Embarking on the captivating journey of options trading demands a thorough understanding of the eligibility criteria that govern this thrilling financial endeavor. Options trading empowers investors with the opportunity to leverage their understanding of market dynamics to potentially enhance their financial gains. However, before delving into this realm, aspiring traders must meet specific minimum requirements to ensure a successful and compliant trading experience.

Image: www.ino.com

Eligibility Criteria: Demystified

To engage in options trading, individuals must meet the following key requirements set forth by regulatory bodies:

1. Sufficient Funds

Options trading necessitates the availability of a substantial amount of capital to serve as collateral. This financial buffer serves as protection against potential losses, as options strategies often entail a degree of risk. The exact capital requirements vary depending on the specific exchange or brokerage firm involved, but generally speaking, traders should anticipate the need for a healthy account balance.

2. Appropriate Risk Tolerance

Options trading inherently carries a level of risk, and potential traders should carefully assess their risk appetite before venturing into this domain. Options strategies can amplify both profits and losses, making it crucial to have a clear understanding of one’s risk tolerance and to trade accordingly.

Image: seekingalpha.com

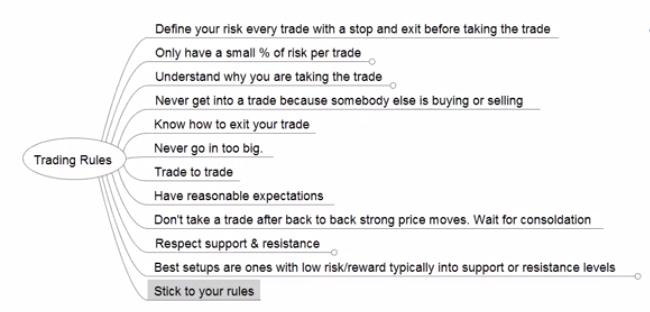

3. Knowledge and Experience

Options trading is not a suitable endeavor for novice investors. It demands a solid foundation in financial markets, trading concepts, and options-specific strategies. Aspiring traders are strongly advised to acquire the necessary knowledge and experience through formal courses, self-study, or mentorship programs before actively engaging in options trading.

4. Account Approval

To initiate options trading, individuals must obtain approval from their brokerage firm or exchange. This typically involves completing an application, demonstrating sufficient knowledge and experience, and agreeing to the associated risks. Brokerage firms may conduct a formal review process to assess the applicant’s suitability for options trading.

5. Suitability Assessment

Prior to approving an account for options trading, the brokerage firm or exchange will conduct a suitability assessment to determine whether the applicant has the requisite knowledge, experience, and financial capacity to engage in this complex financial activity. This assessment may involve a questionnaire or a telephone interview.

Understanding the Rationale

These minimum requirements are not merely arbitrary hurdles but are essential safeguards designed to protect both the individual trader and the overall integrity of financial markets.

- Sufficient Funds: Options strategies often magnify gains or losses, thus requiring adequate capital as buffer against potential setbacks.

- Appropriate Risk Tolerance: Traders should fully comprehend the risks involved and trade within the limits of their financial capacity.

- Knowledge and Experience: Options trading requires specialized knowledge and trading skills, making it crucial for traders to possess the necessary qualifications.

- Account Approval: This ensures that traders are aware of exchange rules and regulations and have met the exchange’s criteria for options trading.

- Suitability Assessment: Brokerage firms have a responsibility to ensure that traders fully understand options trading and are suitably equipped to manage its risks.

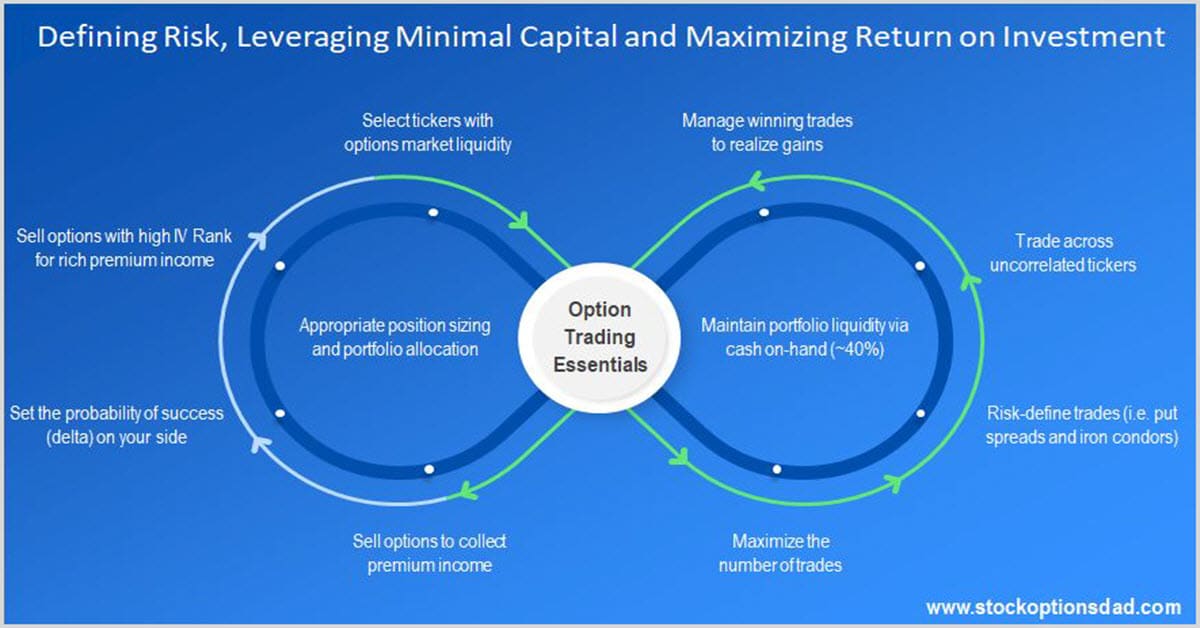

Minimum Requirements For Options Trading

Image: www.tradethetechnicals.com

Conclusion

Meeting the minimum requirements for options trading is not an insurmountable challenge but rather a necessary step in embarking on this exciting financial endeavor. By ensuring that they have the requisite capital, risk tolerance, knowledge, account approval, and suitability assessment, aspiring traders can lay the foundation for a successful and informed trading journey. Remember, financial success in options trading stems not only from meeting these entry criteria but also from continuous learning, strategic decision-making, and disciplined risk management.