Introduction

In the realm of investing, options pairs trading holds a unique position as a strategy that seeks to exploit market volatility. By combining two options contracts with different risk profiles, traders aim to generate returns regardless of market direction or the underlying asset’s price movement. This article unravels the intricacies of options pairs trading, exploring its history, fundamental principles, and effective implementation strategies.

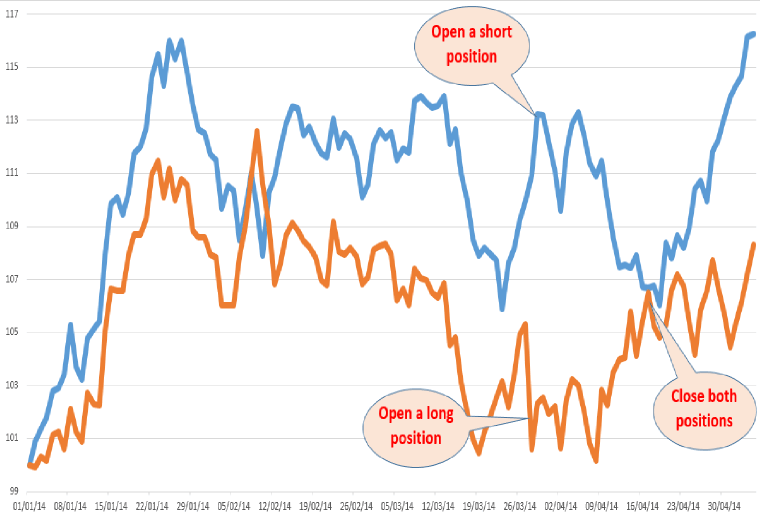

Image: www.youtube.com

Understanding Options Pairs Trading

Options trading involves the exchange of legal contracts that confer upon the buyer (holder) the right, but not the obligation, to buy (in case of a call option) or sell (in case of a put option) an underlying asset at a specified price on or before a predetermined date. Pairs trading, as the name suggests, involves crafting a strategy by combining two options contracts of varying strike prices and expirations. The primary goal is to exploit the relative pricing discrepancies between these two options, often resulting from temporary imbalances in market sentiment or inefficiencies.

Types of Options Pairs Strategies

The wide array of options pairs strategies available caters to diverse risk appetites and objectives. Among the most popular are:

- Long Call-Short Put: Simultaneously buying a call option at a higher strike price while selling a put option at a lower strike price signifies a bullish outlook.

- Short Call-Long Put: This strategy involves selling a call option at a higher strike price while simultaneously acquiring a put option at a lower strike price, reflecting a bearish market outlook.

- Straddle: A straddle consists of simultaneously buying both a call and a put option at the same strike price. Traders employ this strategy when anticipating substantial asset price movement.

- Strangle: Similar to a straddle, traders construct a strangle by purchasing a call option at a higher strike price and a put option at a lower strike price. However, the strike prices used are different, reflecting higher volatility expectations.

Key Considerations for Successful Pairs Trading

Maximizing the potential of options pairs trading mandates careful consideration of several crucial factors:

- Market Volatility: Pairs trading thrives in volatile markets, where asset prices exhibit significant fluctuations. Predicting future volatility is paramount to successful strategy implementation.

- Option Pricing: A thorough understanding of option pricing models, such as the Black-Scholes model, is essential to accurately assess the relative value of options.

- Risk Tolerance: Options pairs trading strategies can entail varying levels of risk. Traders must evaluate their risk appetites and make informed decisions accordingly.

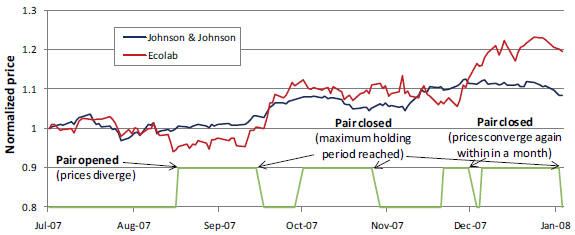

Image: integral.solutions

Options Pairs Trading

Image: www.cxoadvisory.com

Conclusion

Options pairs trading offers a versatile and potentially lucrative strategy for capitalizing on market volatility. Understanding the core concepts, strategies, and risk considerations equips traders with the knowledge necessary to navigate the complexities of this exciting trading space. Remember to prioritize research, stay abreast of market developments, and exercise prudent risk management practices to leverage the full potential of options pairs trading.