Introduction:

In the vast realm of finance, options trading stands as a sophisticated strategy that harnesses the potential of time and risk to amplify returns. Among the diverse avenues of options trading, over-the-counter (OTC) transactions occupy a unique niche, offering unparalleled flexibility and tailored customization. For savvy investors seeking to navigate the intricate web of options, understanding OTC options trading is paramount.

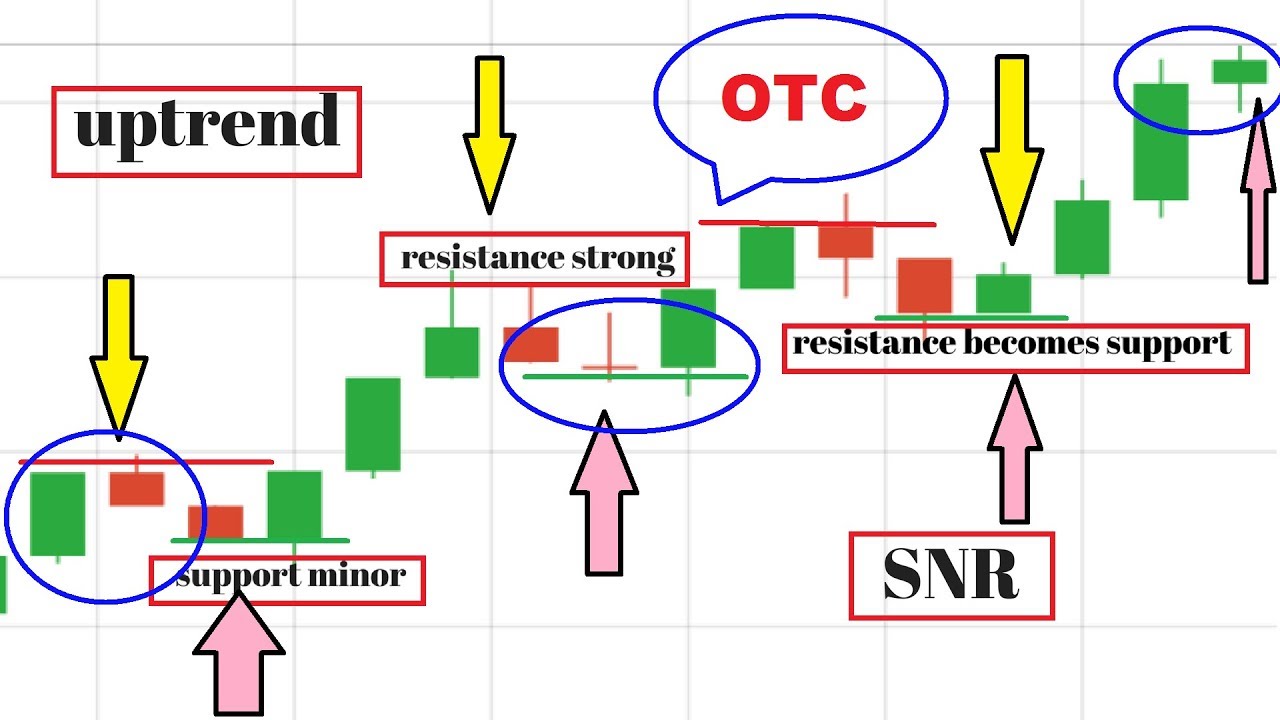

Image: www.youtube.com

OTC options, unlike standardized exchange-traded options, are agreements made between two parties directly, devoid of the intermediation of an exchange. This bespoke approach allows counterparties to tailor contract terms to their precise needs, embracing specific strike prices, expiration dates, and underlying assets that may not be available through exchange-traded options. Customizing these parameters enables investors to fine-tune their risk and reward profiles, catering to their unique objectives.

Navigating the Landscape of OTC Options

The OTC options market operates as a decentralized network where participants engage in bilateral agreements. Market participants range from retail investors to sophisticated institutional giants, encompassing hedge funds, investment banks, and proprietary trading firms. Each transaction is unique, negotiated privately between the buyer and seller, and documented through bilateral agreements.

The absence of a central exchange in OTC options trading necessitates a robust infrastructure to facilitate efficient execution and settlement. Interdealer brokers play a pivotal role in this ecosystem, serving as intermediaries that connect buyers and sellers. These specialized firms provide liquidity, price transparency, and risk management services, ensuring a smooth flow of transactions.

Advantages of OTC Options:

-

Customization: OTC options offer unparalleled flexibility, allowing investors to tailor contracts to their precise specifications. This customization extends to strike prices, expiration dates, and underlying assets, enabling investors to craft strategies that align seamlessly with their unique risk-reward profiles.

-

Liquidity: Despite the absence of a centralized exchange, the OTC options market boasts robust liquidity, particularly for popular underlying assets and standard contract terms. Interdealer brokers and proprietary trading firms contribute significantly to this liquidity, ensuring efficient execution and timely settlement.

-

Access to Complex Products: OTC options provide access to a wider spectrum of products, including exotic options such as barrier options, binary options, and variance swaps. These complex instruments are not typically available through exchange-traded options, expanding the toolset for sophisticated investors.

-

Privacy: OTC options transactions are conducted privately between the counterparties, offering a higher degree of confidentiality than exchange-traded options. This privacy can be advantageous for investors seeking to maintain discretion over their trading activities.

Considerations for OTC Options:

-

Counterparty Risk: OTC options involve bilateral agreements, introducing the risk of default by the counterparty. Careful consideration of the counterparty’s creditworthiness and track record is essential to mitigate this risk.

-

Regulatory Oversight: OTC options markets are subject to less regulatory oversight compared to exchange-traded options. This reduced oversight poses the potential for misconduct or misrepresentation, emphasizing the importance of due diligence and dealing with reputable counterparties.

-

Transaction Costs: While OTC options offer flexibility, they may incur higher transaction costs due to the absence of a central exchange. These costs can include bid-ask spreads, brokerage fees, and regulatory fees.

-

Complexity: OTC options can be complex instruments, requiring a comprehensive understanding of options theory and market dynamics. Investors should possess a high level of financial sophistication and seek professional guidance if necessary.

Image: www.youtube.com

Options Trading Otc

Image: forexscalpingriskrewardratio.blogspot.com

Conclusion:

OTC options trading presents a multifaceted arena where investors can refine their risk and reward profiles through customized contracts. While OTC options offer distinct advantages, prudent consideration of counterparty risk, regulatory oversight, and transaction costs is vital. By leveraging the flexibility and tailored nature of OTC options, savvy investors can enhance their financial strategies, embracing the intricacies of this unique and potentially lucrative market.