A Beginner’s Guide to Navigating the Options Market

Options trading, a dynamic aspect of the financial markets, offers intriguing opportunities but also demands a comprehensive grasp of its mechanics. Before embarking on the thrilling world of options trading, it’s crucial to know the essential requirements set forth by brokers like TD Ameritrade.

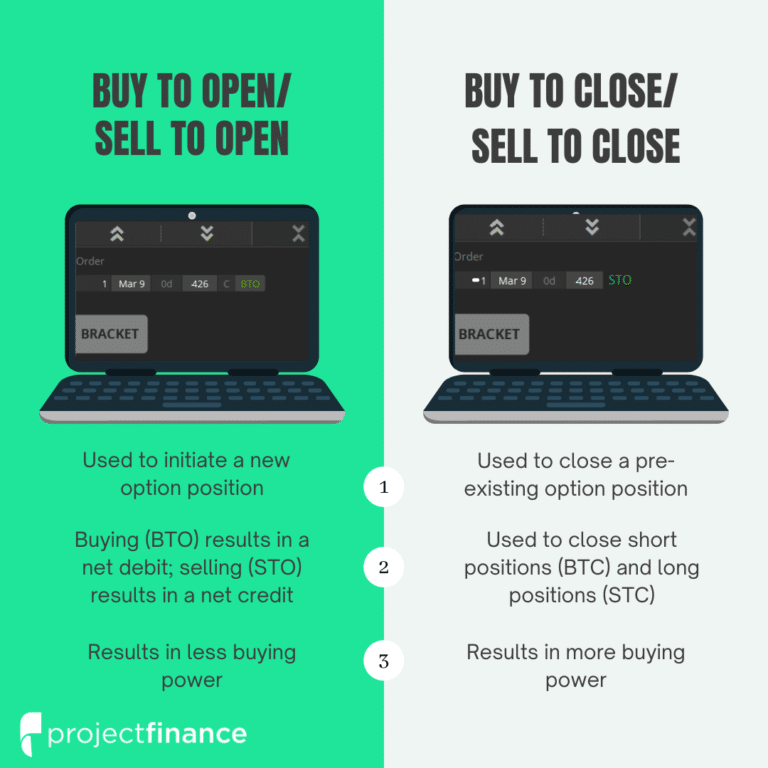

Image: www.projectfinance.com

Understanding TD Options Trading Minimum Requirements

To establish an options trading account with TD Ameritrade, aspiring traders must meet specific eligibility criteria. These requirements have been meticulously designed to safeguard investors and ensure responsible trading practices.

-

Account Type: You will initially establish an individual or joint brokerage account. To engage in options trading, your account must be classified as a margin account. Margin accounts grant you the flexibility to borrow funds for investment purposes, allowing you to amplify your potential returns.

-

Experience and Knowledge: TD Ameritrade takes your trading proficiency seriously. Before approving your options trading application, they will assess your experience and knowledge. You must demonstrate a fundamental understanding of options trading through prior training, coursework, or trading experience.

-

Financial Standing: Your financial health is an essential factor in qualifying for options trading. TD Ameritrade analyzes your income, assets, and liabilities to determine your suitability. You must have sufficient financial resources to cover potential losses incurred during options trading.

-

Risk Tolerance: Options trading carries inherent risks that investors need to be willing and prepared to take. TD Ameritrade evaluates your risk appetite to ensure that you are comfortable with the potential fluctuations and losses associated with this type of trading.

Navigating the Options Trading Landscape

Once you have met the minimum requirements and your options trading account is established, it’s time to navigate the exciting but challenging world of options trading. Here are some key points to keep in mind:

-

Types of Options: Options come in two primary forms: calls and puts. Calls convey the right, but not the obligation, to buy an asset at a specified price on or before a certain date. Puts, on the other hand, grant the right to sell an asset under the same conditions. Understanding the distinctions between these options is crucial for successful trading.

-

Option Pricing: The price of an option is determined by intricate calculations that consider factors like the underlying asset’s price, time to expiration, strike price, and market volatility. Grasping these pricing dynamics is essential for making informed trading decisions.

-

Risk Management: Options trading exposes you to potential risks, including the possibility of losing your entire investment. Adopting sound risk management strategies, like setting stop-loss orders and understanding the concept of delta, is critical to mitigating losses and protecting your capital.

