Unlock the Power of Informed Decision-Making

In the fast-paced world of finance, the ability to make informed and timely trading decisions can mean the difference between success and failure. Embracing option trading offers traders the potential to capitalize on market volatility and generate substantial returns. However, navigating the complexities of option strategies can be a daunting task. In this comprehensive guide, we’ll delve into the essential steps involved in building an effective option trading system that empowers you to trade with confidence.

Image: yufyfiqec.web.fc2.com

Define Your Trading Objectives

The foundation of any successful trading system lies in clearly defined trading objectives. Determine your risk tolerance, return expectations, and preferred trading horizon. These objectives will guide your subsequent decisions regarding option strategies, market selection, and risk management.

Understand Options Basics

Before constructing your trading system, it’s imperative to grasp the fundamental concepts of options. Learn about call and put options, strike prices, expiration dates, and option pricing models. Understanding these concepts will lay the groundwork for your future trading decisions.

Choose a Trading Strategy

There are numerous option trading strategies available, each with its own unique characteristics. Some popular strategies include covered calls, cash-secured puts, bull put spreads, and bear put spreads. Evaluate each strategy’s risk and reward potential to find one that aligns with your trading objectives.

Image: forex-station.com

Identify Potential Trading Opportunities

Market analysis plays a crucial role in identifying potential trading opportunities. Study historical price charts, monitor economic indicators, and follow news events to gauge market sentiment and identify potential market trends. Technical indicators, such as moving averages and support/resistance levels, can provide valuable insights into potential trading points.

Manage Risk Effectively

Managing risk is paramount in option trading. Utilize stop-loss orders to limit potential losses, and consider using options with lower risk profiles, such as covered calls or protective puts. Additionally, maintain a diversified portfolio to spread risk across different assets and strategies.

Continuously Monitor and Refine

The financial markets are constantly evolving, necessitating constant monitoring and refinement of your trading system. Regular performance reviews, backtesting with historical data, and seeking feedback from experienced traders can help you identify areas for improvement and optimize your system’s effectiveness.

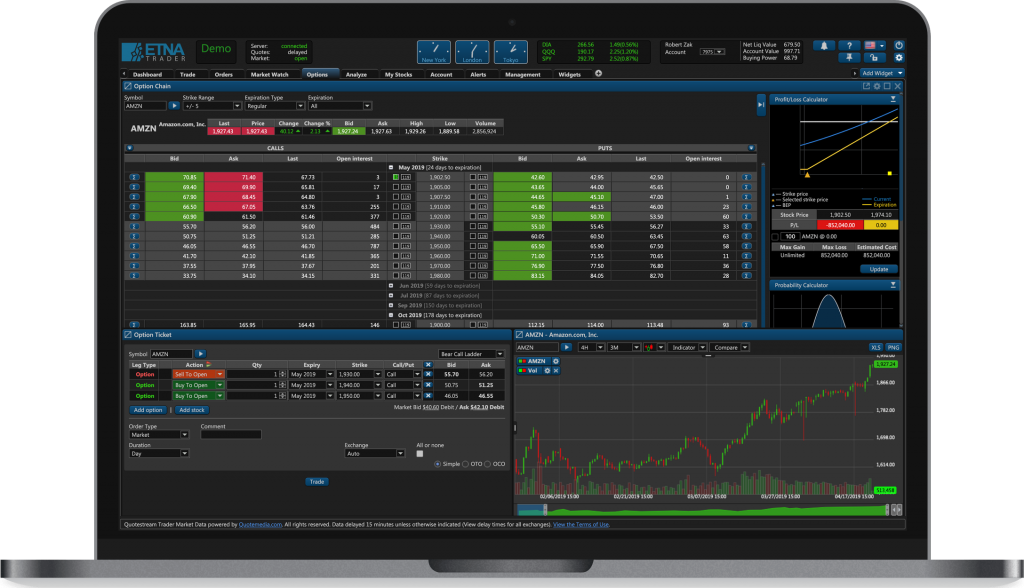

Embrace Technology

Technology can greatly enhance your trading efficiency and decision-making capabilities. Utilize trading platforms that offer advanced charting tools, real-time data, and automated trading features. Subscription-based services that provide up-to-date market insights and analysis can also be invaluable resources.

Seek Support and Education

Building an effective option trading system requires a combination of knowledge, experience, and ongoing education. Engage with online forums, attend workshops or webinars, and connect with experienced traders to expand your understanding of the market and refine your trading strategies.

Build An Option Trading Systems

Image: www.etnasoft.com

Conclusion

Building an option trading system is an iterative process that requires a solid understanding of options basics, strategic planning, market analysis, and risk management. By following the steps outlined in this guide and embracing the power of technology and ongoing education, you can construct a trading system that empowers you to navigate the complexities of the financial markets and maximize your trading potential.