When navigating the dynamic world of options trading, understanding the significance of trading volume is paramount. Volume refers to the number of contracts bought and sold for a particular option during a specific time frame, typically a trading day. It provides invaluable insights into market sentiment, liquidity, and price action.

Image: www.financial-spread-betting.com

The volume of options trading plays a crucial role in gauging market activity. High volume indicates strong interest in the underlying asset and can signal potential price volatility. Conversely, low volume may suggest a lack of interest or liquidity, making it more challenging to execute trades efficiently. By monitoring volume, traders can better assess the strength of market movements and make more informed decisions.

Interpreting Volume: Identifying Market Sentiment

Volume can serve as a reliable indicator of market sentiment. When volume surges, it often suggests that many traders are actively buying or selling the underlying asset. This increased activity can be attributed to various factors, such as news events, earnings announcements, or changes in market conditions. A surge in volume can signal potential opportunities or risks and warrant closer attention.

Conversely, low volume may indicate a lack of interest or conviction in the underlying asset. While it can sometimes suggest a period of consolidation or indecision, prolonged low volume can also be a sign of a less liquid market. In such situations, traders should exercise caution, as executing large orders may be more challenging.

Volume and Liquidity: Assessing Trade Execution

Options trading volume is closely intertwined with liquidity. Liquidity refers to the ease with which an asset can be bought or sold without significantly affecting its price. High-volume options tend to be more liquid, as there are more participants actively trading them. This liquidity makes it easier for traders to enter and exit positions without incurring substantial slippage.

On the other hand, low-volume options may pose challenges in executing trades efficiently. A sudden increase in trading activity, such as during market events, can lead to price swings due to limited liquidity. Traders may experience slippage or difficulty filling orders at their desired prices.

Volume and Price Action: Uncovering Market Trends

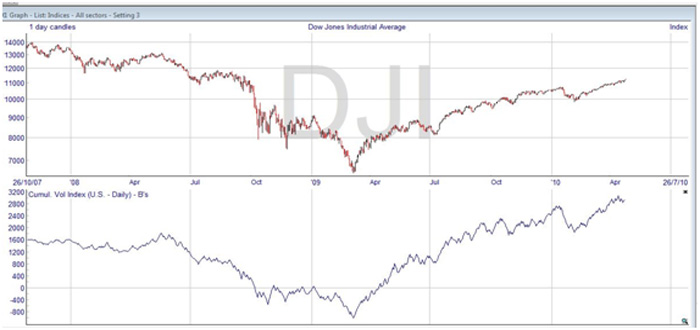

Volume can also provide valuable insights into price action. A surge in volume coinciding with a significant price movement can indicate that the momentum is strong and that the trend is likely to continue. Traders can ride such trends by adjusting their positions accordingly.

However, volume divergence can also be an important signal to watch for. This occurs when volume and price action move in opposite directions. For example, a decline in volume despite rising prices could suggest that the rally is losing steam and may be due for a correction.

Image: olymptrade.broker

Volume in Different Trading Strategies

Traders employ volume to inform their trading strategies and make informed decisions. Volume-based strategies include:

• Volume Profile: Traders use this technique to identify areas of support and resistance based on historical volume levels.

• Volume Accumulation/Distribution: By analyzing volume patterns, traders aim to identify potential breakout opportunities or reversals.

• Gap Analysis: Traders examine volume levels associated with price gaps to assess potential trading opportunities.

• Relative Volume: By comparing the volume of an option to its underlying asset or other similar options, traders gain insights into relative strength or weakness.

Volume Of Options Trading

:max_bytes(150000):strip_icc()/dotdash_Final_Average_Daily_Trading_Volume_ADTV_Definition_Oct_2020-01-ae33c3c17bd0404793ff7eb8e3e5713a.jpg)

Image: sharrondonald.blogspot.com

Conclusion

Volume is a crucial aspect of options trading, providing traders with valuable information about market sentiment, liquidity, and price action. By understanding the nuances of volume, traders can better gauge market dynamics and make more informed trading decisions. Whether it’s identifying potential trends, assessing liquidity, or employing volume-based strategies, mastering the art of volume analysis can significantly enhance trading performance.