Expert Tips for Aspiring Options Traders

Embarking on options trading is an enriching but potentially treacherous endeavor. To enhance your odds of success, consider these invaluable tips from seasoned experts:

-

Start Small: Avoid the temptation to dive into the deep end right away. Start with small trades to gain experience and confidence before venturing into more significant positions.

-

Manage Your Emotions: Trading can evoke strong emotions that may cloud your judgment. Strive to maintain composure and make rational decisions based on analysis rather than gut feeling.

-

Seek Continuous Education: The financial markets are constantly evolving. Stay abreast of the latest trends, strategies, and market movements by attending webinars, reading books, and connecting with experienced traders.

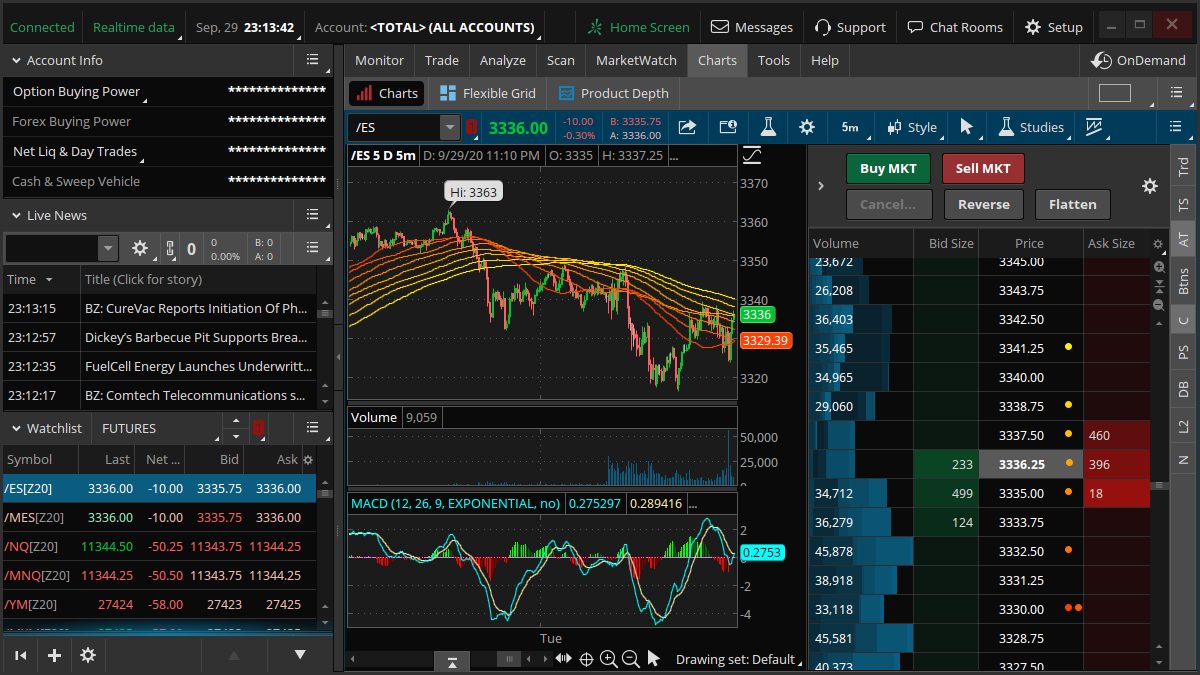

Image: www.forexsfxgroup.com

Frequently Asked Questions

Q: Can I trade options without a margin account?

A: No. Margin accounts are necessary for options trading because they provide the leverage needed to execute these strategies.

Q: What is the minimum account balance required to trade options?

A: TD Ameritrade does not explicitly disclose a minimum account balance for options trading. However, having sufficient capital to cover potential losses is vital.

Q: How do I apply for an options trading account?

A: Reach out to TD Ameritrade, either online or through their customer support team, to initiate the application process. They will guide you through the eligibility criteria and account setup.

Td Options Trading Minimum Requirements

Image: www.tdameritrade.com.sg

Conclusion: Embracing Options Trading with Confidence

Understanding the TD options trading minimum requirements is essential for any aspiring trader, unlocking the gateway to the dynamic world of options trading. Remember the expert tips, continually expand your knowledge, and embrace risk management strategies. Are you prepared to venture into this thrilling realm?