Introduction

In the realm of stock trading, options play a pivotal role. They offer investors a unique blend of flexibility and potential profit generation, and among them, call options stand out as a cornerstone of any trading strategy. When it comes to comprehending call option trading, India provides a vivid and active landscape where lessons can be extracted from real-world scenarios.

Image: www.slideserve.com

Understanding Call Options

A call option grants the holder the right, not the obligation, to buy an underlying asset at a predetermined price, known as the strike price, on or before a specific date, known as the expiration date. In essence, call options are a bet on the prospect that the underlying asset will rise in value, enabling the holder to exercise their right to purchase it at a favorable price.

Trading Call Options in India

In the vibrant Indian stock market, call option trading is prevalent across various exchanges, including NSE and BSE. To trade call options, investors can adopt two primary approaches:

-

Writing (selling) call options: This involves selling the right to buy an underlying asset at a specific strike price to another party for a premium. The premium received represents the potential profit, but the seller bears the risk of the asset’s price exceeding the strike price.

-

Buying (purchasing) call options: Conversely, buying a call option means acquiring the right, not the obligation, to buy an underlying asset at a specific strike price for a finite period. The potential profit is limited to the premium paid, while the loss is capped at the same amount.

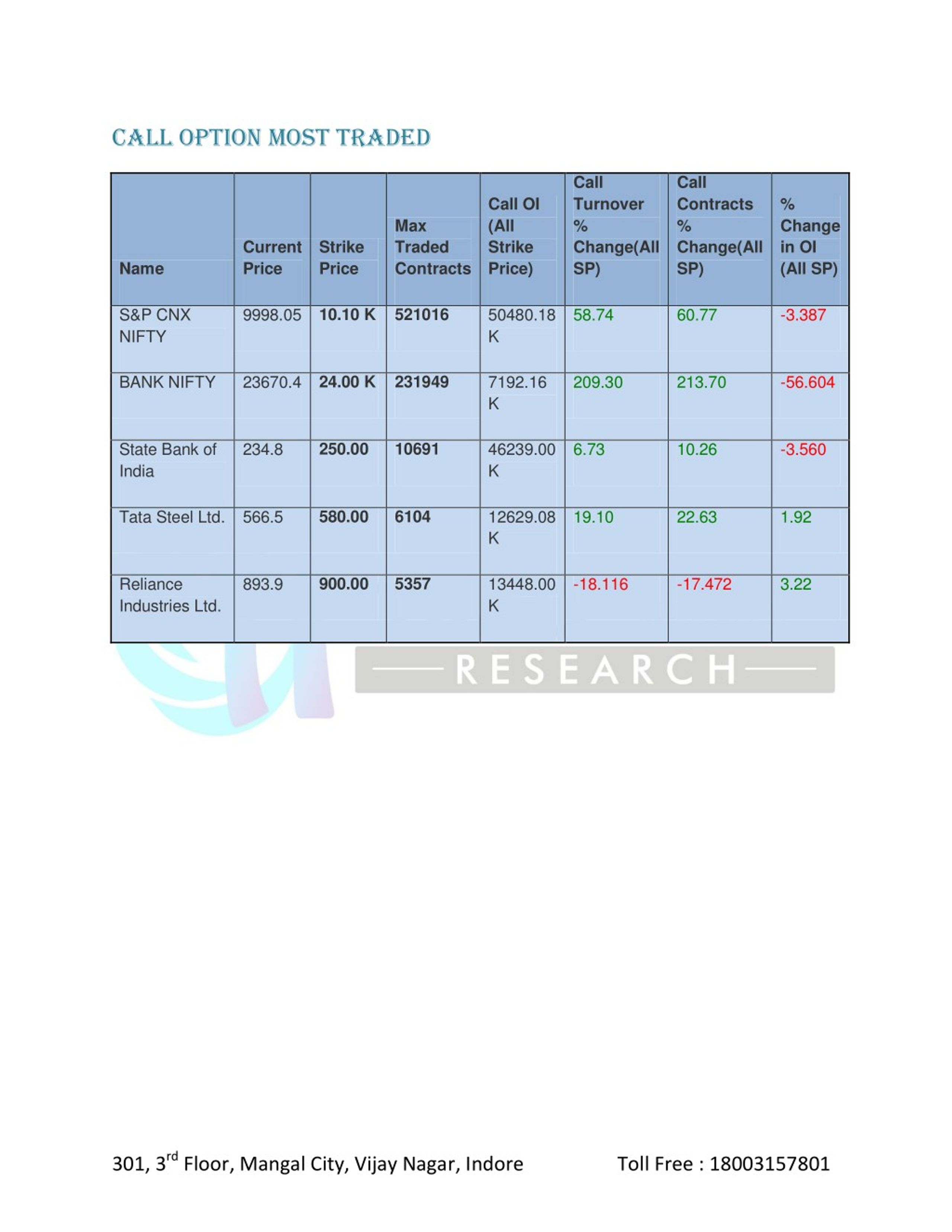

Example of Call Option Trading in India

Consider a scenario where Infosys stock is trading at ₹1,500 per share. An investor purchases a call option with a strike price of ₹1,550 and an expiration date of 3 months. If the Infosys stock price rises to ₹1,600 during the option’s life, the holder can exercise their right to buy the shares at ₹1,550, generating a profit of ₹50 per share (excluding brokerage fees). However, if Infosys stock falls below ₹1,550, the option expires worthless, resulting in a loss for the investor.

