Options trading can be an exhilarating adventure for investors seeking to leverage market volatility. High volatility stocks, characterized by significant price fluctuations, present lucrative opportunities for options traders to capitalize on market movements. In this article, we delve into the realm of high volatility stocks, exploring their dynamics, potential rewards, and expert strategies for successful options trading.

Image: seekingalpha.com

Why High Volatility Stocks?

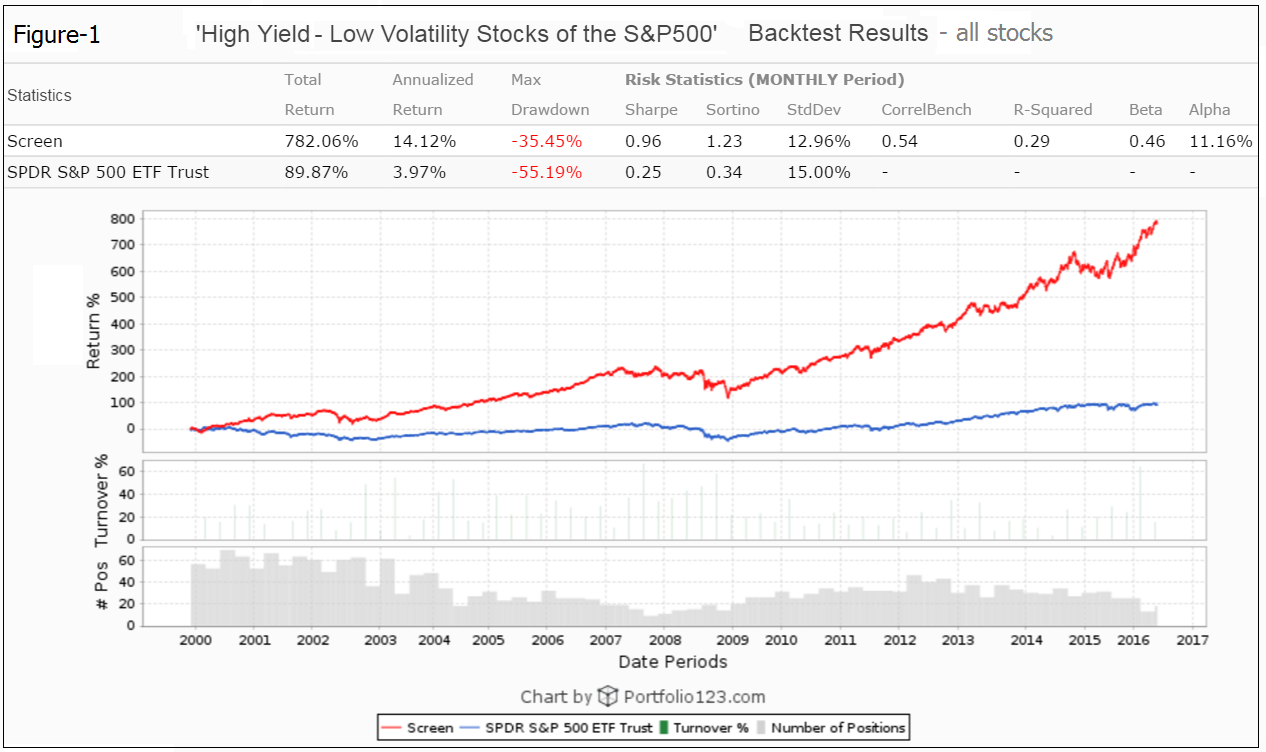

High volatility stocks exhibit wide price swings, providing ample opportunities for options traders. When stock prices fluctuate rapidly, the premiums of options contracts tied to those stocks also experience significant variations. This volatility allows traders to potentially generate substantial profits by accurately predicting price trends and executing well-timed trades.

