Understanding the Costs Associated with Trading

Investing in stocks or options can be an exciting way to grow your wealth, but it’s essential to be aware of the associated costs before you dive in. Whether you’re a seasoned trader or just starting out, understanding the differences between options trading costs and stock trading costs can help you make informed decisions and optimize your investment strategy.

Image: www.pinterest.com

In this article, we’ll delve into the intricacies of options trading costs and stock trading costs, providing you with a comprehensive overview and insider tips to empower your trading journey.

Options Trading Costs

Options trading involves the buying and selling of options contracts, which represent the right (but not the obligation) to buy or sell an underlying asset at a specified price within a set time frame. The primary cost associated with options trading is the **option premium**, which is the price you pay to acquire the contract.

The option premium comprises two components: the **intrinsic value** and the **time value**. Intrinsic value represents the current difference between the underlying asset’s price and the option’s strike price (the price at which the underlying asset can be bought or sold), while time value reflects the remaining time until the option’s expiration date.

Along with the option premium, options traders also incur **brokerage commissions**, which are fees charged by the brokerage firm for facilitating the trade. These commissions vary depending on the brokerage and the type of options contract being traded.

It’s important to note that options trading involves the potential for unlimited losses, unlike stock trading, which limits losses to the amount invested in the stock.

Stock Trading Costs

Stock trading, on the other hand, involves buying and selling stocks, which represent ownership in a company. The primary cost associated with stock trading is the **brokerage commission**, charged by the brokerage firm for executing the trade.

Stock trading commissions vary depending on the brokerage and the number of shares traded. Some brokerages offer flat-rate commissions, while others charge per-share fees.

In addition to brokerage commissions, stock traders may also incur **market data fees**, which are charges for accessing real-time market data and news. These fees vary depending on the brokerage and the level of market data access desired.

Tips for Minimizing Trading Costs

Whether you’re trading options or stocks, there are several tips you can follow to minimize your trading costs:

- Shop around for brokers: Different brokerages offer varying commission structures. Compare fees and services to find a brokerage that aligns with your trading style and budget.

- Negotiate commissions: If you’re a high-volume trader, you may be able to negotiate lower commission rates with your brokerage.

- Consider low-cost brokerages: Several online brokerages offer low or commission-free trading options. These can be advantageous for smaller trades.

- Use limit orders: Limit orders allow you to specify the maximum price you’re willing to pay for a stock or the minimum price you’re willing to sell it for. This can help you avoid overpaying for trades.

- Trade during less active times: Trading during low-volume periods can often result in lower brokerage commissions.

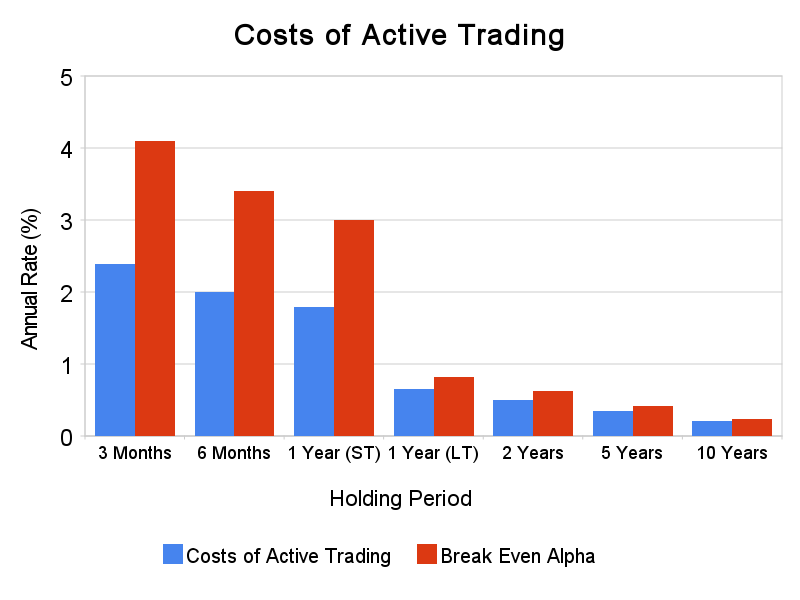

Image: www.mariposacap.com

Frequently Asked Questions (FAQs)

- Q: Which is more expensive: options trading or stock trading?

A: The answer depends on factors such as the underlying asset, option type, and brokerage fees. However, options trading generally incurs higher upfront costs due to the option premium.

- Q: Can I lose more than I invest in options trading?

A: Yes, options trading involves the potential for unlimited losses. Unlike stock trading, where losses are limited to the investment amount.

- Q: What is the purpose of time value in options pricing?

A: Time value reflects the remaining time until the option’s expiration date. It represents the potential for the underlying asset’s price to fluctuate and make the option more valuable.

- Q: How can I find low-cost brokerages for trading?

A: Compare commission structures and fees from different brokerages online or consult with other traders in forums and online communities.

Options Trading Costs Vs Stock Trading Cost

Image: doc.hybridsolutions.com

Conclusion

Navigating the nuances of options trading costs vs. stock trading costs is essential for successful trading. By understanding the intricacies of each, you can optimize your trading strategy, minimize costs, and maximize your potential returns.

If you’re interested in exploring options trading or stock trading, it’s highly recommended to further your research, consult with financial professionals, and gain a comprehensive understanding of the risks and rewards involved.