Unveiling the Secrets of Option Trading with Candlestick Patterns

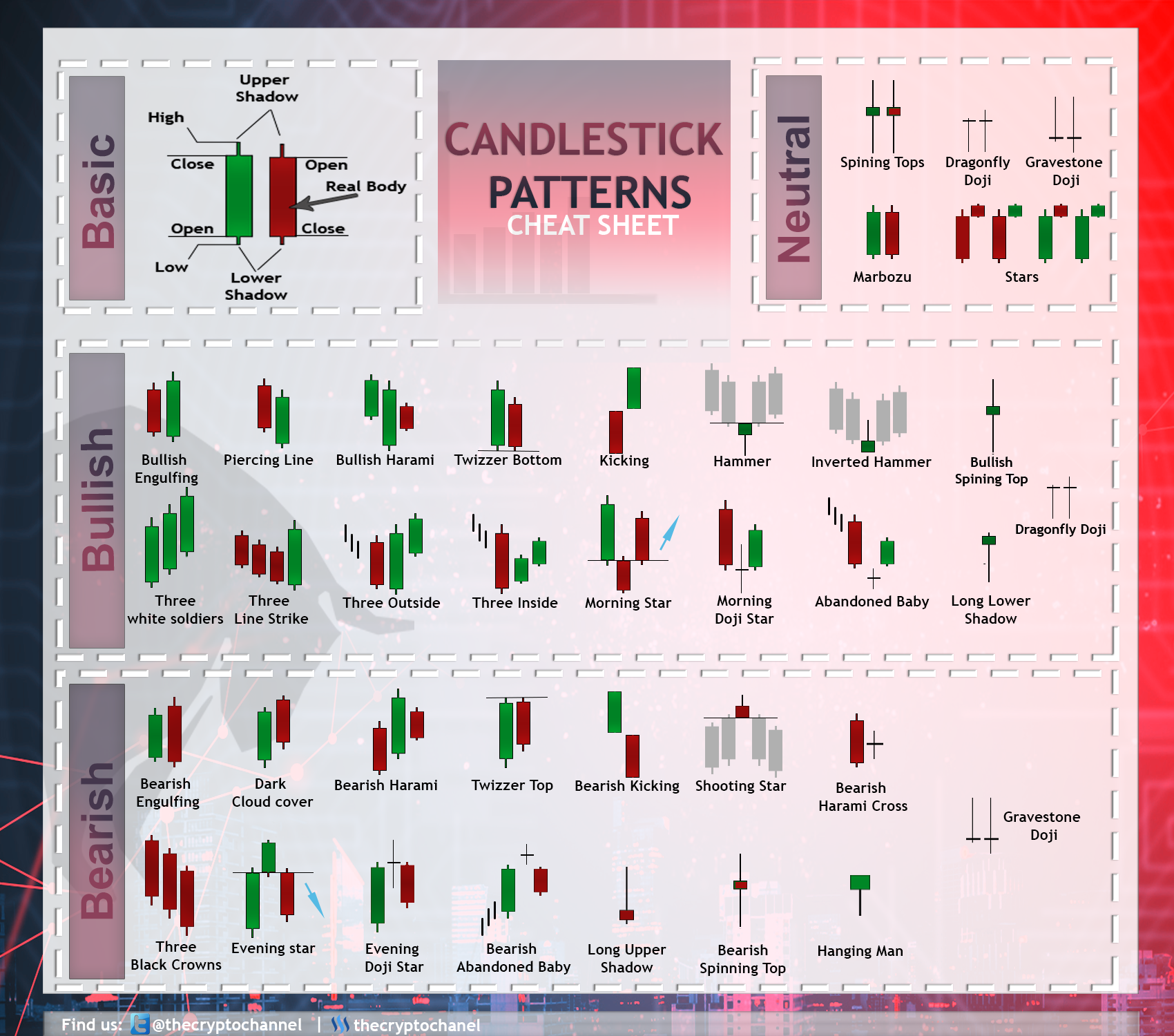

In the realm of option trading, technical analysis plays a pivotal role in discerning market trends and making informed decisions. Among the myriad technical indicators, candlestick patterns stand out as a powerful tool for traders to decipher market sentiment and predict future price movements. This comprehensive guide delves into the intricacies of option trading candlestick patterns, empowering you with the knowledge and insights to navigate the intricate world of options.

Image: www.pinterest.com

Deciphering Candlesticks: A Window into Market Sentiment

Candlestick patterns are graphical representations of price fluctuations over a specific period, typically a day or a week. They provide a detailed visual depiction of market sentiment, highlighting the interplay between buyers and sellers. Each candlestick consists of two primary components: a body and shadows (wicks). The body represents the range between the open and close prices, while the shadows depict the highest and lowest prices reached during the period.

By studying the shape, size, and position of candlesticks, traders can gain insights into the balance of power between buyers and sellers. For instance, a long, bullish candlestick with a small body and long shadows indicates strong buyer pressure, suggesting a potential upward trend. Conversely, a short, bearish candlestick with a large body and short shadows points to seller dominance and a possible downtrend.

Candlestick Patterns: A Lexicon of Market Behavior

Hundreds of candlestick patterns have been cataloged and classified over the years, each representing a unique market scenario. Some of the most common and reliable patterns include:

-

Bullish Candlesticks:

- Morning Star: Three candlesticks pattern, indicating a reversal from a downtrend to an uptrend.

- Bullish Engulfing: A larger bullish candlestick completely engulfs the previous bearish candlestick.

- Hammer: A candlestick with a small body, long lower shadow, and no upper shadow, suggesting buyer support.

-

Bearish Candlesticks:

- Evening Star: Three candlesticks pattern, signaling a reversal from an uptrend to a downtrend.

- Bearish Engulfing: A larger bearish candlestick completely engulfs the previous bullish candlestick.

- Shooting Star: A candlestick with a small body, long upper shadow, and no lower shadow, indicating seller pressure.

Emulating Market Wizards: Trading with Candlesticks

Mastering candlestick patterns is not merely an intellectual exercise; it’s a skill that can directly translate into profitable trades. To effectively harness the power of candlesticks in option trading, consider the following strategies:

- Combine Candlestick Patterns: Don’t rely solely on one candlestick pattern. Instead, combine multiple patterns to strengthen your trading signals.

- Confirm with Other Indicators: Integrate candlesticks with other technical indicators, such as moving averages or oscillators, for a more comprehensive view of market conditions.

- Consider Expiration Dates: Remember that options have expiration dates, so consider the time horizon when analyzing candlestick patterns.

- Manage Risk: Always implement sound risk management strategies, including setting stop-loss orders and managing trade size.

Image: moneytothemasses.com

Option Trading Candlestick Patterns

Conclusion: Embarking on the Path to Option Trading Success

Option trading candlestick patterns provide a valuable tool for traders seeking to navigate market complexities and make informed decisions. By understanding the significance of candlestick patterns and incorporating them into your trading strategy, you can gain an edge in the highly competitive world of options trading. Just remember to approach the markets with prudence, conduct thorough research, and never cease to learn. Embark on this path of knowledge with dedication, and trading success will become your inevitable destination.