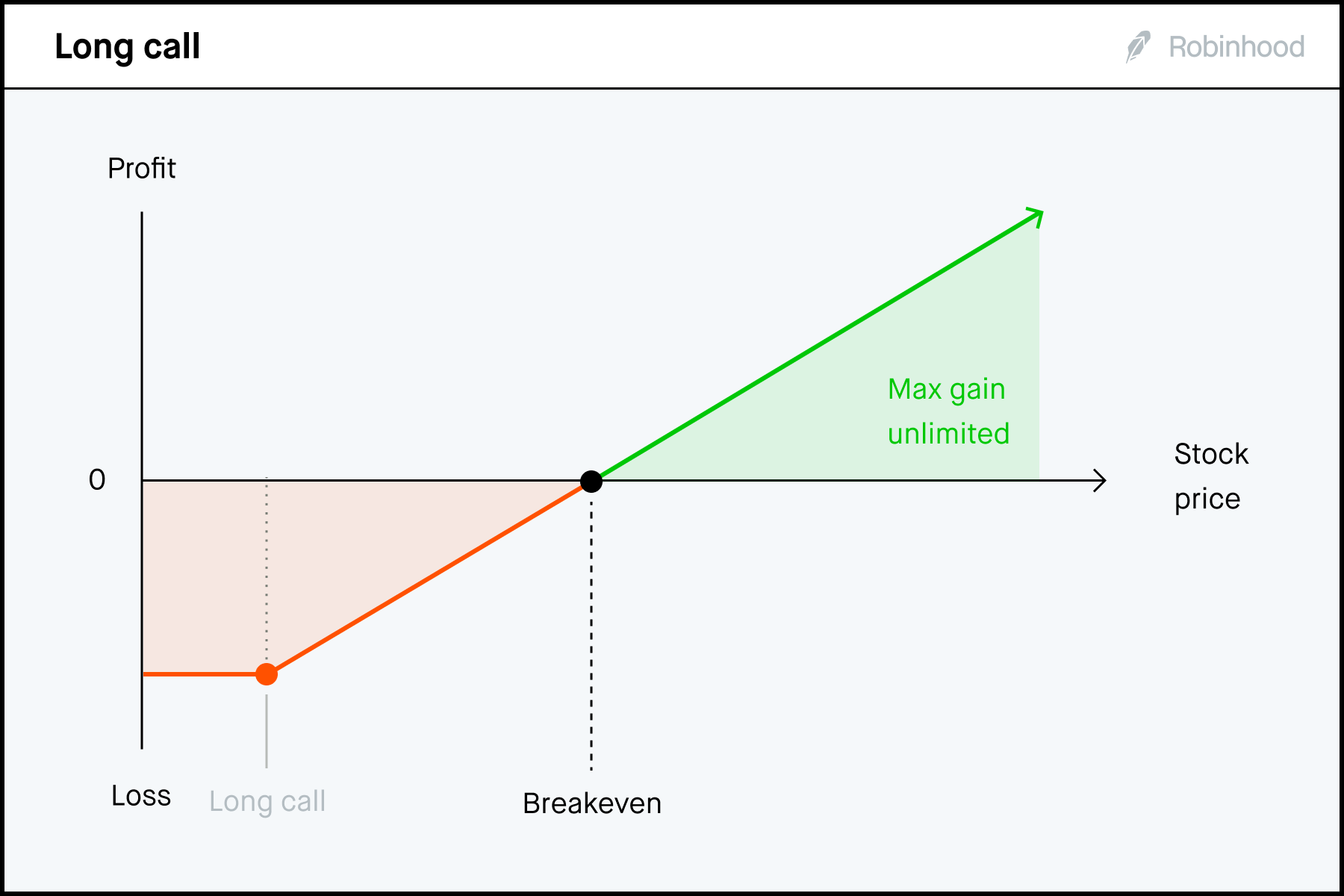

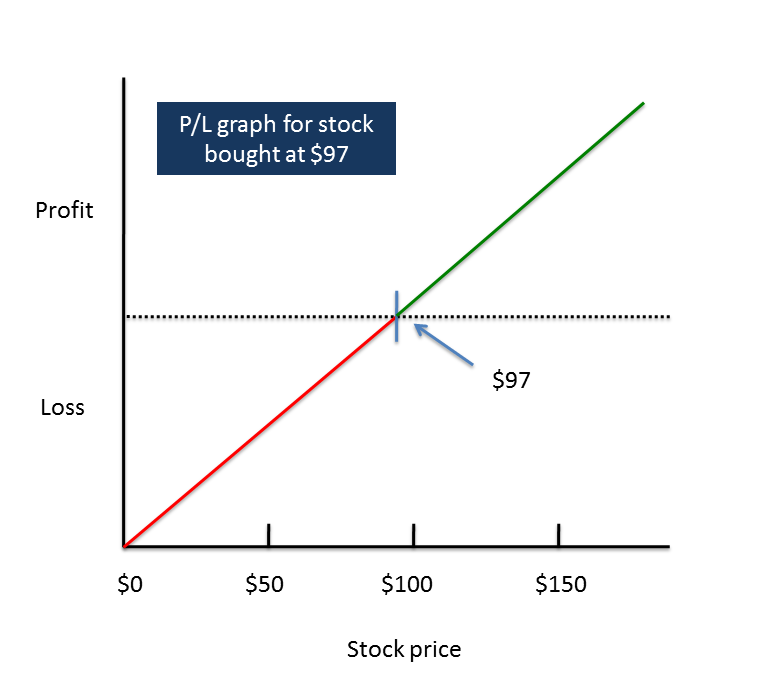

Maximum loss in options trading refers to the highest possible monetary loss an individual can incur when trading options contracts. Unlike stocks, where losses are limited to the capital invested, options have the potential for unlimited losses. This is because options contracts give the buyer the right, but not the obligation, to buy (call options) or sell (put options) the underlying asset at a specified price (strike price) on or before a particular date (expiration date).

Factors Determining Maximum Loss

Maximum loss in options trading is primarily influenced by a number of key factors:

- Premium Paid: The premium paid for the option is the initial investment and represents the maximum loss if the option expires worthless.

- Strike Price: Options with strike prices further away from the current market price have higher premiums and thus higher maximum loss.

- Underlying Asset Volatility: Higher volatility in the underlying asset increases the potential for the option’s value to fluctuate, leading to larger potential losses.

- Time to Expiration: Options with longer time to expiration offer more opportunities for the underlying asset to move in a favorable direction, reducing maximum loss.

- Implied Volatility: Implied volatility measures the market’s expectations for future price movement of the underlying asset. Higher implied volatility leads to higher option premiums and increased maximum loss.

Understanding and Managing Maximum Loss

Navigating options trading requires a clear understanding of maximum loss. Here are some key points to consider:

- Always calculate maximum loss: Before entering an options trade, it is imperative to calculate the maximum possible loss and ensure you are prepared to bear it.

- Manage risk: Managing risk is paramount in options trading. Diversify your portfolio and consider hedging strategies to mitigate losses.

- Use limit orders: Limit orders allow you to specify the maximum price you are willing to pay or receive for an option, reducing the likelihood of unexpected losses.

- Consider stop-loss orders: Stop-loss orders can automatically exit a position when it reaches a predetermined price level, limiting potential losses.

- Avoid overleveraging: Avoid leveraging your trades beyond your financial capacity. Remember, options trading can lead to significant losses.

Image: tickertape.tdameritrade.com

What Is Maximum Loss In Options Trading

Conclusion

Options trading can be a powerful tool for experienced investors seeking to potentially enhance returns. However, understanding and managing maximum loss is crucial. By calculating maximum loss, employing risk management strategies, and adhering to prudent trading practices, you can mitigate risks and capitalize on the opportunities that options trading offers. Remember to always approach options trading with knowledge, caution, and a clear understanding of the potential for both gains and losses.