Introduction:

Image: cei.org

The world of investing can be a labyrinth of complex financial instruments. Among them, options trading stands out as a sophisticated strategy that allows investors to navigate market volatility with calculated risk-taking. But where did this innovative tool originate? Embark on a historical expedition to uncover the fascinating story of when and how options trading was invented, a tale that has shaped the financial landscape we know today.

The Genesis of Options: A Dutch Prelude

The first glimmer of options trading emerged in the heart of 17th century Netherlands, amidst the bustling marketplaces of Amsterdam. In 1602, a pioneering merchant named Jan Wilem de la Faille introduced a novel contract that granted buyers the right, but not the obligation, to purchase a specific quantity of a particular commodity at a pre-agreed price on a specified date. These contracts, known as “options,” became an instant hit among traders seeking to mitigate risks in the unpredictable world of commodities trading.

The Seeds of Modern Options in Chicago

Centuries later, the options trading concept resurfaced on the shores of the United States. In 1848, the Chicago Board of Trade (CBOT) introduced standardized options contracts for agricultural commodities, revolutionizing the way farmers and traders managed price fluctuations. These early options contracts provided a safety net against adverse price movements, allowing agricultural producers to secure a minimum price for their crops and merchants to hedge against potential losses.

The Options Revolution Takes Flight

The true birth of modern options trading occurred in 1973, when the Chicago Mercantile Exchange (CME) introduced the first options contracts on financial instruments. These groundbreaking contracts transformed the financial landscape, giving investors a powerful tool to manage risk and speculate on the movement of stocks, bonds, and currencies. The CME’s innovation paved the way for the rise of options markets worldwide, leading to the creation of exchanges dedicated solely to options trading.

The Black-Scholes Model: A Paradigm Shift

In 1973, the financial world witnessed a groundbreaking development that would forever change the theory and practice of options trading. Fischer Black and Myron Scholes published their seminal paper, “The Pricing of Options and Corporate Liabilities,” introducing the Black-Scholes model. This mathematical formula revolutionized the way options prices were calculated, providing a more accurate and reliable basis for pricing and hedging options contracts.

The Rise of Electronic Trading and Globalization

The advent of electronic trading platforms in the 1990s accelerated the growth and accessibility of options trading. Online platforms made it possible for individual investors to trade options with ease and efficiency, reducing transaction costs and expanding market participation. Globalization further fueled the rise of options trading, as exchanges and brokers connected across borders, creating a truly global market for options contracts.

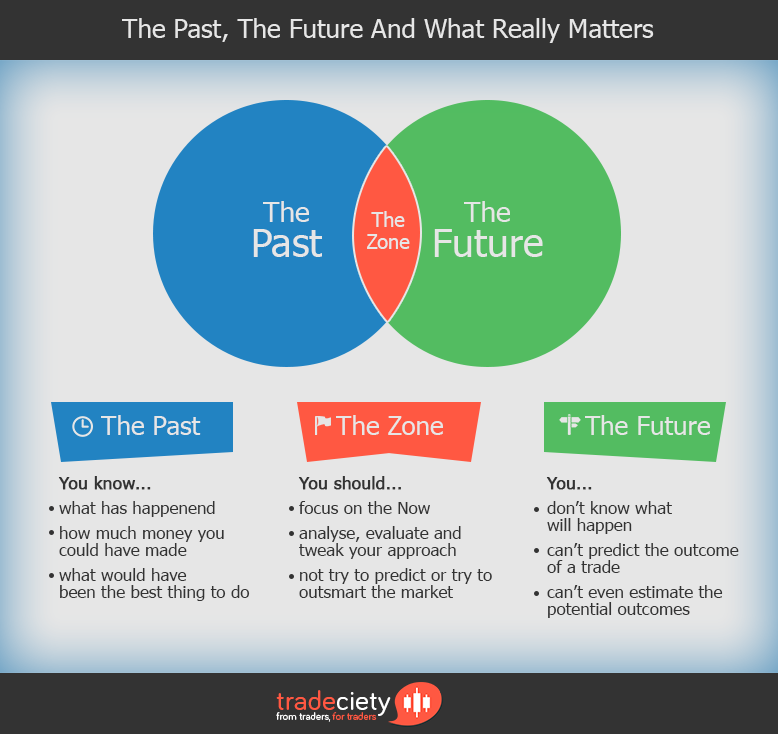

The Ongoing Evolution of Options Trading

Options trading continues to evolve at a rapid pace, with new products and strategies emerging to meet the ever-changing needs of investors. Recent developments include the introduction of exotic options, such as binary options and barrier options, which have added greater complexity and flexibility to the options trading landscape. The ongoing rise of artificial intelligence (AI) and machine learning is also transforming options trading, with algorithms analyzing vast amounts of data to optimize trading strategies and identify trading opportunities.

Conclusion:

The invention of options trading, a journey that began centuries ago, has profoundly shaped the way investors navigate the financial markets. From its humble beginnings in Amsterdam to its modern incarnation as a sophisticated risk management tool, options trading has played a crucial role in facilitating global commerce and empowering individuals to participate in financial markets. As the options trading landscape continues to evolve, one thing remains certain: this innovative instrument will continue to empower investors with a powerful means to manage risk and capitalize on market opportunities.

Image: tradeciety.com

When Was Options Trading Invented

https://youtube.com/watch?v=qyxKp8gLJU8