Candlesticks: Your Ultimate Guide to Binary Options Trading

Candlesticks have been an integral part of technical analysis for centuries, offering traders a visual representation of price action that can provide unparalleled insights into market dynamics.

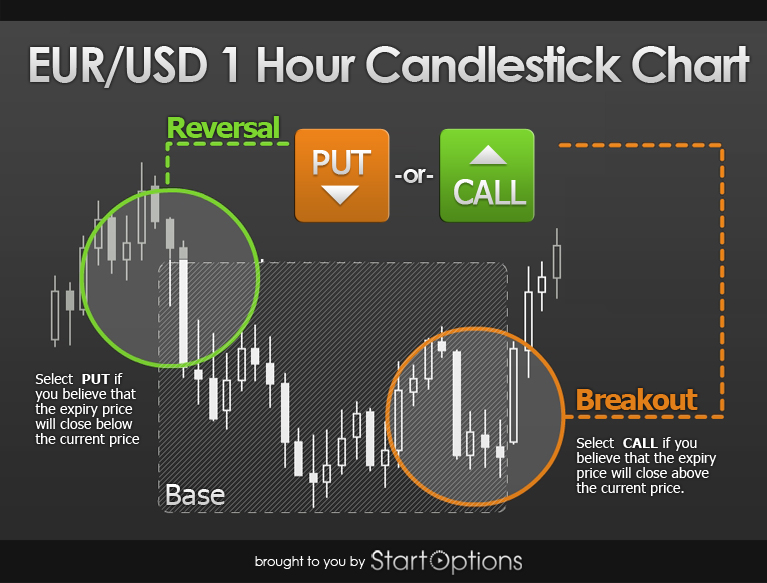

Image: fourlitimo.hatenablog.com

In the realm of binary options trading, candlesticks hold even greater significance, as they can assist you in making informed predictions and optimizing your trading strategies.

Deciphering Candlestick Patterns

A candlestick pattern consists of a body and two wicks or shadows, with the body representing the difference between the opening and closing prices, while the wicks depict the highs and lows reached during the trading period.

Depending on the relationship between these elements, different candlestick patterns emerge, each carrying its own implications for price action.

Types of Candlestick Patterns

There are numerous candlestick patterns, each with its own unique shape and significance. Some common patterns include:

- Bullish patterns: Engulfing, Piercing Line, Marubozu

- Bearish patterns: Bearish Engulfing, Dark Cloud Cover, Marubozu

- Neutral patterns: Doji, Harami, Spinning Top

Technical Analysis Using Candlesticks

Technical analysis using candlesticks involves identifying these patterns and interpreting them in the context of the overall market trend.

By analyzing the size, shape, and position of candlesticks, traders can deduce possible price reversals, support and resistance levels, and overall market sentiment.

Image: www.goodreads.com

Combining Indicators for Better Results

While candlesticks provide valuable insights on their own, you can significantly enhance your trading strategy by combining them with other technical indicators, such as moving averages, Bollinger Bands, and the RSI.

This comprehensive approach allows you to confirm candlestick signals, identify potential trading opportunities, and minimize the risk of false or premature entries.

Tips and Expert Advice

Here are some invaluable tips and expert advice to help you fully leverage candlesticks in your binary options trading:

- Understand the limitations: Candlesticks can provide valuable information, but they are not a foolproof predictor of future price movements.

- Consider the trend: Always assess candlestick patterns in the context of the prevailing market trend, as their significance can vary depending on the overall price action.

- Combine patterns: Combine multiple candlestick patterns and other technical indicators for more accurate and reliable trading signals.

- Practice and research: Continuously practice interpreting candlestick patterns and study price history to refine your skills and improve your trading decisions.

FAQs on Binary Options Trading Candlesticks

Q: How many candlestick patterns are there?

A: There are numerous candlestick patterns, but some of the most common and widely used include engulfing patterns, inside bars, and dojis.

Q: What is the most reliable candlestick pattern?

A: No single candlestick pattern is always reliable, but some patterns, such as engulfing patterns, inside bars, and dojis, have a higher probability of correctly predicting price reversals and market trends.

Q: How can I use candlestick patterns to improve my binary options trading?

A: By identifying and interpreting candlestick patterns, you can make more informed trading decisions, identify potential trading opportunities, and increase your chances of profitable trades.

Binary Options Trading Candlesticks

Image: www.forexstrategiesresources.com

Conclusion

Mastering candlestick patterns empowers binary options traders with a powerful tool for technical analysis and enhanced trading strategies.

By thoroughly understanding their formation, implications, and limitations, you can unlock valuable insights into market dynamics and maximize your profitability.

Are you ready to embrace the power of candlesticks in your binary options trading journey? Let their unique patterns guide you towards informed decisions and a successful trading future.