If you’ve ventured into the realm of investing, you’ve likely stumbled upon the term “options trading.” It’s a potent financial tool that can amplify your investment returns or hedge against potential risks. But what exactly is options trading, and how does it work? Dive into this comprehensive guide to unravel the mysteries surrounding options and empower yourself with this valuable investment strategy.

Image: thestockmarketwatch.com

Understanding Options Trading: A Concise Overview

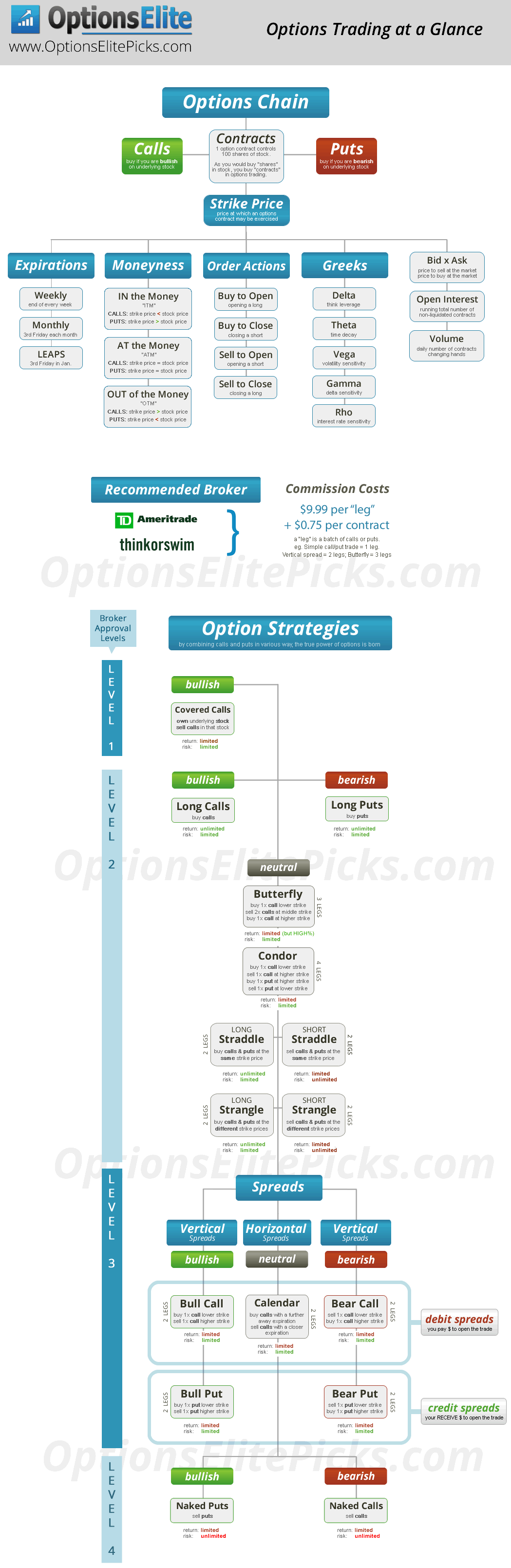

Options trading involves contracts that grant you the “option” to buy or sell an underlying asset, such as stocks or commodities, at a specified price within a predetermined time frame. As the name suggests, these contracts provide you with a choice, not an obligation. You can choose to exercise your right to buy or sell, or you can let the contract expire worthless if the market conditions are unfavorable. This flexibility offers investors a versatile instrument for managing risk and potentially enhancing returns.

Types of Options: A Path to Diverse Strategies

The world of options trading encompasses two primary types of contracts: call options and put options. A call option grants you the right to buy an underlying asset at a set price, known as the strike price, on or before the expiration date. On the other hand, a put option bestows upon you the right to sell an underlying asset at the strike price. Understanding the distinction between these two types of options is crucial for selecting the appropriate strategy based on your investment objectives.

Call Options: Unveiling the Art of Buying Rights

A call option grants you the right to buy an underlying asset at the strike price until its expiration date. This strategy is beneficial when an investor anticipates a rise in the asset’s price. However, if the asset’s price decreases or remains stagnant, the option can expire worthless, resulting in a loss of the premium paid. Examples of call option strategies include buying a single call option, purchasing several call options at different strike prices, or implementing a covered call strategy by selling a call option against an underlying asset you own.

Image: fintrakk.com

Put Options: Exploring the Nuances of Selling Rights

Put options provide investors with the right to sell an underlying asset at the strike price before the expiration date. These options are advantageous when an investor foresees a decline in the asset’s price. Exercising the put option then allows the individual to sell the asset at the strike price, potentially profiting from the price decrease. Alternatively, like call options, a put option can expire worthless if the asset’s price rises or remains stable. Popular put option strategies include buying a single put option, combining multiple put options, or engaging in a cash-secured put, which involves selling a put option while possessing sufficient cash to cover potential losses.

Options Trading Strategies: Navigating the Choice Spectrum

Options trading unfolds through a diverse range of strategies, allowing investors to tailor their approach to their risk tolerance and investment goals. From simple strategies geared toward beginners, such as purchasing a single option contract, to advanced techniques designed for seasoned traders, the options market presents ample opportunities for customization. Explore the nuances of each strategy to identify the ones that align best with your investment philosophy and financial circumstances.

Hedging with Options: Shielding Your Investments

Options trading shines as a powerful tool for hedging against potential losses in your investment portfolio. By implementing hedging strategies, you can minimize the downside risk associated with your investments while maintaining the upside potential. For instance, you can buy a put option on an asset you own, thereby protecting yourself from a potential price decline. However, it’s important to note that hedging strategies come with their own set of costs and complexities that demand careful consideration.

Options Terminology: Unveiling the Language of Options

Delving into the world of options trading necessitates familiarity with its specialized terminology. Comprehending the unique vocabulary of options will empower you to participate effectively in this dynamic market. From terms like “call option” and “put option” to “strike price” and “expiration date,” each term carries specific significance. Dive deep into the glossary of options trading to enhance your understanding of its intricacies.

Risk Management in Options Trading: Essential Considerations

Options trading presents a double-edged sword of potential rewards and risks. Prudent risk management practices are essential to navigate this market successfully. Always remember, options trading involves the potential to incur substantial losses. Allocate capital wisely, and don’t invest more than you can afford to lose. Comprehensive risk management strategies, such as limiting trade size and implementing hedging techniques, can help you mitigate potential losses.

Options Trading What Is

Image: myfinanceresources.com

Conclusion: Options Trading Unraveled

Options trading emerges as a multifaceted financial tool, offering diverse strategies to enhance returns and reduce risks in the investment landscape. Understanding the concepts discussed in this article will empower you to embark on your options trading journey with confidence. However, remember, knowledge is not the sole determinant of success. Consistent research, diligent risk management, and a well-informed approach will guide you toward leveraging the true potential of options trading.