Image: thedailycalls.com

Tips and Expert Advice

Navigating the world of call option trading requires a considered approach. Here are some valuable tips for maximizing your trading success:

-

Research thoroughly: Delve into the underlying assets you’re considering, their historical performance, market trends, and industry dynamics.

-

Assess market sentiment: Stay abreast of economic news, company announcements, and market chatter to gauge investor confidence and potential market movements.

-

Set realistic targets: Avoid chasing excessive profits and instead focus on achievable goals based on your risk tolerance and trading strategy.

-

Manage risk: Utilize stop-loss orders to mitigate losses and avoid catastrophic outcomes.

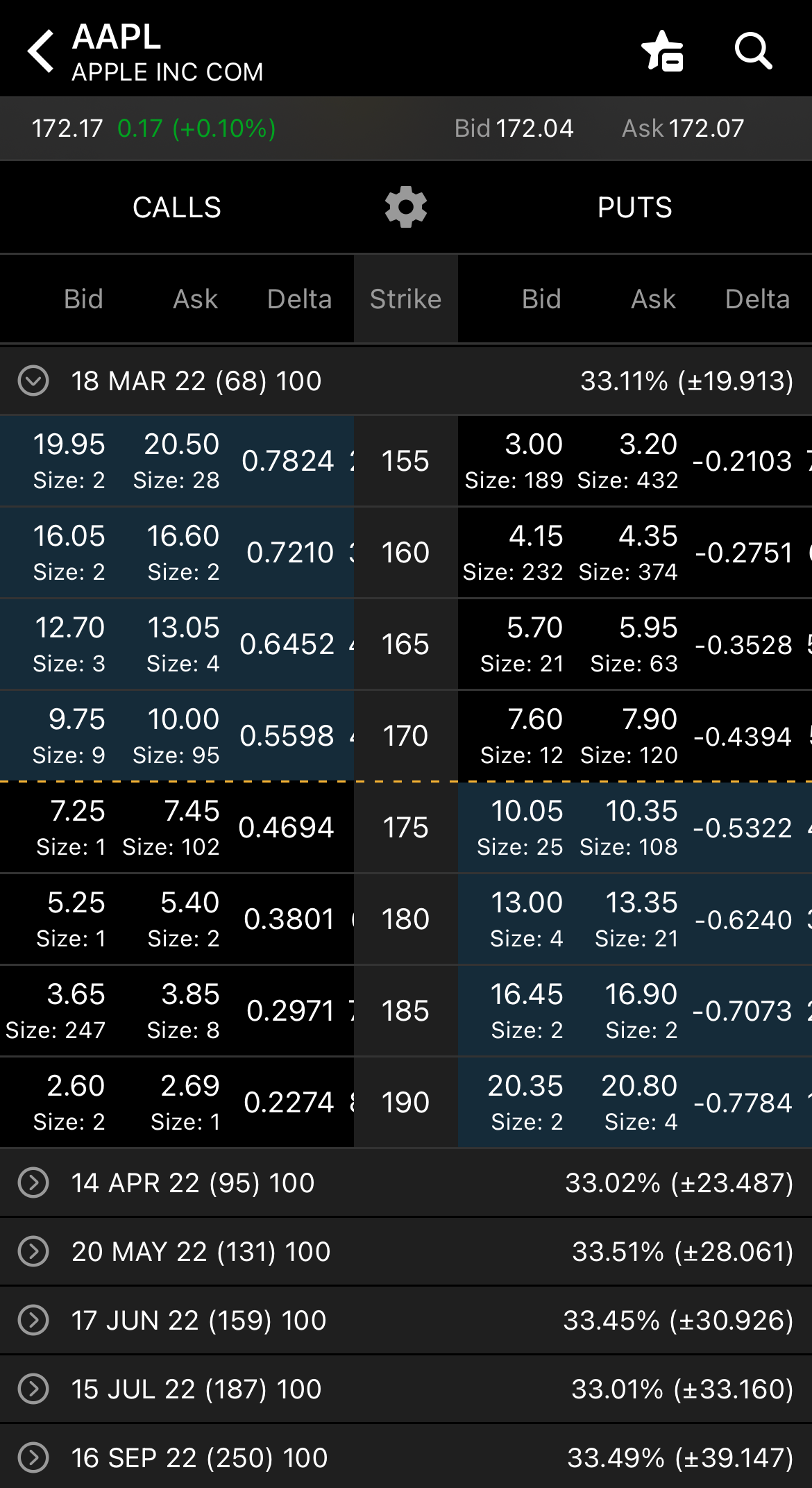

Call Option Trading Example India

Image: www.tradethetechnicals.com

Conclusion

Call option trading provides investors with a powerful tool to capitalize on potential market uptrends. By understanding the fundamentals and leveraging expert advice, traders can navigate the Indian stock market with confidence. Comprehending call option trading not only enhances the potential for gain but also empowers you with a proactive approach to investing. Are you ready to embrace the opportunities and complexities of call option trading?