Introduction:

In the ever-evolving world of financial trading, finding an edge is paramount. Candlestick pattern option trading is a powerful technique that grants traders a deeper understanding of market behavior, providing them with data-driven insights to make informed decisions and potentially lucrative returns.

Image: www.pinterest.com

Candlestick patterns, derived from ancient Japanese trading practices, are graphical representations of price action that reveal potential future price movements. By recognizing specific patterns and interpreting their significance, traders can make calculated predictions about market direction and place option trades accordingly, amplifying their profit potential.

Decoding Candlestick Patterns:

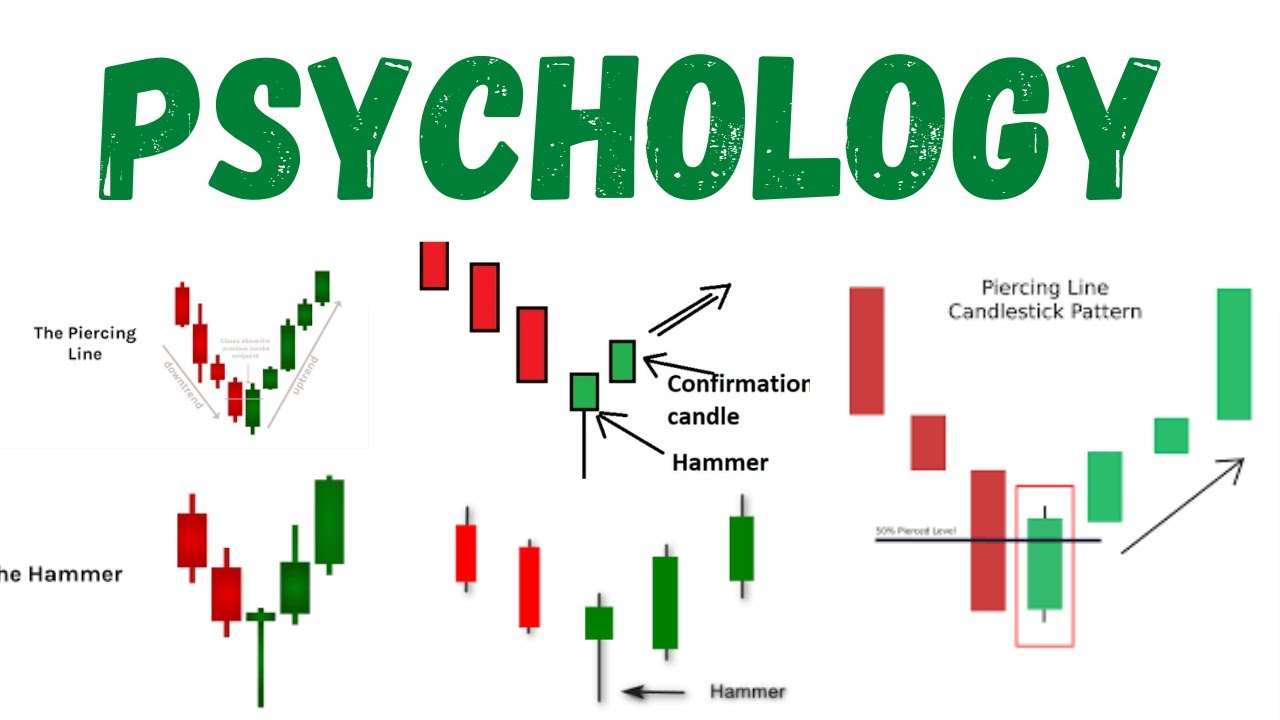

Candlestick patterns are formed by the interplay of four key elements: the opening price, closing price, highest price, and lowest price within a specific timeframe. The shape and color of the candlestick provide crucial information about market sentiment and potential price trends.

Common bullish candlestick patterns include the Hammer, Hanging Man, and Bullish Engulfing candles, suggesting a reversal of a downtrend or continuation of an uptrend. Contrastingly, bearish patterns like the Shooting Star, Bearish Engulfing, and Tweezer Top patterns signal a potential downtrend or reversal of an uptrend.

Option Trading Strategies Based on Candlestick Patterns:

Integrating candlestick pattern analysis with option trading strategies can significantly enhance trading efficiency. Buying call options after identifying bullish candlestick patterns during an uptrend allows traders to capitalize on potential price increases. Conversely, selling put options after recognizing bearish candlestick patterns in a downtrend enables them to profit from falling prices.

Real-World Examples of Candlestick Pattern Option Trading:

Consider a scenario where a trader identifies a Hammer candlestick pattern at the bottom of a downtrend. The Hammer pattern suggests a potential reversal, and the trader purchases call options with a strike price above the resistance level. If the market continues the uptrend, the call options will gain value, resulting in a profitable trade.

In contrast, if the trader observes a Shooting Star candlestick pattern at the peak of an uptrend, they can strategically sell put options with a strike price below the support level. Should the market reverse and enter a downtrend, the put options will increase in value, generating profits for the trader.

Image: www.jlcatj.gob.mx

Advanced Techniques for Enhanced Accuracy:

Seasoned traders employ advanced techniques to further refine their candlestick pattern option trading. By combining multiple patterns, using Fibonacci retracement levels, and considering market context, they enhance the reliability of their trade entries and exits.

Combining the Hammer candlestick pattern with a Fibonacci retracement level of 61.8% can strengthen the bullish signal, increasing the probability of a successful call option trade. Conversely, recognizing a Shooting Star pattern near a resistance level reinforces the bearish outlook, bolstering the case for a profitable put option trade.

Candlestick Pattern Option Trading

Conclusion:

Candlestick pattern option trading empowers traders with a potent tool to decipher market movements and make informed trading decisions. By recognizing key candlestick patterns, understanding their implications, and integrating them into well-defined option trading strategies, traders can navigate the financial markets with greater confidence and potentially reap substantial rewards.

Remember, the key to success in candlestick pattern option trading lies in continuous learning, disciplined risk management, and a deep understanding of market dynamics. Embrace this powerful technique, and embark on a journey toward financial empowerment.