Introduction

In the rapidly evolving world of entertainment, Netflix stands as an undisputed colossus, captivating audiences worldwide with its vast library of captivating content. As the streaming giant continues its meteoric rise, savvy investors are turning towards trading Netflix options as a promising avenue for generating substantial profits. This comprehensive guide will delve into the intricacies of Netflix options, empowering you with the knowledge and strategies to navigate this dynamic market successfully.

Image: www.youtube.com

What are Netflix Options?

Netflix options grant investors the right, but not the obligation, to buy or sell a specific number of Netflix shares at a predetermined price on or before a certain date. Call options give investors the right to buy, while put options grant the right to sell. These options provide investors with a flexible tool to speculate on the future performance of Netflix stock without the upfront capital required to purchase the actual shares.

Understanding the Basics

Traders evaluate Netflix options based on several key factors, including the strike price, expiration date, and premium. The strike price represents the price at which the underlying Netflix shares can be bought (for call options) or sold (for put options). The expiration date indicates the last day on which the option can be exercised. Finally, the premium is the price paid to acquire the option.

Call Options vs. Put Options

Call options are appropriate when investors anticipate a rise in Netflix stock price, while put options are suitable for hedging against potential declines. By understanding the dynamics of each option type, traders can tailor their strategies to match their investment goals.

Image: www.wyattresearch.com

Strategies for Trading Netflix Options

Traders employ diverse strategies when trading Netflix options. Covered calls involve selling call options on shares owned, enabling investors to collect premiums and potentially benefit from stock appreciation. Alternatively, naked calls involve selling call options without owning the underlying shares, increasing the risk but also the potential return.

Advanced Strategies

As traders gain experience, they can explore more advanced strategies such as spreads, where two or more options are combined to create a specific risk and reward profile.を活用することで、リスクとリターンのバランスが取れた戦略を構築できます。

Identifying Trading Opportunities

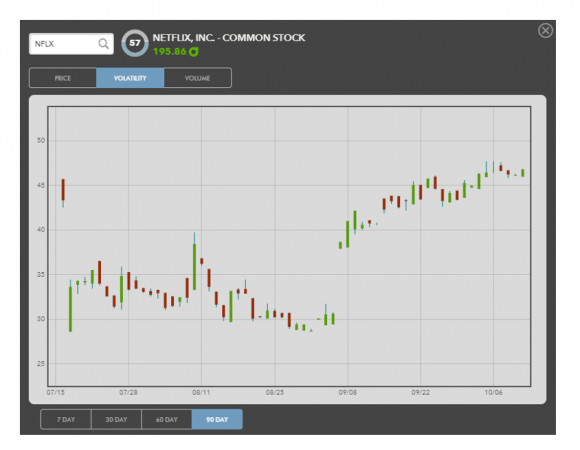

Successful trading requires identifying trading opportunities, which involve analyzing various market factors. Technical analysis employs chart patterns and indicators, while fundamental analysis examines financial metrics and news events to forecast the price behavior of Netflix stock.

Market Trends and Developments

Staying abreast of the latest market trends and developments is crucial for informed trading. Industry news, earnings reports, and economic data can significantly impact Netflix stock price, offering valuable insights into potential trading opportunities.

Trading Netflix Options

Image: basitfx.com

Conclusion

Trading Netflix options requires a deep understanding of the financial markets, risk management, and a keen eye for market trends. By embracing the principles outlined in this guide and不断に学び、トレードの機会を的確に捉えることができます。Embracing constant learning, traders can harness the power of Netflix options to capitalize on the company’s continued success in the ever-evolving streaming landscape.