Exploring the Limits of Intraday Option Trading

Introduction

Image: club.ino.com

The fast-paced world of option trading offers traders a thrilling opportunity to capitalize on market fluctuations and potentially generate substantial returns. Among the many questions that intrigue aspiring option traders is the issue of daily trading limits. Understanding the number of option trades one can execute within a given trading day is crucial for effective planning and risk management.

Understanding the Basics of Option Trades

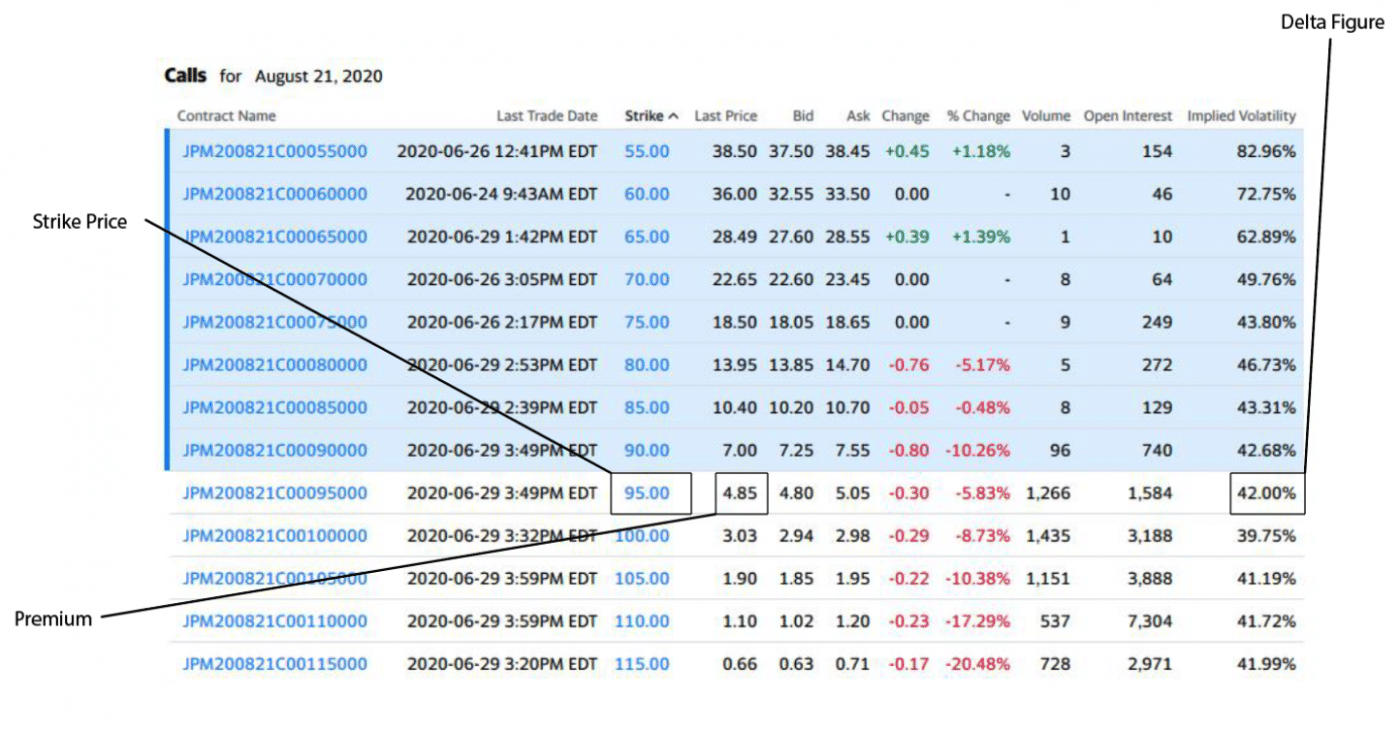

Options are derivative contracts that grant traders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specified date. These contracts derive their value from the underlying asset’s price movements and market volatility. Option traders can engage in various strategies, such as buying or selling calls and puts, to capitalize on their market predictions.

Determining Trading Limits

The number of option trades one can make in a day is primarily determined by two factors: brokerage account permissions and regulatory guidelines.

Brokerage Account Permissions

Different brokerage firms have varyingpolicies regarding the number of option trades a trader can execute within a day. Some brokerages impose daily limits, while others may set no restrictions. Traders should carefully review their brokerage’s account agreement to understand the specific guidelines applicable to their trading activity.

Regulatory Guidelines

Regulators, such as the Financial Industry Regulatory Authority (FINRA) in the United States, establish rules and regulations to govern option trading practices. These regulations aim to mitigate excessive trading and maintain market stability. FINRA Rule 4210, commonly known as the “pattern day trader” rule, is particularly relevant to this topic.

The Pattern Day Trader Rule

FINRA’s pattern day trader (PDT) rule defines a PDT as an individual who executes four or more “day trades” within a rolling five-business-day period. A day trade involves buying and then selling (or vice versa) the same security on the same day. Intraday option trades fall under this definition.

Implications of the PDT Rule

If an individual is designated as a PDT, they are subject to certain restrictions, including:

- The requirement to maintain a minimum account balance of $25,000.

- Restrictions on the use of margin for intraday option trading.

Exceptions to the PDT Rule

Certain exemptions exist to the PDT rule, including:

- Individuals with a professional trading license.

- Those who trade through an introducing broker who exercises supervisory control.

- Individuals who receive written approval from their brokerage firm due to exceptional circumstances.

Managing Trading Activity

To avoid being designated as a PDT, traders should carefully manage their trading activity. This includes planning trades in advance, considering market conditions, and understanding the risks associated with excessive trading. Traders who anticipate exceeding the PDT threshold should consider exploring alternatives, such as swing trading or investing in long-term options strategies.

Conclusion

The number of option trades one can make in a day is influenced by both brokerage account permissions and regulatory guidelines. Understanding these limits is essential for responsible trading practices and compliance with industry regulations. By managing trading activity effectively, traders can maximize their opportunities in the dynamic world of option trading while adhering to regulatory requirements.

Image: www.angelone.in

How Mnay Option Tradings Can Do In A Day

Image: profitnama.com