Options trading, the buying and selling of contracts that give the holder the right but not the obligation to buy or sell an underlying asset, has gained popularity in Utah as a way to potentially boost investment returns and manage risk. With a proactive business environment and a growing tech industry, Utah presents unique opportunities for individuals seeking to master this dynamic financial instrument.

Image: www.webull.com.au

Options provide versatile trading strategies for various market conditions. They enable traders to gain exposure to stocks, indices, commodities, or other financial instruments without the upfront cost of owning the asset outright. Utah’s entrepreneurial spirit aligns with the inherent risk-reward balance of options trading, providing a conducive environment for savvy investors.

Understanding Options Trading Basics

At its core, an option represents a contract between a buyer and a seller. The buyer acquires the right to buy or sell a specified asset at a predetermined price on or before a specific date. Unlike buying stocks outright, owning options grants the holder flexibility and potential leverage, as they only control the right to trade an asset, not the underlying asset itself.

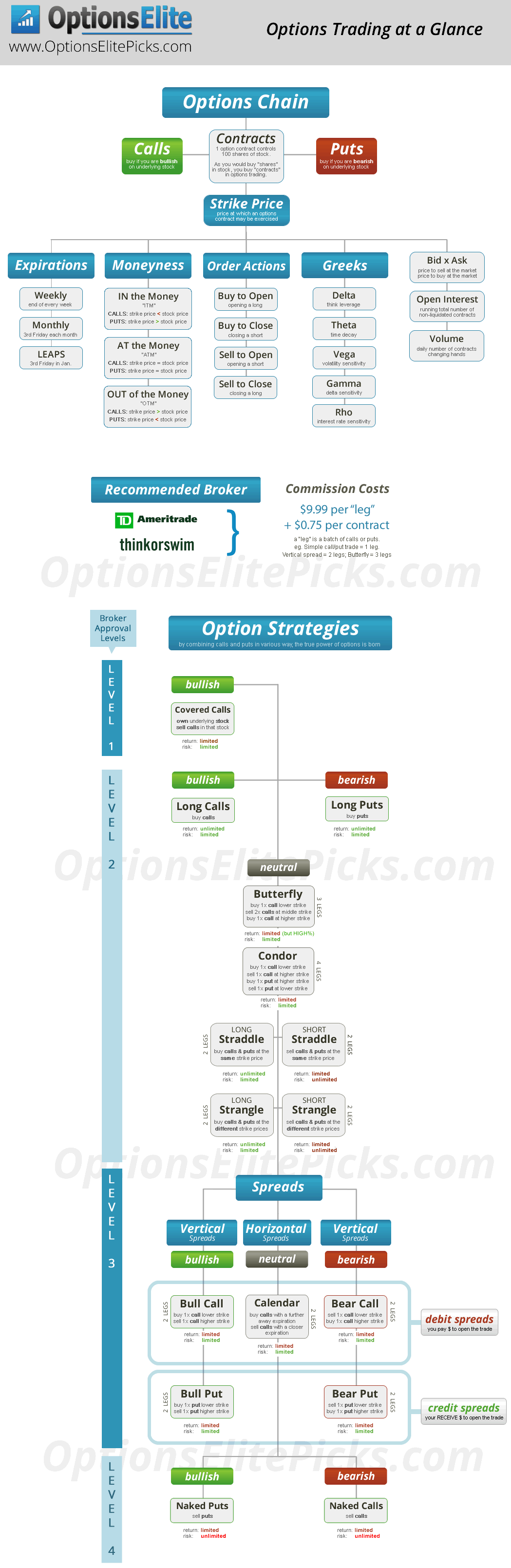

Options can be classified into two primary types: calls and puts. A call option gives the buyer the right to purchase the underlying asset at the strike price, while a put option provides the right to sell. The strike price is the agreed-upon price at which the buyer can trade the underlying asset.

Strategies for Options Trading

Options trading offers a plethora of strategies catering to different investor risk tolerances and financial goals. Some common strategies include:

- Covered Call Writing: Selling call options while owning the underlying asset to generate income and potentially enhance returns.

- Protective Put Buying: Purchasing put options to hedge against potential downturns in the value of assets.

- Bull Call Spread: Buying a lower-strike call option and selling a higher-strike call option to capture potential price appreciation.

Essential Considerations for Options Traders in Utah

To navigate the options trading landscape successfully, investors should consider the following key factors:

- Risk Management: Options trading carries inherent risks, so managing those risks is crucial. Researching, understanding contract terms, and using appropriate risk management strategies is vital.

- Market Trends: Staying informed about market conditions, economic indicators, and industry-specific news can provide valuable insights for making informed trading decisions.

- Volatility: Options prices are influenced by volatility, so monitoring this factor and understanding how it affects options pricing is essential.

- Liquidity: The volume of options traded affects their liquidity and can influence their prices. Considering liquidity when making trading decisions is prudent.

Image: thestockmarketwatch.com

Commissions and Fees in Utah

Options trading commissions vary among brokerages operating in Utah. It’s advisable for traders to research and compare different brokers to find the most competitive rates. Some brokers offer discounted commissions for high-volume traders, while others charge a flat fee per contract.

Options Trading Utah

Image: marketbusinessnews.com

Conclusion

Options trading presents a viable avenue for investors in Utah seeking to expand their financial horizons. By embracing a balanced approach that incorporates risk management, market awareness, and a deep understanding of options contracts, traders can potentially harness the flexibility and leverage options provide. Whether aiming to enhance investment returns or hedge against market downturns, options trading offers a versatile toolset for savvy investors navigating Utah’s dynamic business landscape.