Introduction

Image: techelec.ma

In the dynamic realm of financial markets, options trading presents a sophisticated strategy for investors seeking to capitalize on market movements. Among the various options trading techniques, VWAP options trading stands out as a powerful tool for harnessing prevailing price trends. By integrating historical volume and price data, VWAP options traders gain valuable insights into market sentiment, enabling them to make informed decisions that align with the momentum of the underlying asset.

Delving into VWAP Options Trading

The concept of Volume-Weighted Average Price (VWAP) revolves around determining the average price of a financial instrument over a specific trading period, weighted by its trading volume. This metric serves as a reliable indicator of the prevailing market sentiment as it captures both price and volume dynamics. By analyzing the VWAP of an underlying asset, options traders can gauge the strength of a trend and identify potential trading opportunities aligned with market momentum.

For instance, if the VWAP of a particular stock consistently exceeds its spot price, it signals a bullish bias within the market. Consequently, options traders can consider purchasing call options to potentially benefit from a sustained upward trend in the stock’s price. Conversely, a VWAP consistently below the spot price suggests a bearish sentiment, favoring the purchase of put options for potential profits from a downward price movement.

Practical Applications of VWAP Options Trading

VWAP options trading finds wide applications in diverse market conditions and trading strategies. Some notable examples include:

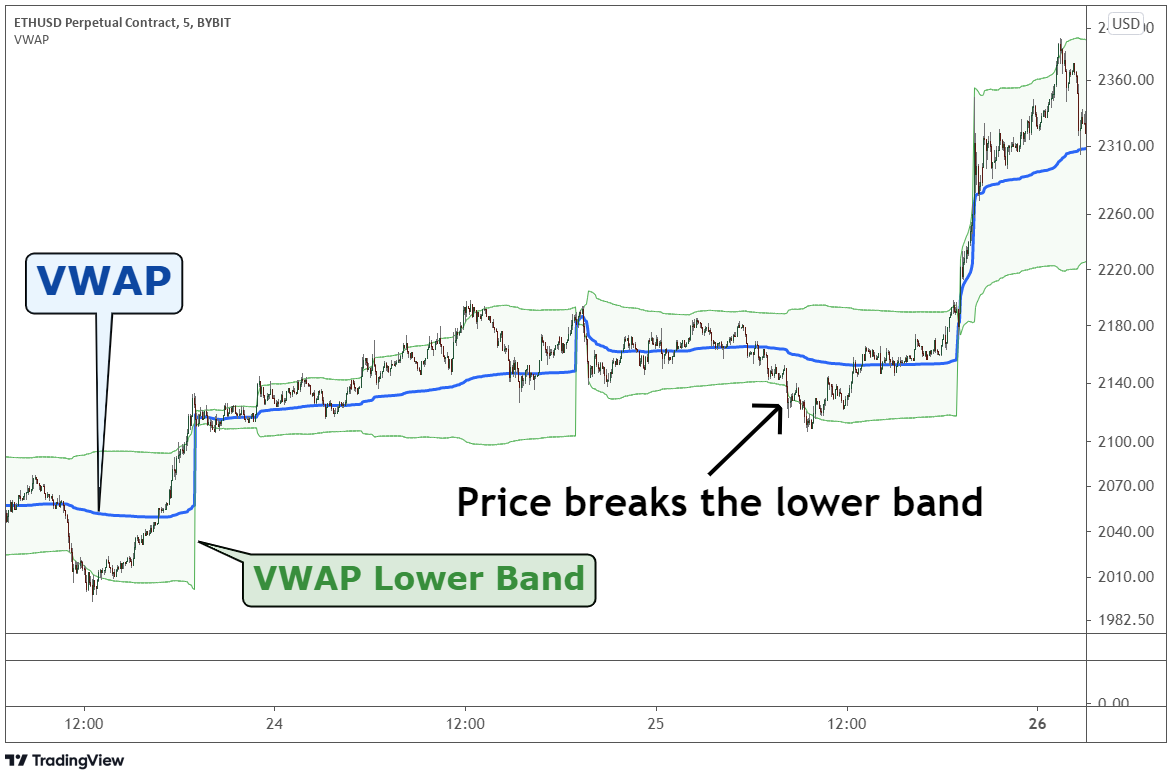

– Trend Confirmation: VWAP effectively confirms the direction and strength of prevailing trends. When the VWAP aligns with the spot price, it reinforces the existing trend, enhancing the confidence of traders in their trading decisions.

– Volatility Assessment: By comparing the VWAP to historical data, options traders can gauge the volatility of the underlying asset. Higher price fluctuations around the VWAP indicate elevated volatility, potentially offering opportunities for option strategies that capitalize on market swings.

– Sentiment Analysis: VWAP serves as a sentiment indicator, reflecting the collective sentiment of market participants. Divergences between the VWAP and the spot price provide valuable insights into shifts in market sentiment, allowing traders to anticipate potential price reversals.

– Trade Timing Optimization: Options traders can refine their trade timing by leveraging VWAP. By entering trades when the asset’s price is favorable relative to its VWAP, they increase their chances of capitalizing on profitable price movements.

Conclusion

VWAP options trading emerges as a sophisticated technique empowering traders to decipher market momentum and uncover potentially lucrative opportunities. Through a meticulous analysis of volume-weighted average prices, options traders can navigate market fluctuations with greater confidence, aligning their strategies with prevailing trends. By incorporating VWAP into their options trading arsenal, they gain a competitive edge in identifying profitable trades and navigating the volatile financial landscape.

Image: learn.bybit.com

Vwap Options Trading