A Guide for Solo Traders

The allure of financial independence and the potential for substantial wealth creation have drawn countless individuals to the world of options trading. However, embarking on this journey as a solo trader requires careful preparation, strategic planning, and unwavering dedication. In this comprehensive guide, we will delve into the intricacies of building a one-man options trading hedge fund, empowering you with the knowledge and tools necessary to navigate this complex market effectively.

Image: www.informit.com

Understanding Options Trading and Hedge Funds

Options trading involves buying or selling contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a particular date. Hedge funds, on the other hand, are investment vehicles that employ sophisticated investment strategies to generate returns for their investors. By establishing a one-man options trading hedge fund, you can combine these two elements, seeking to achieve consistent profits while mitigating risks.

Essential Knowledge and Skills

To succeed in this endeavor, you must possess a deep understanding of options pricing, volatility, and market dynamics. This requires thorough study and practical experience. Mathematical proficiency, including statistics and probability, is also essential for developing effective trading strategies.

Building Your Hedge Fund

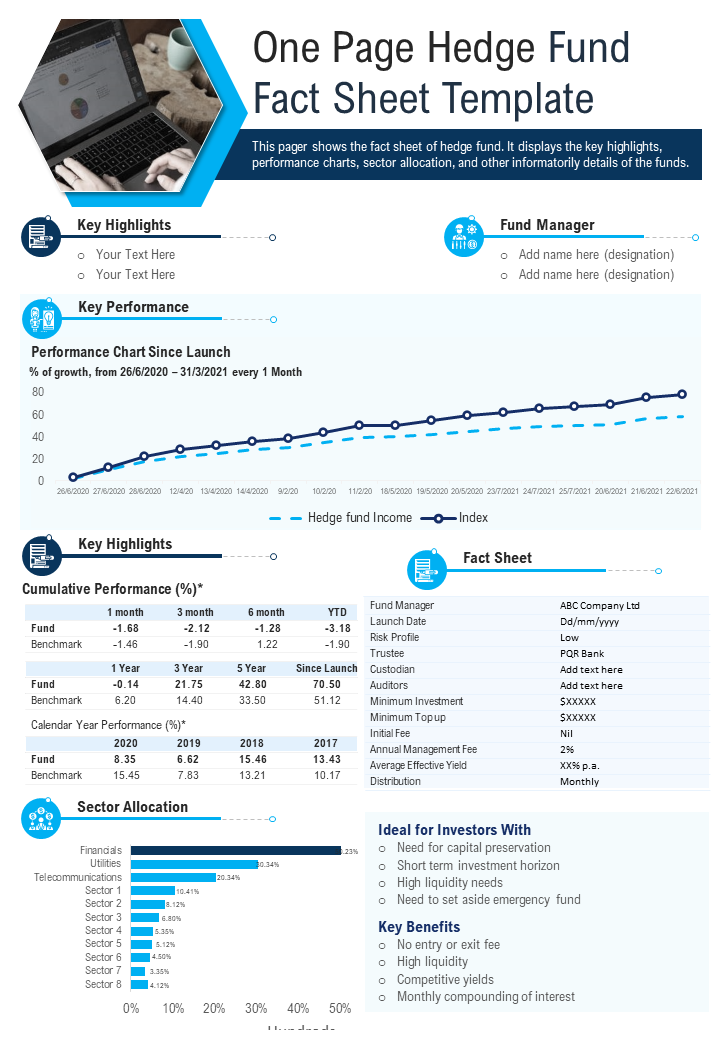

Image: www.slideteam.net

1. Establishing a Legal Entity

Choose a legal structure for your hedge fund, such as a limited liability company (LLC) or limited partnership (LP). This will provide tax advantages and protect your personal assets from potential losses.

2. Developing a Trading Plan

Outline your investment strategy, including the types of options you will trade, your risk management parameters, and your profit-taking and stop-loss targets. Consistency is key, so adhere to your plan diligently.

3. Managing Risk

Risk management is paramount in options trading. Employ strategies such as diversification, position sizing, and hedging to minimize losses and protect your capital.

4. Selecting a Trading Platform

Choose a reliable trading platform that offers advanced tools, charting capabilities, and quick order execution. Consider factors such as fees, user interface, and data quality when making your selection.

5. Brokerage Account

Open a brokerage account with a reputable broker that specializes in options trading. Compare fees, execution speed, and customer service before deciding on a broker.

Best Practices for Success

1. Constant Research and Education

Stay abreast of market developments, economic indicators, and financial news. Continuously expand your knowledge and refine your trading strategies through reading, attending conferences, and connecting with other professionals.

2. Discipline and Patience

Successful options trading requires unwavering discipline. Stick to your trading plan and avoid emotional decision-making. Patience is also crucial, as profits may not come immediately.

3. Psychological Fortitude

Options trading can be psychologically demanding. Develop emotional resilience and manage stress effectively. Stay calm during market volatility and learn from both your successes and failures.

4. Community and Mentorship

Surround yourself with a supportive community of like-minded traders and seek guidance from experienced mentors. Collaboration and knowledge-sharing can accelerate your learning and enhance your performance.

How To Build A One-Man Options Trading Hedge Fund

Image: www.youtube.com

Conclusion

Building a one-man options trading hedge fund is a challenging but potentially rewarding endeavor. By equipping yourself with the necessary knowledge, skills, and sound strategies, you can navigate the complexities of this market and strive for consistent profitability. Remember to prioritize risk management, stay committed to your trading plan, and embrace the continuous education and personal development necessary for long-term success.