Identifying and Selecting High Volatility Stocks

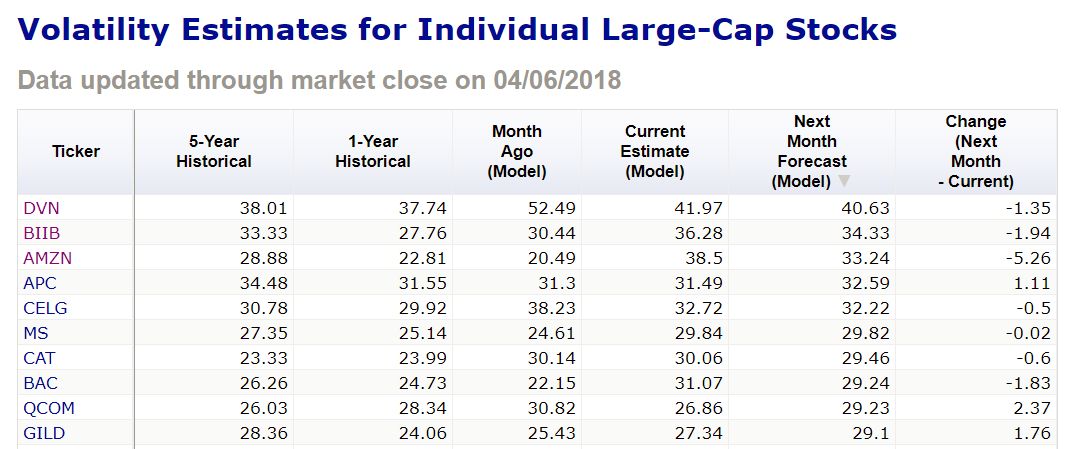

Recognizing high volatility stocks is crucial for successful options trading. Volatility can be measured using historical data, technical indicators, and market sentiment. Traders can utilize historical price charts to identify stocks that have historically exhibited large price fluctuations. Technical indicators, such as the Bollinger Bands or Average True Range (ATR), can provide real-time insights into volatility levels. Additionally, monitoring market news, earnings reports, and analyst recommendations can uncover potential drivers of volatility.

Trading Strategies for High Volatility Stocks

To maximize returns from options trading in high volatility stocks, traders can adopt various strategies. Bullish strategies, such as long calls and call spreads, are employed when traders anticipate a stock’s price to rise. Bearish strategies, including short puts and put spreads, are utilized when traders foresee a decline in stock price. Each strategy has its own risk-reward profile, and traders should carefully consider their investment objectives and risk tolerance before selecting a particular approach.

Image: tradeproacademy.com

Expert Advice and Tips

Seasoned options traders often leverage specific tips and strategies to enhance their profitability. Hedging, a risk management technique, involves employing offsetting positions to mitigate potential losses. Option chains, which display all available options contracts for a specific stock, can provide traders with a comprehensive view of potential opportunities. Monitoring implied volatility, or the market’s expectations of future volatility, can assist in gauging the potential for option premiums to expand or contract.

FAQs on High Volatility Stocks

- Q: What is the difference between low and high volatility stocks?

- A: Low volatility stocks exhibit minimal price fluctuations, while high volatility stocks experience significant price swings.

- Q: How do I measure stock volatility?

- A: Volatility can be measured using historical data, technical indicators, and market sentiment.

- Q: What are some examples of high volatility stocks?

- A: Examples may include technology stocks, biotech stocks, and certain commodity-related stocks.

High Volatility Stocks For Options Trading

Image: seekingalpha.com

Conclusion

Options trading in high volatility stocks can be a rewarding endeavor for astute investors. By embracing the dynamic nature of these stocks, understanding the mechanics of options trading, and adopting sound strategies, traders can harness market volatility to generate potential profits. Whether you are a seasoned trader or a novice exploring the world of options, this article provides a comprehensive guide to navigate the exciting realm of high volatility stocks and maximize your chances of success.

Would you like to dive deeper into the world of high volatility stocks and options trading? Let us know your thoughts in the comments below, and we will be delighted to engage with you further on this captivating topic.