Introduction

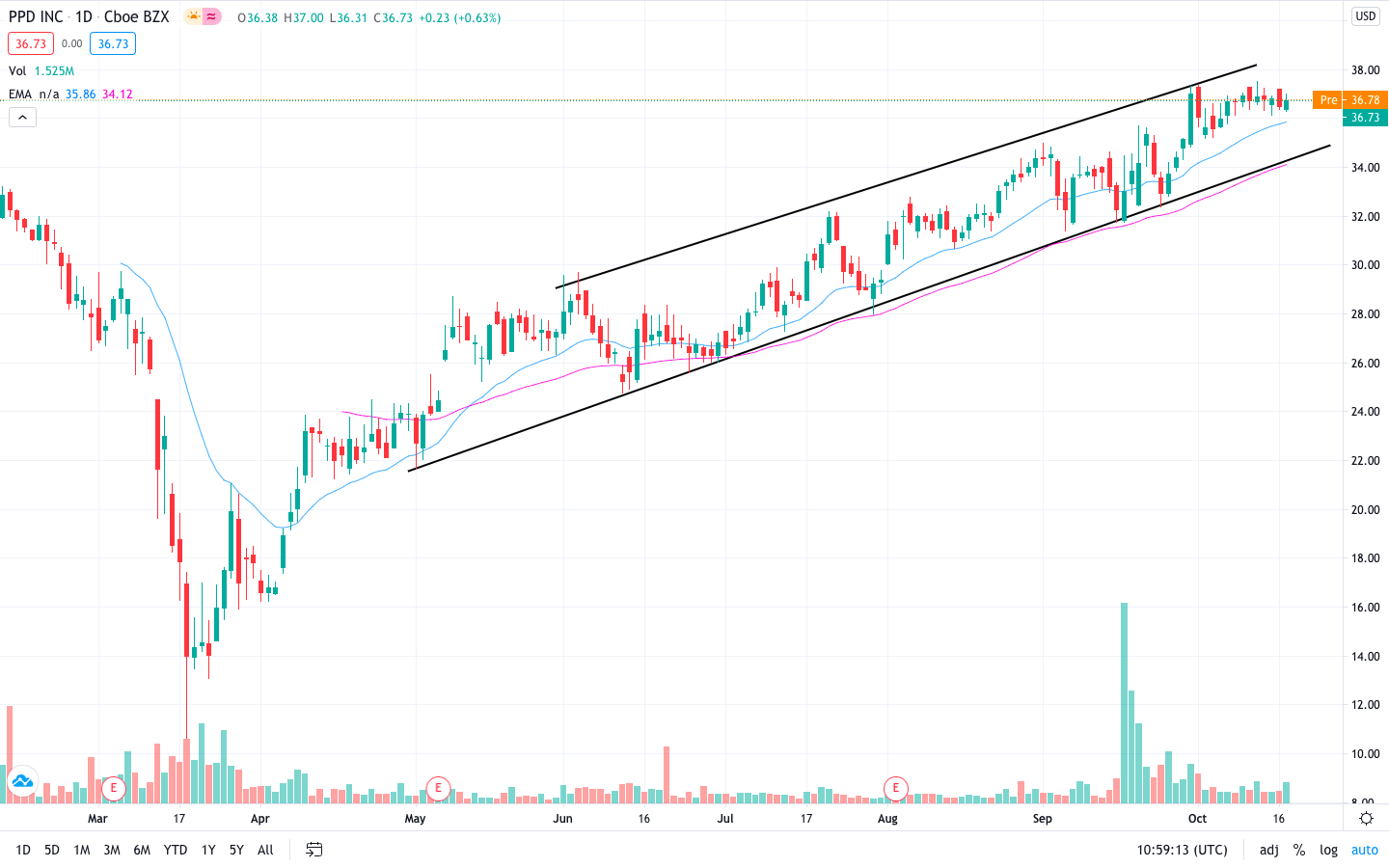

Image: seekingalpha.com

In the labyrinthine world of finance, options trading stands out as a powerful tool for investors seeking to navigate market volatility and optimize their returns. Among the various options strategies, Pairs of Pairs Trading (PPT), commonly known as PPD, has gained considerable traction due to its potential to generate consistent profits. By delving into the intricacies of PPD options trading, we aim to empower you with the knowledge and insights to harness this strategy effectively.

Unveiling PPD Options Trading

PPD options trading involves the simultaneous execution of two separate pairs of options, typically involving a stock and its corresponding index. The underlying premise of this strategy is that the relative performance of these two pairs tends to exhibit strong correlations, allowing for the exploitation of pricing inefficiencies. By capturing discrepancies in implied volatility, traders can potentially generate significant returns with limited downside risk.

Establishing the Pair

To execute a PPD trade, select a stock that exhibits a strong correlation with a broader market index, such as the S&P 500 or Nasdaq. The next step is to identify the corresponding options pairs: the stock pair (call option and put option) and the index pair (call option and put option). The strike prices should be carefully chosen, taking into account the desired profit target and risk tolerance.

Implementing the Strategy

Once the pairs have been established, the PPD strategy involves selling one option from each pair while simultaneously purchasing the other options. This creates a delta-neutral position, meaning the trader’s exposure to market direction is minimized. By closely monitoring the relative performance of the stock and index pairs, traders can adjust their positions accordingly to capitalize on market movements.

Managing Risk

While PPD options trading offers the potential for substantial returns, it is crucial to emphasize the inherent risks involved. Options trading requires a comprehensive understanding of market dynamics, and traders should only allocate a portion of their portfolio to this strategy. Careful position sizing, strict stop-loss orders to limit potential losses, and thorough risk management techniques are paramount for successful PPD execution.

Expert Insights and Actionable Tips

To enhance your PPD options trading journey, consider seeking insights from seasoned experts in the field. Attend webinars, read industry publications, and connect with experienced traders. By leveraging their knowledge and experience, you can refine your strategies and optimize your outcomes.

Conclusion

PPD options trading presents a compelling opportunity for investors seeking to enhance their returns and mitigate market risks. By mastering the nuances of this strategy, you can unlock the potential for consistent profits. Remember to approach options trading with a prudent and well-informed mindset, seeking guidance from reputable sources and implementing robust risk management measures. Embracing the principles of PPD options trading can propel you towards financial success while navigating the ever-changing market landscape.

Image: www.benzinga.com

Ppd Options Trading