Maximize Your Profit Potential with Calculated Strategy

Have you ever delved into the alluring world of options trading, navigating the intricate maze of calls and puts? If you’re a seasoned investor or an aspiring trader keen on expanding your financial horizons, consider the dynamic world of option spreads. And when it comes to executing these strategies seamlessly, Robinhood emerges as a platform of choice for its intuitive interface and accessible features.

Image: learn.robinhood.com

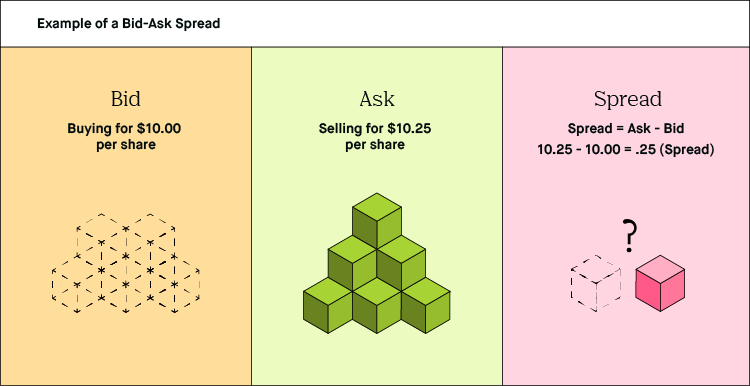

Option spreads, a marriage of multiple options contracts, offer investors an array of nuanced strategies to suit diverse market conditions. By bundling options with varying strike prices and expiration dates, traders can craft customized risk-reward profiles, potentially enhancing their profit potential while managing risk.

A Multifaceted Tool for Market Maneuvers

Understanding the fundamentals of option spreads is paramount to exploiting their versatility. At its core, an option spread involves buying and selling options of the same underlying asset, such as a stock or ETF, at different strike prices and expirations. This symphony of contracts allows traders to tailor their positions to specific market scenarios and profit objectives.

Consider a bullish trader anticipating an impending surge in Apple stock. Instead of purchasing a single call option outright, they might opt for a bull call spread. This entails buying a lower strike price call option and simultaneously selling a higher strike price call option with the same expiration date. The potential profit from this strategy lies within the difference between the two strike prices, less the net premium paid. This prudent approach provides leverage while simultaneously capping the potential loss at the premium paid.

A Tale of Two Worlds: Debit vs Credit Spreads

Option spreads come in two distinct flavors: debit spreads and credit spreads. Debit spreads, as the name suggests, require an upfront payment of premium to initiate the position. Bull call spreads and bear put spreads fall under this category, offering limited risk and defined profit potential.

In contrast, credit spreads involve receiving a net premium as compensation for taking on the obligation to buy or sell the underlying asset at the predetermined strike price. With credit spreads, the potential profit is capped, while the risk may be unlimited. Bear call spreads and bull put spreads exemplify this approach.

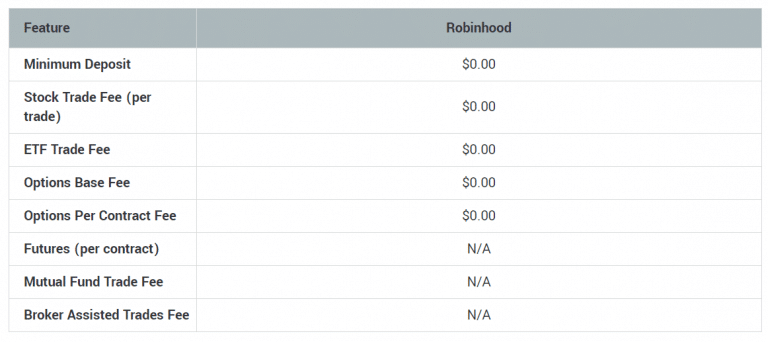

Robinhood: Your Trading Gateway

Robinhood’s user-friendly platform simplifies the complexities of option spreads, making them accessible to traders of all experience levels. Its intuitive interface guides you through the process of crafting and executing spread strategies with ease. The platform provides real-time market data, comprehensive charting tools, and educational resources to empower informed decision-making.

Whether you’re seeking to amplify your gains in bullish markets or navigate bearish conditions strategically, Robinhood offers a comprehensive suite of option spread strategies to cater to your investment objectives. Unleash your trading acumen with Robinhood and harness the transformative power of option spreads.

Image: www.marcocasario.com

Trading Option Spread With Robinhood

Image: marketxls.com

Embark on an Educational Journey

Mastering option spreads requires a concerted effort to grasp the underlying concepts and nuances. Immerse yourself in educational materials, including books, articles, and online courses, to deepen your understanding and hone your trading skills. Seek guidance from experienced traders or financial advisors to gain valuable insights and refine your approach.

Remember, the financial markets are a dynamic landscape, and option spreads are sophisticated instruments that demand a thorough understanding of the risks involved. Approach trading with prudence, conducting thorough research, and managing your risk exposure wisely.