The world of options trading presents a realm of potential opportunities for savvy investors seeking to navigate the ever-evolving financial landscape. Options, like multifaceted instruments, empower traders with the flexibility to execute complex strategies, hedge against risk, and potentially maximize returns. Understanding the intricacies of options trading is paramount, and this comprehensive guide aims to unravel its enigmatic fabric.

Image: thestockmarketwatch.com

Demystifying Options: A Tale of Two Rights

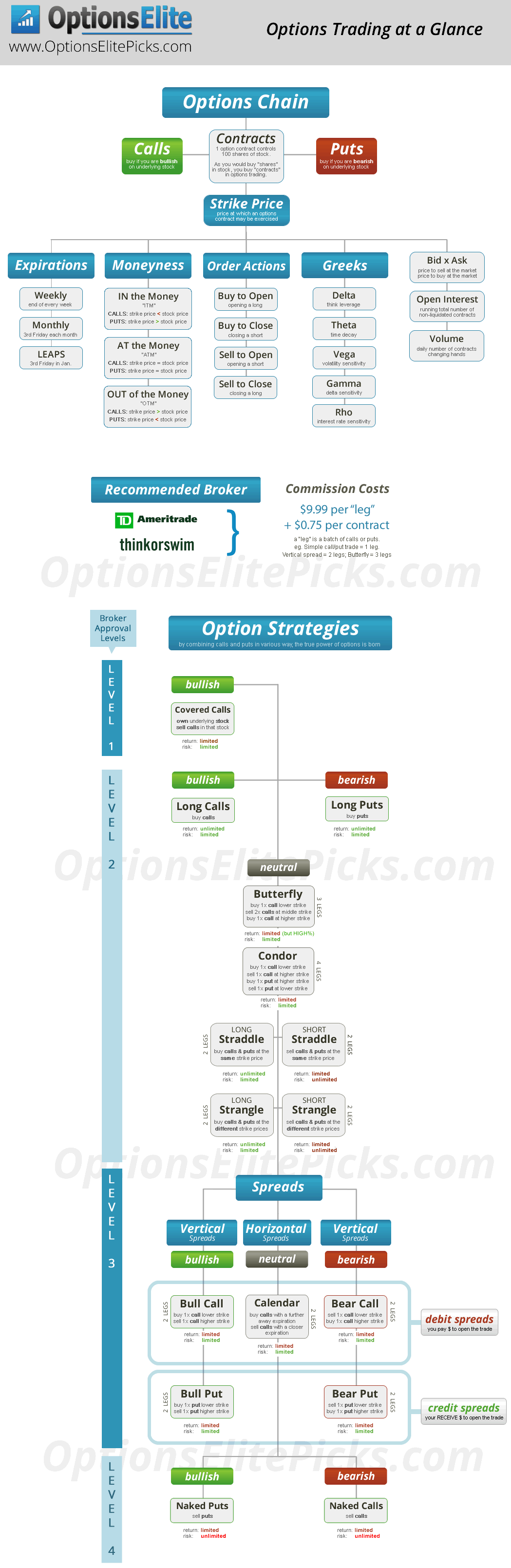

At its core, an option is a financial contract that grants the buyer the right, but not the obligation, to buy (call option) or sell (put option) a specific asset at a predetermined price and time. These contracts provide immense flexibility, allowing traders to speculate on future market movements without the immediate need to acquire the underlying asset.

The defining characteristic of options lies in their time-sensitive nature. Options have an expiration date, beyond which they become obsolete. This feature infuses options with an element of decay, as the value of the option diminishes as it approaches its expiration date.

Understanding the Anatomy of an Option

To fully grasp the mechanics of options trading, it is crucial to delve into their fundamental components. Each option contract is characterized by three primary attributes: strike price, expiration date, and premium.

The strike price represents the predetermined price at which the underlying asset can be bought (call option) or sold (put option). The expiration date defines the point in time when the option contract becomes void. Lastly, the premium is the price paid by the buyer of the option in exchange for its rights.

Navigating the Options Marketplace

The options market operates on the Chicago Board Options Exchange (CBOE), where a vast array of options contracts are traded. These contracts cover a wide spectrum of underlying assets, including stocks, indices, commodities, and currencies.

Traders can choose between two distinct types of options contracts: standard options and index options. Standard options are tied to a single underlying asset, while index options track the performance of a broader market index, providing broader exposure and potential returns.

Unveiling the Strategies of Option Kings

Seasoned options traders deploy a repertoire of strategies tailored to their individual goals and risk appetites. Some of the most common strategies include:

-

Covered Calls: Selling a call option against an existing position in the underlying asset, generating income while capping potential gains.

-

Protective Puts: Buying a put option to hedge against potential losses in the underlying asset, ensuring a minimum return.

-

Iron Condor: A combination strategy involving selling an at-the-money call option, buying an out-of-the-money call option, selling an out-of-the-money put option, and buying an at-the-money put option, creating a profit zone within a defined range.

Conquering the Challenges of Options Trading

While options trading offers enticing rewards, it is not without its complexities. Volatility, the measure of price fluctuations, plays a significant role in options valuation. Higher volatility increases the potential profits but also magnifies the risks involved.

Managing emotions is also crucial in options trading. Greed and fear can swiftly sway decisions, leading to suboptimal outcomes. Traders must maintain a disciplined approach, anchored in sound risk management principles.

Conclusion: Embracing the Promise of Options Trading

Delving into the world of options trading can be a transformative experience for skilled investors. Options empower traders to amplify returns, hedge against risk, and unlock a multitude of strategies. By understanding the concepts, strategies, and risks involved, traders can navigate the options market with confidence, unlocking the secrets of this dynamic and rewarding arena.

Image: uk.investing.com

Trading Options Blog

Image: tradebrains.in