In the labyrinthine world of financial markets, where uncertainty reigns supreme, volatility is a constant companion. Like an ethereal force, it ebbs and flows, creating ripples that can both empower and confound investors. For those seeking to harness the fickle nature of volatility, option trading offers a tantalizing opportunity to navigate the market’s turbulent waters.

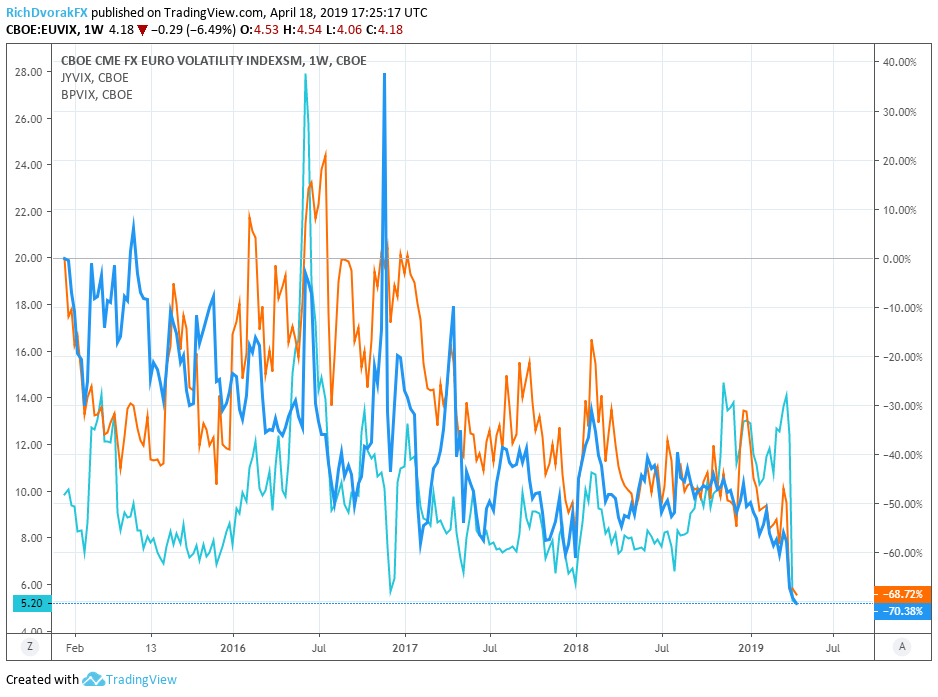

Image: www.dailyfx.com

Volatility: A Double-Edged Sword

What is Volatility?

Volatility, in essence, measures the magnitude of price fluctuations in a given security or market index over a specified period. When volatility is high, prices swing wildly, creating both substantial opportunities and potential risks. Conversely, low volatility periods are characterized by relatively stable prices, offering less potential for dramatic gains (or losses).

Historical Volatility vs. Implied Volatility

Historical volatility relies on past price data to estimate future price fluctuations. Implied volatility, on the other hand, is derived from option prices and reflects market expectations of future volatility. Understanding both metrics is crucial for crafting effective volatility trading strategies.

The Psychology of Volatility

Volatility also has a profound psychological impact on investors. Extreme market swings can trigger fear and greed, clouding judgment and leading to impulsive decisions. Managing emotions is paramount for successful volatility trading.

Leveraging Volatility through Options

:max_bytes(150000):strip_icc()/Volatility-89fb205b705c493ba02c00a3fc4964cd.jpg)

Image: www.investopedia.com

Options Contracts

Options contracts are derivative instruments that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). This flexibility makes options uniquely suited for managing volatility.

Volatility Option Trading Strategy

Option Strategies for Volatility

There are numerous option strategies that can be employed to benefit from volatility. Some popular strategies include:

- Long Straddle: Buy both a call option and a put option at the same strike price, capitalizing on high volatility in either direction.

- Short Strangle: Sell both a call option and a put option at different strike prices, benefiting from low volatility within a predefined range.

- Iron Condor: A combination of a bullish call spread and a bearish put spread with different strike prices, capturing profits from moderate volatility.

Expert Tips and Advice

Seasoned volatility traders offer invaluable insights for navigating the complexities of this market:

- Monitor Volatility Levels: Keep a close eye on historical and implied volatility metrics to identify potential trading opportunities.

- Manage Risk: Always trade within your risk tolerance and consider stop-loss orders to limit potential losses.

- Study Option Pricing Models: Understand how option prices are derived and use pricing models, such as the Black-Scholes model, to evaluate potential strategies.

- Practice and Experiment: Gain experience through paper trading or simulation before risking actual capital.

Frequently Asked Questions

- What is the best volatility trading strategy? There is no one-size-fits-all strategy. The optimal approach depends on market conditions, risk tolerance, and individual investment goals.

- Is volatility trading risky? Yes, volatility trading entails inherent risks due to price fluctuations. It’s essential to manage risk effectively.

- Can I make money from volatility trading? While potential profits are substantial, volatility trading is not a get-rich-quick scheme. Success requires comprehensive research, strategic execution, and disciplined risk management.

Conclusion

Volatility option trading offers both opportunities and challenges in the ever-evolving financial markets. By understanding the nature of volatility, mastering option strategies, and adhering to expert advice, you can harness its power to navigate the ebb and flow of the markets and potentially enhance your investment returns.

Call to Action: Join our exclusive webinar on volatility option trading to delve deeper into this exciting topic and unlock the secrets to mastering market swings.

Are you intrigued by the prospects of volatility option trading? Share your thoughts and questions in the comments below!