When venturing into the world of options trading, the potential for both profit and loss is inherent. One crucial concept every trader must grasp is maximum loss, the worst-case scenario in any options trade. Understanding this concept can empower you with informed decision-making and effective risk management.

Image: www.chittorgarh.com

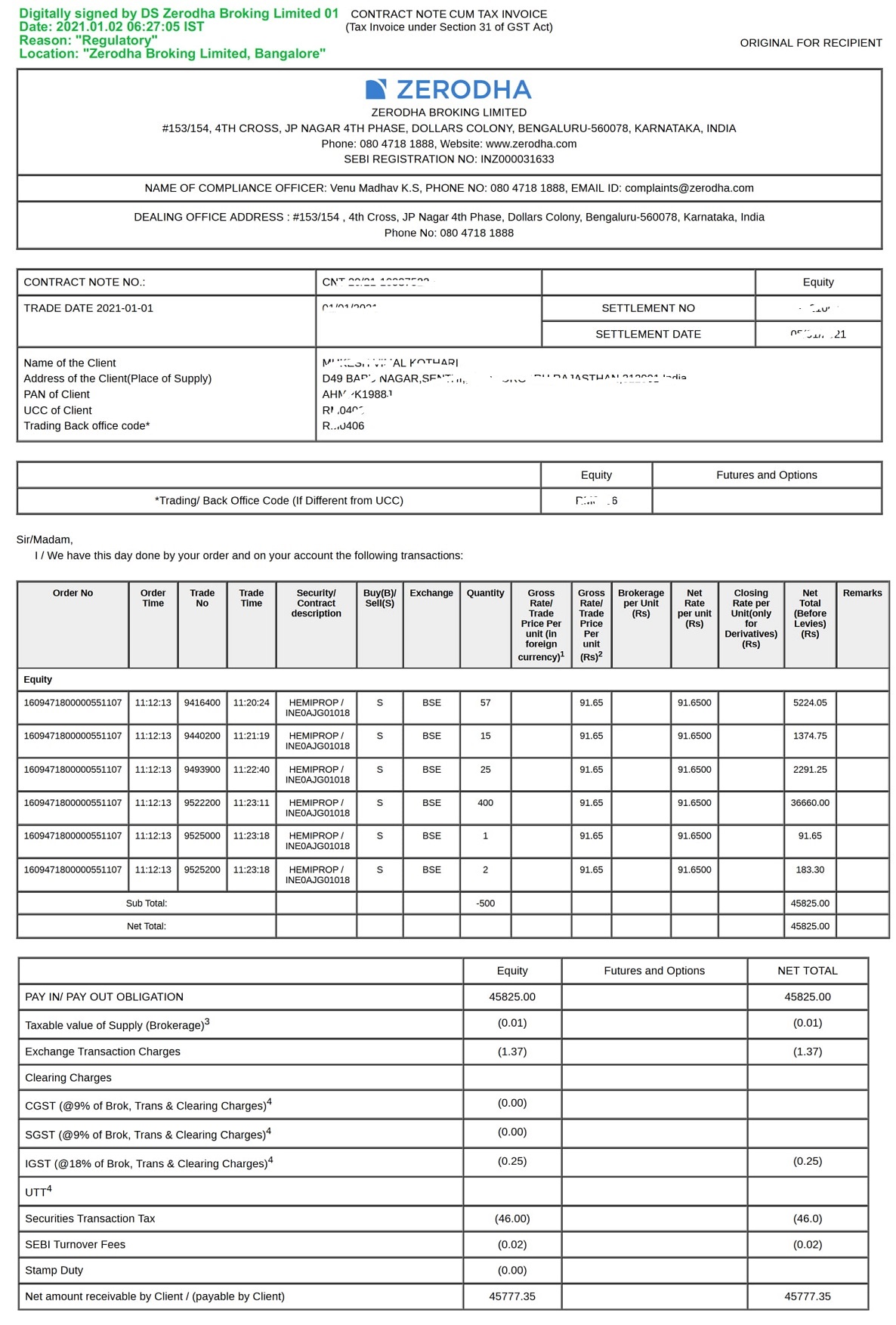

Defining Maximum Loss in Options

Maximum loss in options trading refers to the maximum amount of money you can lose on a particular trade. It’s the difference between the premium you pay to enter the trade and the proceeds you receive upon its expiration or exercise. Unlike stocks, where losses can be unlimited due to price fluctuations, the maximum loss in options is predefined and known upfront.

Factors Affecting Maximum Loss

Several factors determine the maximum loss in an options trade:

-

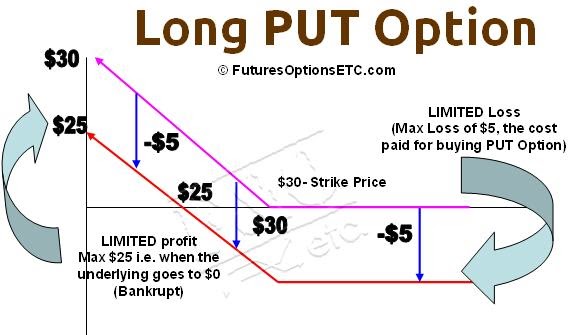

Type of Option:

Call options have different maximum loss profiles than put options. Generally, the maximum loss in a call option is the premium paid, while in a put option, it’s the premium paid minus the strike price.

-

Image: futuresoptionsetc.comStrike Price:

The strike price significantly influences the maximum loss. The higher the strike price above the underlying asset’s spot price for a call option, the greater the premium and, consequently, the maximum loss. Similarly, for a put option, a lower strike price below the spot price results in a higher premium and maximum loss.

-

Expiration Date:

Options with longer expirations typically have higher premiums due to time decay, which means the maximum loss is generally greater for longer-term options.

Calculating Maximum Loss

To calculate the maximum loss in an options trade, determine the following:

-

Premium Paid: The amount of money paid to enter the trade (the option price).

-

Proceeds Upon Expiration or Exercise: This varies depending on the trade’s performance and the type of option.

Example:

Consider a trader buying a call option with a strike price of $100 and a premium of $5. If the underlying asset’s price at expiration is below $105 ($100 strike + $5 premium), the call option will expire worthless, and the trader will lose the entire premium paid, resulting in a maximum loss of $5.

Implications of Maximum Loss

Understanding maximum loss has several implications for options traders:

-

Risk Management:

It helps traders establish clear trading limits and avoid risking more than they can afford to lose.

-

Trading Strategy:

Knowing the maximum loss can influence trading strategies, such as selecting options with appropriate strike prices and expirations.

-

Pricing Options:

Maximum loss is a key component in pricing options and determining their fair value.

What Is Maximum Loss In Option Trading

Image: tradeciety.com

Conclusion

Maximum loss in option trading is a crucial concept for any trader to comprehend. By understanding the factors affecting it and calculating it accurately, traders can make informed decisions, manage their risk effectively, and navigate the complexities of options trading with confidence. Remember, while options offer great potential for gains, it’s essential to approach them with a deep understanding of the risks involved.