As an avid Netflix enthusiast, I couldn’t help but notice its consistent presence among the most popular streaming services. This inspired me to delve deeper into the world of Netflix options contract trading. Options trading involves speculating on the price movements of an underlying asset, such as a stock or commodity, without owning the asset itself. The allure of Netflix’s high trading volume and potential for capital gains made it an intriguing subject for my research.

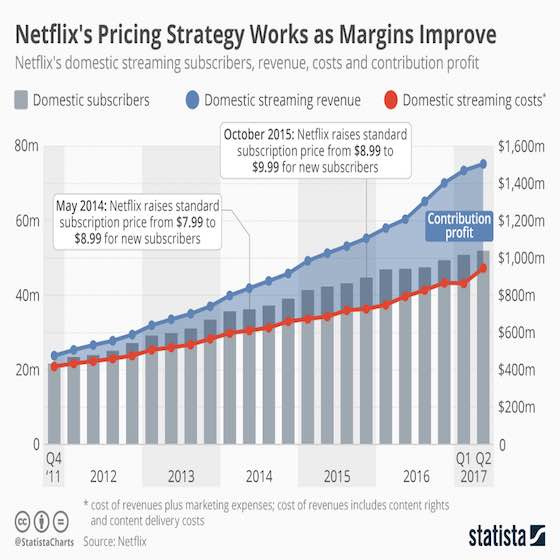

Image: www.ihavenet.com

Understanding Netflix Options Contracts

Netflix options represent contracts giving the holder the right but not the obligation to buy (call option) or sell (put option) a specific number of Netflix shares at a predetermined price (strike price) on or before a certain date (expiration date). Traders use these options to make speculative bets on the future stock price behavior. If they anticipate an increase (decrease), they buy call (put) options, aiming to profit from the price appreciation (depreciation) of the underlying stock.

Real-Time Netflix Options Contract Prices

The real-time prices of Netflix options contracts are crucial for successful trading. Traders rely on market data to make informed decisions based on supply and demand dynamics. To access real-time options prices, one can utilize online trading platforms or brokerage websites that provide live market quotes. Some notable platforms for real-time options pricing include Fidelity, Robinhood, and Webull.

Factors Influencing Netflix Options Prices

Various factors influence the pricing of Netflix options contracts:

- Underlying Stock Price: The current stock price of Netflix primarily drives the value of its options contracts. Changes in the stock price can significantly impact the premiums paid for options.

- Time to Expiration: The remaining time before the options contract expires influences its price. Longer-term contracts generally command a higher premium due to the increased uncertainty surrounding the stock’s price movements.

- Volatility: Expected market volatility affects options prices. Higher anticipated price swings in either direction can lead to higher option premiums.

- Interest Rates: Changes in interest rates can impact the cost of carrying options positions, especially for longer-term contracts.

- Supply and Demand: The market’s perception of favorable trading conditions for Netflix options can drive up demand and subsequently increase option prices.

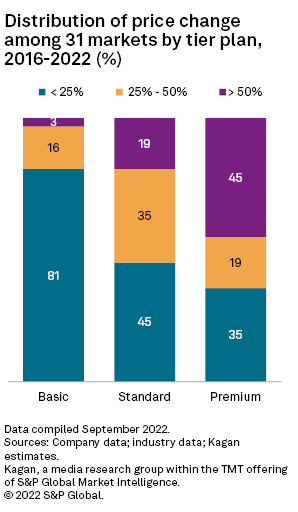

Image: www.spglobal.com

Tips for Trading Netflix Options

Successful Netflix options trading requires a combination of knowledge, strategy, and risk management. Here are some tips for aspiring traders:

- Understand the Basics: Familiarize yourself with options terminology, concepts, and strategies before engaging in actual trading.

- Choose Appropriate Strategies: There are various options trading strategies, such as buying calls or puts or selling option premiums. Research and understand which strategies align best with your risk tolerance and trading goals.

- Manage Risk Properly: Use tools like stop-loss orders to limit potential losses and ensure prudent risk management practices.

- Monitor Market Trends: Stay informed about market updates and news that may impact Netflix’s stock price and, by extension, the value of its options contracts.

- Seek Professional Guidance (Optional): If needed, consider consulting with a financial advisor or broker to gain insights and recommendations tailored to your individual trading circumstances.

Frequently Asked Questions (FAQs)

Q: What is the difference between a call and a put option?

A: A call option gives the holder the right to buy the underlying asset, while a put option provides the right to sell the asset at a specified price and date.

Q: What is the relationship between stock price and options prices?

A: Options prices typically increase with increasing stock prices for call options and decrease with increasing stock prices for put options.

Q: Can I lose money trading Netflix options?

A: Yes, options trading involves risk, and it’s possible to lose money. Proper risk management, including using stop-loss orders and understanding market dynamics, is crucial.

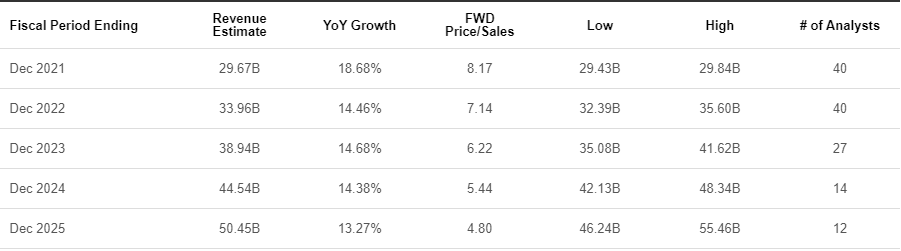

Netflix Options Contract Trading Prices

Image: seekingalpha.com

Conclusion

Netflix options contract trading presents both opportunities and challenges for investors. By comprehending the fundamentals, staying abreast of market trends, and implementing sound trading strategies, individuals can harness the potential of options to enhance their investment portfolios. Whether you’re an experienced trader or just starting your options trading journey, continuous learning and a disciplined approach are key to maximizing your trading success.

Are you curious to know more about Netflix options contract trading? Share your questions or insights in the comments section below.