In the fast-paced world of financial markets, traders and investors are constantly seeking ways to gauge the strength and direction of different assets. Among the plethora of available tools, average trading volume options stand out as a crucial indicator, providing valuable insights into market sentiment and potential price movements. In this comprehensive guide, we’ll delve into the world of average trading volume options, exploring their significance, types, and practical applications, empowering you with the knowledge to make informed trading decisions.

Image: financelyzer.com

Understanding Average Trading Volume Options

Average trading volume options measure the number of contracts traded for a specific option contract over a given time period, typically a day or a week. It serves as a reliable indicator of market interest and liquidity, with higher trading volumes often reflecting increased confidence and speculation. By analyzing average trading volume options, traders can assess the overall health of the underlying asset, identify potential trends, and make more informed decisions about their trading strategies.

Types of Average Trading Volume Options

There are two primary types of average trading volume options:

1. Historical Average Trading Volume (HAV): HAV represents the average number of contracts traded over a historical period, ranging from one month to one year or even longer. It provides a long-term perspective on average trading activity, helping traders identify trends and establish baselines for comparison.

2. Recent Average Trading Volume (RAV): RAV measures the average number of contracts traded over a more recent period, typically the past 10 or 20 trading days. It offers a more up-to-date view of market activity, allowing traders to gauge the current level of interest and momentum in an option contract.

Importance of Average Trading Volume Options

Average trading volume options play a crucial role in various aspects of trading and investing:

1. Market Sentiment Indicator: High trading volumes often indicate strong market sentiment, whether bullish or bearish. Conversely, low trading volumes may suggest a lack of interest or a period of consolidation.

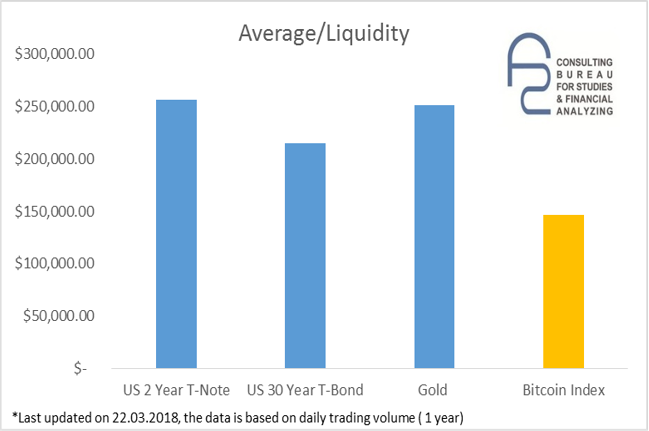

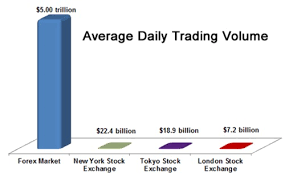

2. Liquidity Assessment: Options with higher average trading volumes tend to be more liquid, meaning it’s easier to buy or sell contracts at favorable prices. This liquidity is essential for effective trading strategies.

3. Volatility Indicator: Significant changes in average trading volume options can signal potential increases or decreases in price volatility. Traders can use this information to adjust their risk management strategies accordingly.

4. Identifying Trading Opportunities: By combining average trading volume options with other technical and fundamental analysis techniques, traders can identify potential trading opportunities based on price patterns and changes in market interest.

Image: www.livingfromtrading.com

Expert Insights and Actionable Tips

-

“In uncertain markets, average trading volume options can provide valuable insights into market sentiment and potential trends. Look for options with significant volume relative to their historical averages.” – Jonathan Green, Managing Director, Volta Trade Corp.

-

“When analyzing average trading volume options, consider comparing multiple time frames. For instance, comparing RAV with HAV can help identify changes in recent trading patterns.” – Dr. William Scott, Professor of Finance, Harvard Business School

-

“Remember that average trading volume options are not a predictive indicator but rather a measure of past activity. They should be used in conjunction with other analysis methods to enhance decision-making.” – Michelle Patel, Senior Analyst, Goldman Sachs Asset Management

-

“Volume changes can sometimes serve as early indicators of potential breakouts or reversals. Keep an eye on sudden spikes or drops in trading volume while monitoring other key technical indicators.” – Steve Crown, Author, “The Advanced Guide to Options Trading”

Average Trading Volume Options

Conclusion

Average trading volume options are a powerful tool that can enhance any trader’s or investor’s knowledge of market dynamics and potential trading opportunities. By understanding the significance, types, and applications of average trading volume options, individuals can gain a deeper understanding of market sentiment, liquidity, volatility, and more. Remember to always consider multiple time frames, combine volume analysis with other technical and fundamental indicators, and approach trading with a prudent risk management strategy. By harnessing the insights provided by average trading volume options, you can unlock a world of possibilities and make more informed decisions that align with your financial goals.