When you trade options, it’s crucial to understand the concept of limits to manage your risk and maximize your potential profits. In this comprehensive guide, we will delve into the complexities of limits in options trading, empowering you with knowledge to optimize your trading strategies.

Image: tikloenglish.weebly.com

What are Limits in Options Trading?

Limits in options trading refer to the restrictions or boundaries imposed by exchanges or trading platforms on the number of contracts that can be bought or sold by a trader during a specific trading session. These limits are designed to maintain market stability, prevent excessive speculation, and protect traders from overexposure to risk.

Exploring the Different Types of Limits

Options exchanges typically impose two main types of limits:

- Position Limits: These limits restrict the total number of contracts that a trader can hold in a particular underlying security. They vary based on the type of option (call or put) and the expiration month.

- Order Limits: Order limits refer to the maximum number of contracts that a trader can execute in a single order. These limits are intended to prevent large, market-moving orders from destabilizing the market.

Impact of Limits on Trading Strategies

Limits play a significant role in shaping options trading strategies. Traders must carefully consider these limitations when planning their trades to avoid order rejections and potential losses. For instance, if a trader wants to establish a large option position but the position limit is relatively small, they may need to break up their order into multiple smaller executions.

Image: www.stockmarkethindi.in

Understanding the Rationale Behind Limits

Options exchanges implement limits for several reasons:

- Market Stability: Limits help prevent excessive speculation and volatility by restricting the number of contracts in the hands of individual traders.

- Risk Management: By limiting the size of positions that traders can hold, exchanges mitigate the risk of large losses for both individual traders and the market as a whole.

- Orderly Trading: Limits prevent large orders from overwhelming the market, ensuring orderly trading and fair price discovery.

Strategies for Managing Limits

While limits can pose constraints, traders can adopt various strategies to navigate these limitations effectively:

- Splitting Orders: Breaking large orders into smaller executions can help traders work within order limits.

- Multiple Accounts: Using multiple brokerage accounts allows traders to distribute their positions across different entities, potentially offering greater flexibility.

- Automated Trading: Employing automated trading strategies can help traders execute orders quickly and efficiently within order limits.

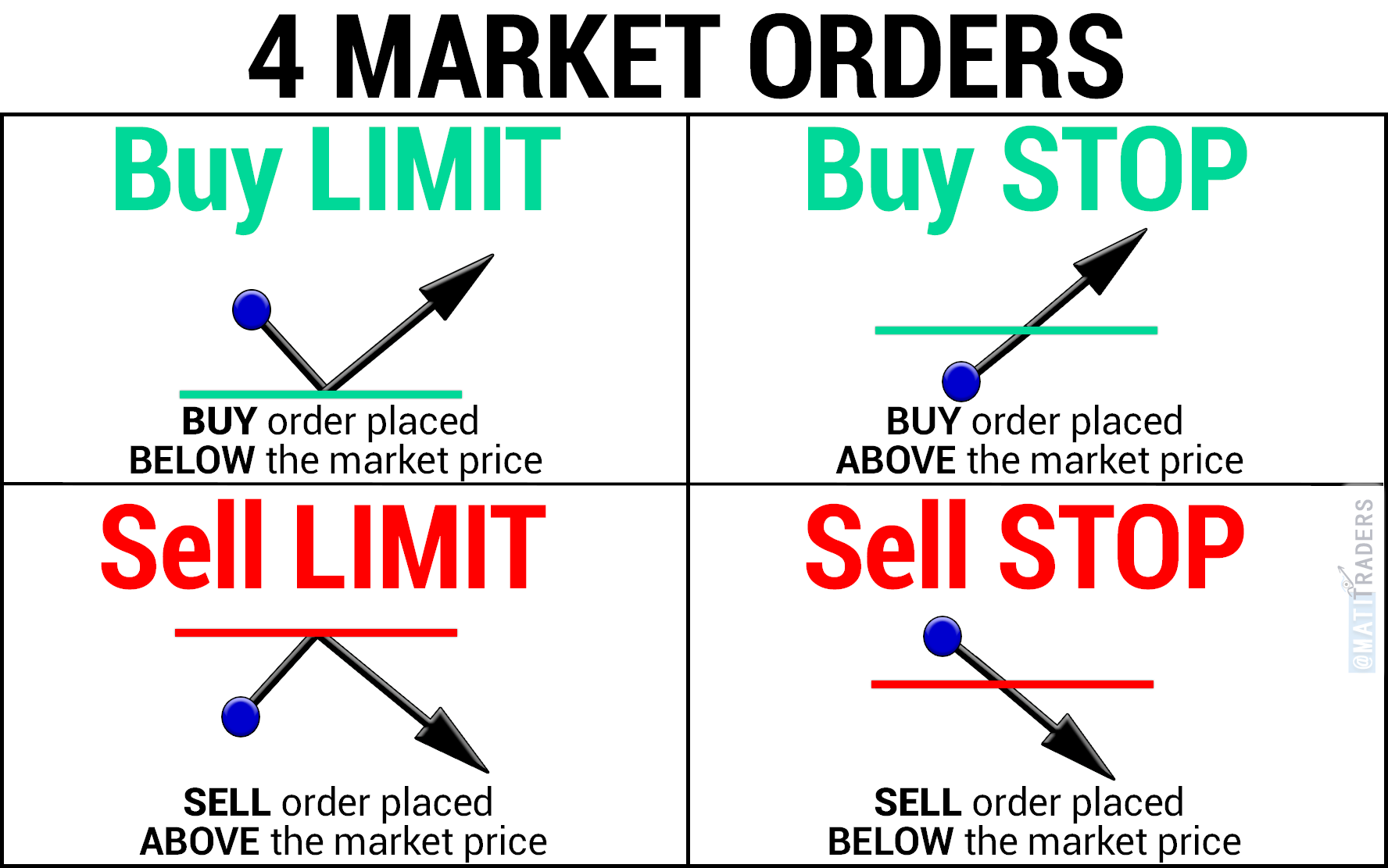

How To Limits In Options Trading Work

Image: timonandmati.com

Conclusion

Limits in options trading are essential safeguards that maintain market stability, protect traders from excessive risk, and ensure orderly trading. By understanding the types of limits, their rationale, and strategies for managing them, traders can effectively navigate these constraints and optimize their options trading strategies. Remember to research specific exchange regulations thoroughly and consult with a financial professional if needed to tailor your approach to your individual circumstances.