In the realm of financial markets, crude oil options trading has emerged as a significant instrument for investors seeking to manage risk and leverage fluctuations in crude oil prices. India, being a major consumer and importer of crude oil, offers a dynamic landscape for this type of trading. This comprehensive guide delves into the world of crude oil options trading in India, providing essential insights for both beginners and experienced traders.

Image: www.gktoday.in

Understanding Crude Oil Options

Options contracts are financial derivatives that confer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. In the case of crude oil options, the underlying asset is the price of crude oil in the futures market.

Call Options: Give the holder the right to buy a certain amount of crude oil at a specified price (strike price) on or before a specific date (expiry date). If the market price of crude oil rises above the strike price, the holder can exercise the call option to purchase the oil at a profit.

Put Options: Grant the holder the right to sell a certain amount of crude oil at a specified price (strike price) on or before a specific date (expiry date). If the market price of crude oil falls below the strike price, the holder can exercise the put option to sell the oil at a profit.

Key Features of Crude Oil Options Trading in India

Exchanges: Crude oil options are traded on the Multi Commodity Exchange of India Limited (MCX) and the National Commodity and Derivatives Exchange Limited (NCDEX).

Contracts: The contract size is 100 barrels of crude oil, and contracts are available for a variety of expirations, ranging from near-month to distant-month contracts.

Trading Sessions: Trading in crude oil options takes place during the weekdays from 10:00 AM to 11:55 PM IST.

Settlement: Options that are exercised result in physical delivery of crude oil. Settlement occurs at the designated delivery centers specified by the exchange.

Advantages of Crude Oil Options Trading

Risk Management: Options allow traders to protect against adverse price movements in the underlying asset. For instance, a producer or refiner can buy a put option to lock in a minimum selling price for crude oil, while a consumer can buy a call option to limit the impact of rising oil prices.

Potential Profits: Options provide leverage, enabling traders to amplify potential profits. By choosing the right strike price and expiration date, traders can capitalize on specific market expectations.

Flexibility: Options can be customized to suit the trader’s risk tolerance and investment objectives. Traders can adjust the strike price and expiration date to reflect their forecasts and market conditions.

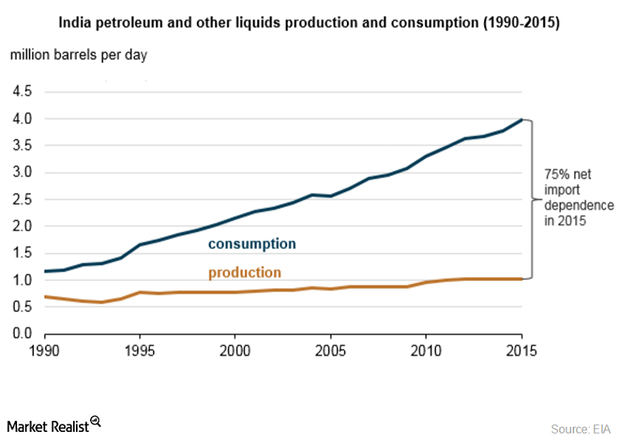

Image: marketrealist.com

Crude Oil Options Trading In India

Image: capital.com

Evaluating Crude Oil Options Strategies

Bullish Strategies: If traders expect crude oil prices to rise, they can consider buying call options. They can choose deep in-the-money options for guaranteed profit but higher premiums, or at-the-money or out-of-the-money options for potential but riskier profits.

Bearish Strategies: If traders expect crude oil prices to fall, they can consider buying put options. The same risk-reward considerations for call options apply to put options.

Neutral Strategies: Traders who anticipate a range-bound market can employ strategies such as the iron condor or butterfly spread to capitalize on time decay. These strategies involve selling options both above and below the expected price range.

In conclusion, crude oil options trading in India offers a versatile tool for investors seeking to manage risk and exploit market opportunities. By understanding the key concepts, evaluating different strategies, and staying informed about market dynamics, traders can effectively navigate this dynamic market and enhance their investment returns.