Netflix has emerged as a dominant player in the entertainment industry, and its stock has soared in recent years. This has led to increased interest in Netflix options trading, which offers the potential for investors to capitalize on the company’s growth while managing risk.

Image: www.skillfinlearning.com

In this comprehensive guide, we will delve into the world of Netflix options trading and provide you with the knowledge and insights you need to make informed decisions. We will explore key concepts, identify opportunities, and offer expert tips to help you maximize your profits.

Understanding Netflix Options

Netflix options are contracts that give the holder the right, but not the obligation, to buy or sell a specified number of shares of Netflix stock at a predetermined price (strike price) on or before a specific date (expiration date). There are two main types of options: calls and puts.

- Calls give the holder the right to buy Netflix shares at the strike price.

- Puts give the holder the right to sell Netflix shares at the strike price.

Options can be bought (going long) or sold (going short), depending on your market outlook.

Factors Affecting Netflix Options Prices

The price of Netflix options is influenced by several factors, including:

- Volatility: High volatility in the underlying stock (Netflix shares) leads to more expensive options premiums.

- Time to expiration: The closer the expiration date, the lower the option premium will be.

- Interest rates: Rising interest rates make options more expensive.

- Supply and demand: The level of buyer and seller activity can also impact option premiums.

Trading Netflix Options Strategies

There are numerous options trading strategies that can be employed to capitalize on different market conditions. Some common strategies include:

- Covered calls: Selling call options against shares you own to generate income.

- Cash-secured puts: Selling put options while holding cash to buy Netflix shares at a lower price if the price falls.

- Bullish call spread: Buying a call option at a lower strike price and selling a call option at a higher strike price to profit from a rising stock price.

- Bearish put spread: Buying a put option at a higher strike price and selling a put option at a lower strike price to profit from a falling stock price.

Image: www.pinterest.com

Expert Insights and Tips

- Understand the risks: Options trading involves risk, so always invest within your limits.

- Do your research: Thoroughly analyze Netflix’s financial performance, market trends, and competitive landscape before making any trades.

- Trade with discipline: Establish clear trading rules and stick to them to avoid emotional decision-making.

- Use options to manage risk: Options can be used as a hedge against potential losses in the underlying stock.

- Seek professional advice: Consider consulting with a financial advisor if you are new to options trading or have complex investment goals.

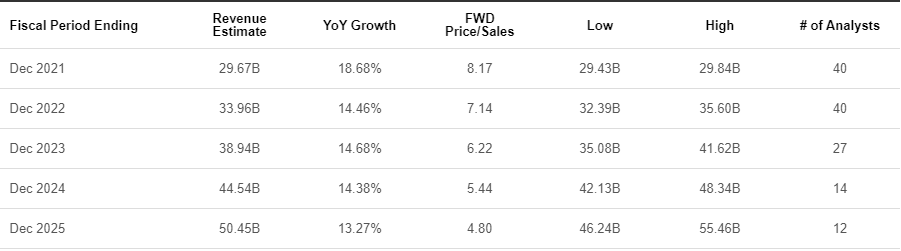

Netflix Options Trading Analysis

Image: seekingalpha.com

Conclusion

Netflix options trading offers investors the opportunity to potentially generate significant profits while managing their risk exposure. By understanding the concepts, strategies, and expert insights outlined in this guide, you can navigate the world of Netflix options trading with confidence and increase your chances of success. Remember to conduct thorough research, trade with discipline, and seek professional advice when necessary.