Introduction

The Multi Commodity Exchange of India (MCX) offers crude oil options, providing traders with a powerful tool to manage risk and speculate on future oil price movements. Understanding the intricacies of MCX crude oil options trading can empower traders to make informed decisions and potentially profit from the dynamic oil market.

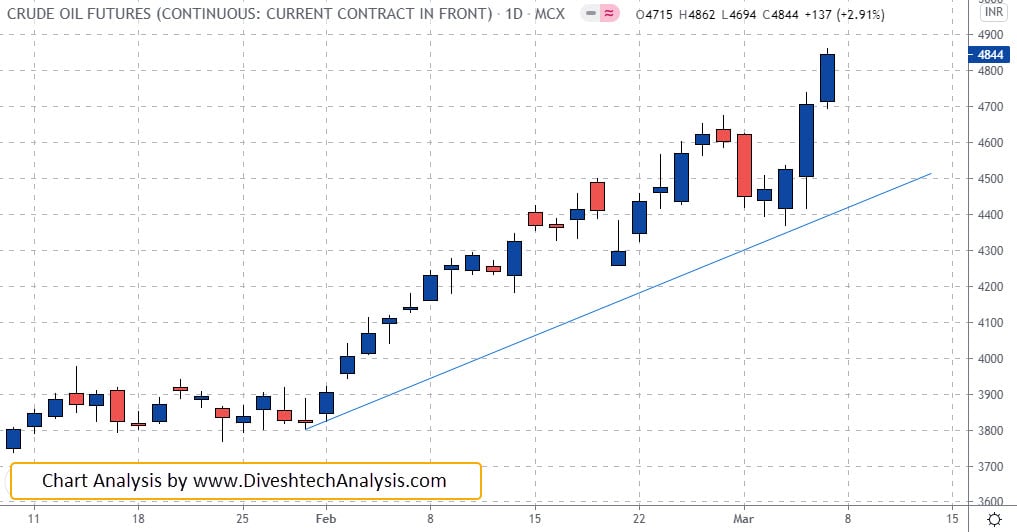

Image: in.tradingview.com

MCX Crude Oil Options: Definition and Importance

A crude oil option is a derivative contract that grants the buyer the right, but not the obligation, to buy or sell a specified quantity of crude oil at a predetermined price (known as the strike price) on or before a specified future date (known as the expiry date). Options trading allows traders to manage price risk by locking in future prices or to speculate on price movements without the obligation to actually make or take physical delivery of the underlying oil.

MCX crude oil options play a crucial role in the Indian commodities market, serving as a hedging tool for oil producers, consumers, and traders who are exposed to price volatility in the crude oil market. It enables them to mitigate potential losses or lock in profitable prices, providing greater stability and predictability in their operations.

Key Concepts in MCX Crude Oil Options Trading

Contract Specifications

MCX crude oil options contracts are standardized and traded on the exchange with specific underlying quantities, strike prices, and expiry dates. The underlying asset is the MCX COMEX Crude Oil futures contract, which represents the physical delivery of crude oil at various locations in India.

Image: www.diveshtechanalysis.com

Call and Put Options

There are two main types of options contracts: call options and put options. A call option gives the buyer the right to buy the underlying oil at a predetermined strike price by the expiry date, while a put option grants the holder the right to sell the underlying oil at a predetermined strike price by the expiry date.

Exercise Price and Expiry Date

The exercise price, or strike price, is a crucial element of an options contract. It represents the specified price at which the buyer can buy or sell the underlying crude oil. The expiry date is the date on which the option expires, after which the contract becomes worthless.

Premium

The premium is the price paid by the buyer of an options contract in exchange for the right to exercise the option. The premium reflects the price risk and time value associated with the contract.

Benefits of MCX Crude Oil Options Trading

Risk Management

One of the primary benefits of MCX crude oil options trading is risk management. By buying an appropriate option, traders can hedge against potential adverse price movements in the oil market. For instance, oil producers can buy put options to lock in a minimum selling price if oil prices decline.

Speculation

Options also allow traders to speculate on the future price movements of crude oil. If a trader expects oil prices to rise, he/she can buy a call option, which provides the flexibility to purchase oil at a predetermined price at a later date, regardless of the prevailing market price.

Leverage

Options trading offers leverage, allowing traders to control a larger position with a relatively small investment. The premium paid for an option is significantly lower than the value of the underlying oil, which enables traders to gain exposure to the oil market with limited capital.

Strategies for MCX Crude Oil Options Trading

Hedging Strategy

A hedging strategy is a common approach in options trading. Hedgers typically sell options to reduce their risk exposure to adverse price fluctuations. For example, an oil producer may sell call options to reduce its risk of losing on future sales if oil prices fall below their desired level.

Speculative Strategy

Traders can use speculative strategies to position themselves for potential profits based on their market outlook. Buying call options benefits traders who expect oil prices to rise, while buying put options aligns with expectations of falling oil prices.

Vertical Spread Strategy

A vertical spread strategy involves buying and selling options with different strike prices but the same expiry date. This strategy allows traders to define their risk and reward parameters within a specific price range.

Market Analysis for MCX Crude Oil Options

Traders who engage in options trading should thoroughly analyze the oil market to make informed decisions. Key factors to consider include global economic growth, geopolitical events, supply and demand dynamics, and inventory levels. Additionally, traders can use technical analysis tools to identify price trends and potential trading opportunities.

Mcx Crude Oil Options Trading

Image: www.youtube.com

Conclusion

MCX crude oil options trading provides a powerful tool for traders to manage risk, speculate on market movements, and potentially generate profits. By understanding the key concepts, strategies, and market analysis involved, traders can navigate the complexities of options trading and make strategic decisions that align with their financial goals. In this dynamic and ever-changing oil market, MCX crude oil options offer traders a means to navigate price volatility and position themselves for success.