Introduction:

In the dynamic world of financial markets, option trading has emerged as a powerful tool for sophisticated investors seeking to navigate market volatility and enhance their portfolios. Option trading programs have revolutionized this practice by providing traders with advanced tools and automation capabilities. In this comprehensive guide, we will delve into the world of option trading programs, exploring their history, benefits, strategies, and how they can empower traders to make informed decisions.

Image: forex-station.com

Option trading involves the buying and selling of contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predefined price and date. These contracts offer investors flexibility and leverage, allowing them to speculate on market movements, hedge against risk, and generate additional income.

History of Option Trading Programs:

The roots of option trading programs can be traced back to the early 20th century, when options were primarily traded over-the-counter (OTC). However, it was not until the advent of electronic trading platforms in the 1990s that option trading became more accessible to a wider range of investors.

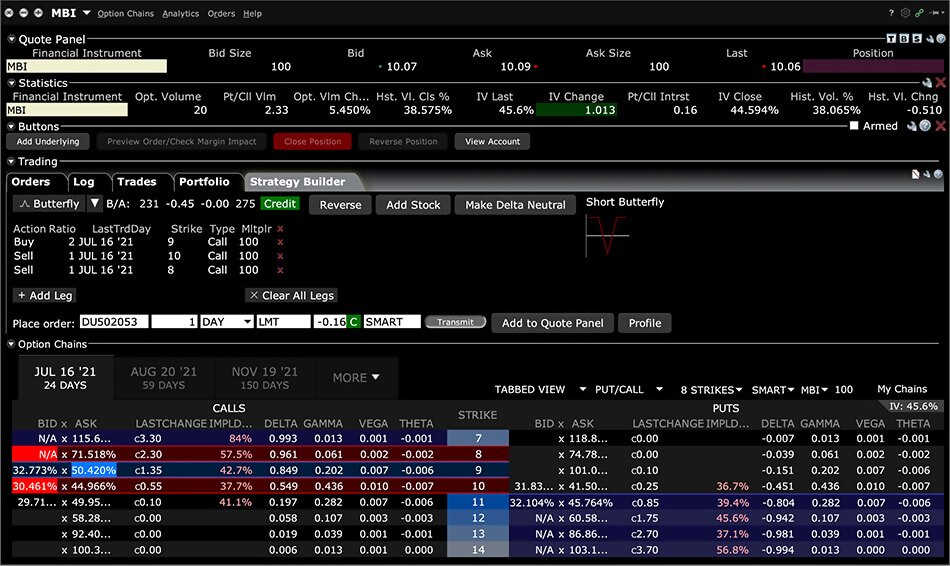

With the proliferation of online brokerages, option trading programs emerged as software applications designed to simplify and automate the option trading process. These programs provide traders with real-time market data, charting tools, order entry, position management, and risk analysis capabilities.

Empowering Traders through Technology:

Option trading programs empower traders by automating complex calculations, optimizing order execution, and providing risk management tools. They offer real-time market data and analytical insights that help traders make informed decisions. Moreover, these programs allow traders to backtest strategies and simulate market conditions, enabling them to refine their approaches before committing real capital.

Types of Option Trading Programs:

There are various types of option trading programs available, each tailored to different trading styles and needs. Some popular programs include:

- Technical analysis programs: These programs focus on identifying market trends and patterns using technical indicators. They analyze historical price data and volume to generate trading signals.

- Fundamental analysis programs: These programs focus on analyzing the underlying fundamentals of companies and industries. They provide access to financial statements, economic data, and news to help traders make informed decisions based on company performance.

- Risk management programs: These programs assist traders in managing their risk by calculating Greeks, such as delta, gamma, and theta. They allow traders to track their positions and adjust them as market conditions change.

Image: www.youtube.com

Strategies for Using Option Trading Programs:

Option trading programs can be used for various trading strategies, including:

- Covered calls: This strategy involves selling a call option on a stock that you own. If the stock price rises, the option will be exercised, and you will sell your shares at a profit. If the stock price falls, you will still own your shares and can benefit from any future appreciation.

- Cash-secured puts: This strategy involves selling a put option on a stock that you have the cash to buy. If the stock price falls, the option will be exercised, and you will be obligated to buy the shares at a predefined price.

- Iron condors: This strategy involves simultaneously selling a call option and a put option at different strike prices. The goal is to profit from a range-bound market where the stock price remains within a predefined range.

Option Trading Programs

Image: www.interactivebrokers.com

Conclusion:

Option trading programs have revolutionized the way investors approach option trading, providing them with advanced tools and automation capabilities to navigate market volatility and enhance their portfolios. By combining sophisticated technology with in-depth market knowledge, traders can leverage option trading programs to develop and execute tailored trading strategies, manage risk, and achieve their financial goals. As the financial markets continue to evolve, option trading programs will undoubtedly remain an indispensable tool for discerning investors seeking strategic market opportunities.