Introduction

In the labyrinthine landscape of financial markets, options trading often conjures images of standardized contracts traded on bustling exchanges. However, lurking beneath the surface lies a hidden realm where options dance freely off-exchange, a world teeming with unique opportunities and nuanced challenges.

Image: www.cboe.com

Off-exchange options, also known as over-the-counter (OTC) options, are bilateral contracts negotiated and executed directly between two parties without the involvement of an exchange. This subterranean market offers a myriad of advantages but also demands a heightened level of understanding and risk management.

The Genesis of Off-Exchange Trading

The roots of off-exchange options trading can be traced back to the early days of options themselves. In the 1970s, as options gained popularity, the need for a centralized platform to facilitate standardized trading became apparent. Exchanges were born, providing a venue for buyers and sellers to meet, ensuring transparency, and reducing counterparty risk.

However, the standardized nature of exchange-traded options also posed limitations. Investors craved greater flexibility, the ability to customize contracts, and tailored risk-reward profiles. Off-exchange trading emerged as the answer, providing a haven for sophisticated investors, hedge funds, and institutions seeking bespoke options solutions.

Demystifying the Mechanics of Off-Exchange Trading

Unlike their standardized counterparts, off-exchange options are negotiated one-on-one, allowing for a high degree of customization. The parties involved have the freedom to tailor every aspect of the contract, including the underlying asset, strike price, expiration date, and premium.

This flexibility comes with a unique set of challenges. Without the oversight of an exchange, counterparty risk becomes paramount. Trust and reputation are essential, as the enforceability of the contract rests solely on the integrity of the parties involved.

Advantages and Disadvantages of Off-Exchange Trading

The allure of off-exchange options lies in several compelling advantages. Firstly, the flexibility and customization options allow investors to craft highly specific strategies tailored to their unique investment goals.

Additionally, the absence of exchange fees and regulations can translate into substantial cost savings, especially for large-scale trades. The ability to negotiate directly with the counterparty also creates opportunities for more favorable pricing.

However, off-exchange trading is not without its drawbacks. The lack of standardization and transparency can make it challenging to assess liquidity and price discovery. The absence of an exchange also removes the protective mechanisms, such as circuit breakers, designed to prevent extreme price movements.

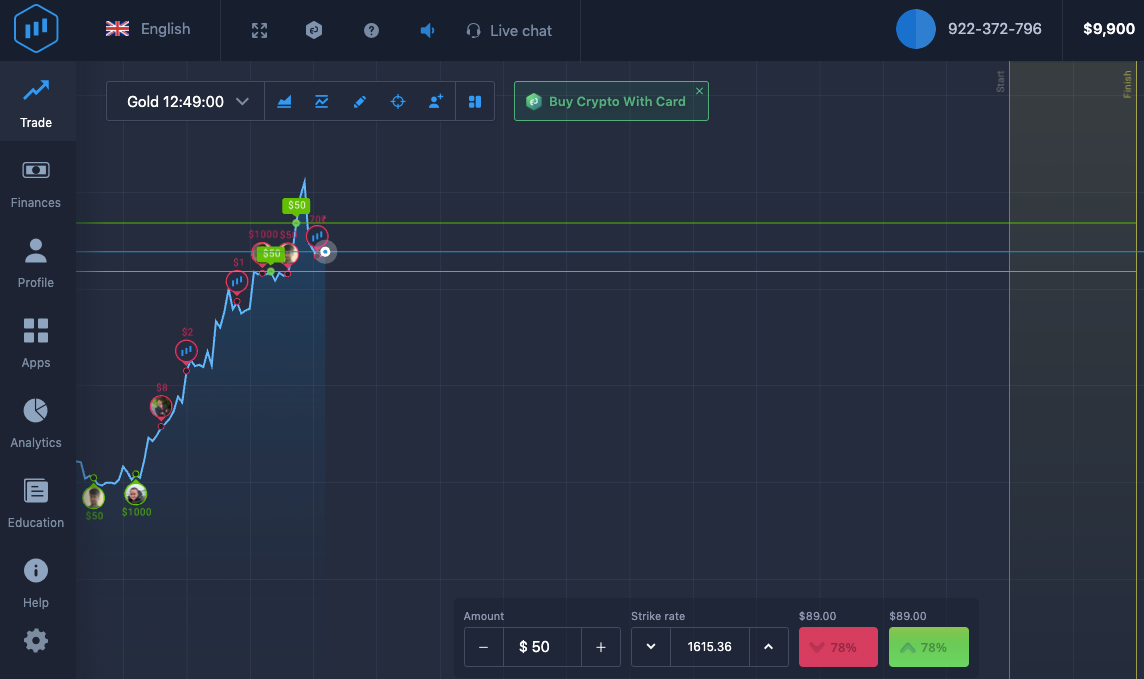

Image: www.slideserve.com

Exploring the Types of Off-Exchange Options

The realm of off-exchange options encompasses a diverse array of variations, each catering to specific investment strategies.

- Vanilla Options: The building blocks of off-exchange options, vanilla options grant the buyer the right but not the obligation to buy (call) or sell (put) the underlying asset at a pre-determined strike price before a set expiration date.

- Exotic Options: Embracing complexity, exotic options extend beyond the vanilla framework, incorporating features such as multiple underlying assets, path-dependent payouts, and sophisticated pricing models.

- Structured Products: Hybrid financial instruments, structured products combine options with other asset classes, such as bonds or loans, to create customized investment solutions.

Navigating the Risks of Off-Exchange Trading

Venturing into the world of off-exchange options demands a keen awareness of the potential risks involved. Counterparty risk, as mentioned earlier, is a primary concern. Due diligence and careful selection of reputable counterparties are crucial.

Moreover, the lack of exchange-enforced margin requirements places the onus of risk management solely on the shoulders of the traders. Understanding the dynamics of off-exchange trading and employing robust risk management strategies are essential to mitigate potential losses.

Current Trends and Future Prospects in Off-Exchange Trading

The off-exchange options market is constantly evolving, influenced by technological advancements and regulatory changes. The rise of electronic trading platforms has facilitated greater efficiency and liquidity, while regulatory efforts have focused on enhancing transparency and mitigating systemic risk.

Looking ahead, off-exchange options are poised for continued growth, driven by increasing demand for tailored investment solutions and the need for risk management amidst volatile market conditions.

Off-Exchange Options Trading

Image: www.daytrading.com

Embarking on Your Off-Exchange Trading Journey

Approaching off-exchange options trading requires a unique blend of expertise, risk tolerance, and access to the right resources. Thorough research and a comprehensive understanding of the nuances of this market are paramount.

Professional guidance from experienced practitioners can prove invaluable in navigating the complexities of off-exchange trading. Additionally, seeking