In the ever-evolving landscape of financial markets, options trading stands out as a remarkable tool that has shaped investment strategies for centuries. Its origins, however, remain shrouded in a captivating tapestry of history, risk-taking, and financial innovation. Join us on an enchanting journey as we explore the fascinating tale of options trading, tracing its humble beginnings to its present-day prominence.

Image: www.plafon.id

Roots in Ancient Greece: A Tale of Wise Investors

The seeds of options trading were first sown in the bustling marketplaces of ancient Greece. Merchants and traders, ever seeking to hedge against risk and maximize profits, embraced a practice known as “bottomry.” In essence, bottomry allowed merchants to sell claims on future cargo shipments in exchange for upfront funding, providing them with protection against potential losses.

Renaissance Revival: The Birth of Modern Options

Centuries later, during the Italian Renaissance, options trading resurfaced with renewed vigor. In the vibrant merchant republics of Florence, Venice, and Genoa, traders invented new and sophisticated financial instruments, including options. These contracts, known as “optioni,” granted buyers the right to buy or sell an underlying asset at a predetermined price within a specific time frame.

Amsterdam’s Golden Age: Options Flourish in the Dutch Republic

The 17th century witnessed the Golden Age of Amsterdam, a period of unprecedented maritime trade and financial innovation. Options trading flourished in this bustling hub, where merchants used options to mitigate the risks associated with long-distance voyages. The Amsterdam Stock Exchange became the epicenter of options trading, offering a platform for investors to trade contracts on commodities such as pepper, tulips, and spices.

Image: www.binaryoptions.com

London’s Mercantile Dominance: Lloyd’s and the Rise of Marine Insurance

As Britain rose to maritime dominance in the 18th century, London established itself as a global hub for shipping and insurance. Lloyd’s Coffee House, the birthplace of the iconic Lloyd’s of London insurance market, played a pivotal role in the development of options trading. Marine insurance policies took on options-like characteristics, allowing merchants to transfer and diversify their risks.

Expansion in the United States: A New Frontier for Options Trading

Across the Atlantic, options trading gained traction in the burgeoning markets of the United States. In 1871, the Chicago Board of Trade introduced standardized options contracts for agricultural commodities, making them more accessible and transparent. As America’s economic might grew, so did the demand for options trading, with new exchanges emerging to meet the needs of investors.

The 20th Century: Technological Advancements and Trading Revolution

The 20th century ushered in a technological revolution that transformed options trading forever. The development of computers and sophisticated mathematical models enabled the creation of more complex and innovative options strategies. The Chicago Mercantile Exchange (CME) and Chicago Board Options Exchange (CBOE) became major players in the options market, offering contracts on stocks, indices, and currencies.

Modern Era: Options Trading Goes Global

In the modern era, options trading has become a truly global phenomenon. Exchanges in Europe, Asia, and the Middle East have sprung up, providing investors with access to a wide range of options markets. The rise of electronic trading has further enhanced efficiency, liquidity, and accessibility, making options trading available to retail investors around the world.

The Role of Options Trading in Today’s Markets

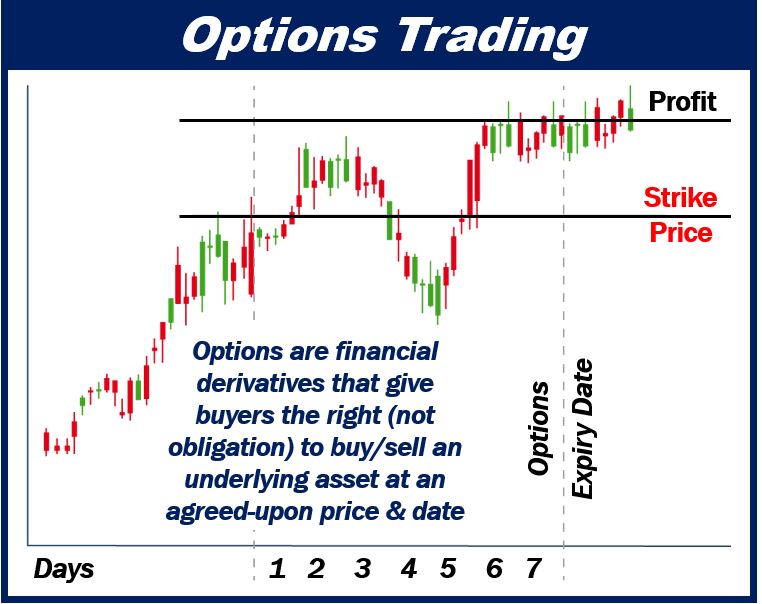

Today, options trading remains an indispensable tool for investors seeking to manage risk and enhance portfolio returns. Options contracts offer a flexible and versatile way to speculate on market movements, hedge against volatility, and generate income through strategies such as covered calls and cash-secured puts.

Expert Insights and Actionable Tips

As you embark on your options trading journey, it is crucial to seek guidance from experienced professionals. Consult with a financial advisor who can help you understand the risks and rewards of options trading and develop suitable strategies aligned with your financial goals.

Educating yourself through books, online resources, and workshops is also vital. Familiarize yourself with different options strategies, such as buying calls and puts, selling covered calls, and engaging in vertical spreads. By honing your knowledge and skills, you can navigate the complex world of options trading with greater confidence.

How Old Is Options Trading

Image: marketbusinessnews.com

Conclusion

The story of options trading is a testament to the enduring power of financial innovation. From its humble origins in ancient Greece to its present-day prominence in global markets, options trading has played a vital role in shaping the way investors manage risk and pursue financial opportunity. As the financial landscape continues to evolve, options trading will undoubtedly remain a powerful tool for savvy investors seeking to navigate market complexities and achieve their financial aspirations.