Stepping into the world of options trading can be an exhilarating yet confusing experience. One of the first questions that aspiring traders must address is the financial implications involved, particularly the cost of trading options live. This comprehensive guide will delve into the multifaceted nature of options trading costs, providing a detailed overview for those eager to embark on this financial adventure.

![OptionsHouse [Reviewed - 2019] | Best Stock Picking Services](https://www.beststockpickingservices.com/wp-content/uploads/2015/11/OptionsHouse-Trading-Platform2.png)

Image: www.beststockpickingservices.com

Understanding Options Trading Costs

Options contracts carry inherent value that determines their price. The number of contracts, expiration date, and underlying asset all contribute to this valuation. Trading options involves paying two primary costs: the option premium and commissions.

Option Premium

The option premium is the price a trader pays to acquire the rights and obligations associated with an options contract. It represents the intrinsic value of the option, which is determined by the factors mentioned earlier. The premium can vary significantly depending on market conditions and the specific options contract being purchased.

Commissions

Commissions are the fees charged by brokers for facilitating the trade. These fees can vary depending on the broker chosen and the type of trading platform used. Some brokers offer flat-rate commissions, while others charge tiered commissions based on the number of contracts traded or the total trade value.

Image: www.youtube.com

Factors Affecting Live Trading Costs

In addition to the base costs, several factors can influence the overall cost of live trading options:

- Account type: Different account types, such as individual or institutional accounts, may have varying commission rates.

- Trading platform: The platform used for trading can impact commissions and other fees.

- Market volatility: Fluctuating market conditions can affect option premiums and trading volume.

- Number of contracts traded: The more contracts traded, the higher the total premium and commissions will be.

Expert Tips for Minimizing Trading Costs

To optimize trading costs and maximize profitability, aspiring traders can follow these expert tips:

- Shop around for brokers: Compare commission rates and trading fees from different brokers to find the most cost-effective option.

- Negotiate with your broker: For high-volume traders, it may be possible to negotiate lower commission rates.

- Use limit orders: By setting limit orders, traders can control the maximum premium they are willing to pay while executing their trades.

- Trade during off-peak hours: Reduced trading activity during off-peak hours can lead to lower commissions and slippage costs.

FAQs on Options Trading Costs

Q: What is the minimum amount required to start live trading options?

A: The minimum starting amount is determined by the broker and the options contracts being traded.

Q: Do all brokers charge commissions for options trading?

A: Not all brokers charge commissions, but some may offer lower commissions for high-volume traders.

Q: Is it necessary to fund my account the full value of the options contract I want to trade?

A: Margin trading allows traders to use a portion of their account balance to cover the premium of the options contract.

Q: What are the tax implications of options trading?

A: Options trading is subject to capital gains tax and other regulations, so consult with a tax professional for specific tax implications.

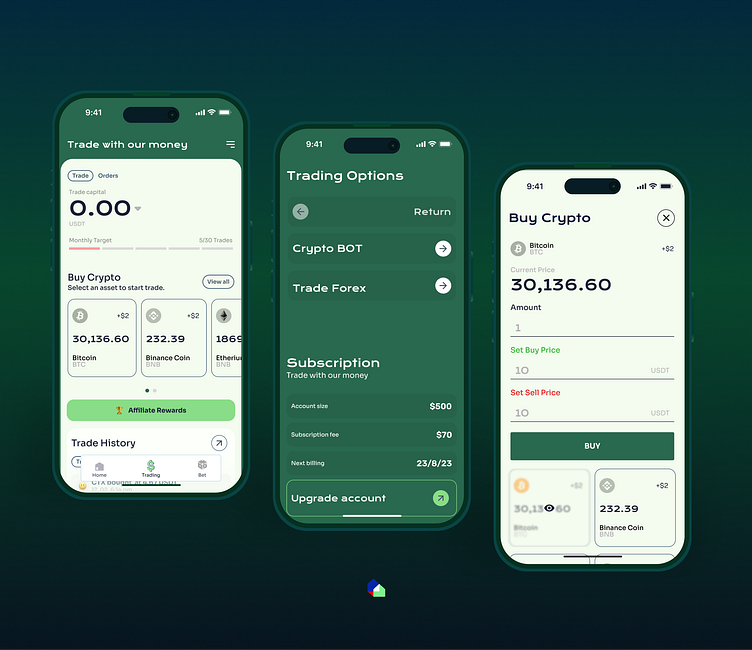

Options House How Much For Live Trading

Image: dribbble.com

Conclusion

The cost of live options trading can vary based on multiple factors, including the option premium, commissions, and other fees. By understanding the costs involved and employing expert strategies to minimize expenses, aspiring traders can optimize their profitability and maximize their chances of success in this rewarding yet challenging financial market.

If you found this article informative, please let us know if you have any questions or would like to pursue further research on options trading. Together, let’s delve deeper into the world of finance and conquer the complexities of investing.