Introduction

The prospect of growing your wealth through trading financial instruments is alluring. However, navigating the complexities of options trading and navigating tax implications can be daunting. This article aims to shed light on TD Options Trading TFSA, offering a comprehensive guide to this potent investment vehicle. We’ll explore its advantages, nuances, and strategies to help you unlock its full potential.

Image: oxfordstrat.com

Decoding TD Options Trading TFSA

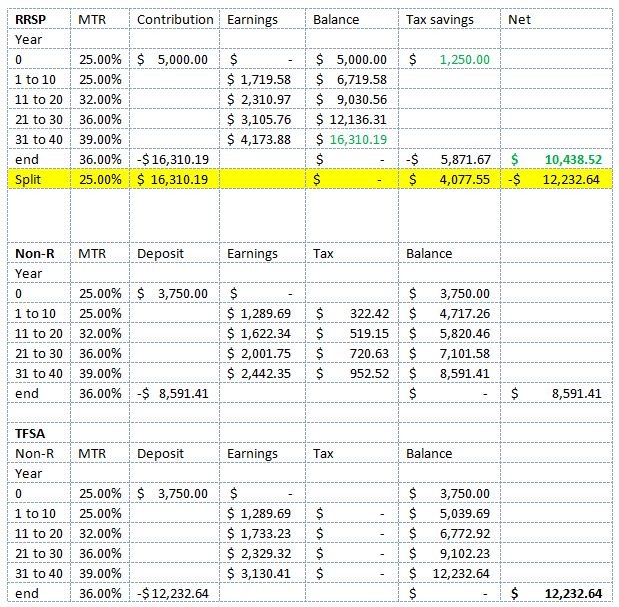

A TD Options Trading TFSA (Tax-Free Savings Account) is a powerful financial instrument that combines the flexibility of options trading with the tax-sheltered benefits of a TFSA. By investing within a TFSA, all earnings from options trading, including capital gains and dividends, accumulate tax-free. This unique feature enables investors to accelerate their wealth growth without any fiscal drag.

Advantages of TD Options Trading TFSA

- Tax-Free Earnings: The cornerstone of a TD Options Trading TFSA is its tax-free nature. It allows investors to retain the entirety of their trading profits, fostering exponential wealth creation.

- Diversification: Options trading provides investors with a robust platform for diversification. By incorporating options strategies, they can mitigate portfolio risk and enhance overall investment performance.

- Income Generation: Options trading empowers investors to generate income through various strategies, such as selling covered calls or cash-secured puts, providing an additional stream of tax-free revenue.

Essentials of Options Trading

Understanding options trading is crucial for navigating a TD Options Trading TFSA effectively. Options are financial contracts that grant investors the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price on or before a set expiration date.

Key components of an option contract include the underlying asset (e.g., stock, index, or currency), strike price (the predetermined price at which the option can be exercised), expiration date, and premium (the cost of purchasing the option).

Image: www.tradingview.com

Strategies and Tips for Success

Mastering TD Options Trading TFSA demands a strategic approach. Consider employing the following strategies:

- Covered Call Writing: This strategy involves selling (writing) a call option against a stock you own. It generates income through option premiums while limiting the upside potential of the underlying asset.

- Cash-Secured Put Writing: Similar to covered call writing, this strategy entails selling a put option while holding cash to cover potential assignment of the underlying asset. It earns income and provides downside protection.

- Bull Call Spread: This is a bullish strategy that involves buying a call option with a lower strike price and simultaneously selling a call option with a higher strike price. It provides leveraged exposure to an underlying asset’s price appreciation.

Remember, successful options trading requires a thorough understanding of risk management. Careful consideration of factors like position sizing, profit targets, and stop-loss orders is essential to mitigate potential losses.

FAQs on TD Options Trading TFSA

Q: What is the contribution limit for a TD Options Trading TFSA?

A: The TFSA contribution limit is set by the Canadian government and can change from year to year. It’s currently $6,500 for 2023.

Q: Can I trade U.S.-listed stocks in a TD Options Trading TFSA?

A: Yes, you can trade U.S.-listed stocks in a TD Options Trading TFSA. However, any dividends you receive from these stocks will be subject to a 15% withholding tax.

Q: How do I open a TD Options Trading TFSA?

A: To open a TD Options Trading TFSA, you can visit a TD branch or apply online through TD’s website. You will need to provide personal information, financial details, and trading experience.

Td Options Trading Tfsa

Image: investpost.org

Conclusion

TD Options Trading TFSA presents a compelling opportunity to enhance your investment portfolio. By harnessing the tax-free growth and strategic flexibility of options, you can unleash your financial potential. Embrace the insights and techniques outlined in this article to navigate TD Options Trading TFSA with confidence and set the stage for long-term wealth accumulation.

Call to Action: Are you ready to explore the depths of TD Options Trading TFSA? Contact a qualified financial advisor today to discuss your investment goals and craft a customized trading strategy.