Options Trading Strategies for SPY: Unlocking the Power of the S&P 500

Image: www.youtube.com

Introduction

In today’s volatile market, options trading has emerged as a potent tool for investors seeking to navigate uncertainty and capitalize on market movements. Among the most widely traded options instruments is the SPDR S&P 500 ETF (SPY), which tracks the performance of the S&P 500 index. This article unveils a comprehensive guide to options trading strategies for SPY, empowering you to harness this powerful investment vehicle and unlock the potential of the S&P 500.

Delving into Options Trading

Options are financial instruments that grant you the right, but not the obligation, to buy (call options) or sell (put options) an underlying asset at a predetermined price (strike price) on a specific date (expiration date). This flexibility allows you to customize your trading strategy and manage risk while pursuing potential gains.

Options Trading Strategies for SPY

1. Bull Call Spread:

This strategy is designed for bullish investors who anticipate a moderate increase in SPY’s price. By buying a lower-priced call option and simultaneously selling a higher-priced call option that expires on the same date, you create a spread that caps your profit potential but limits your potential losses.

2. Bear Put Spread:

This strategy targets bearish traders expecting a decline in SPY’s price. Similar to the call spread, you purchase a lower-priced put option and sell a higher-priced put option. This spread generates profits if SPY’s price falls and limits your downside risk.

3. Covered Call:

This strategy is best suited for investors who own SPY shares and wish to generate additional income through options. By selling a covered call option against your current holdings, you collect a premium in exchange for the obligation to sell your shares at the strike price if reached before expiration.

4. Naked Put:

This aggressive strategy involves selling a put option without owning any underlying SPY shares. It carries a higher potential for profit than covered puts but comes with unlimited downside risk if SPY’s price drops significantly below the strike price.

5. Collar Strategy:

This combination strategy seeks to balance potential gains with downside protection. By purchasing a put option at a strike price below current SPY levels while simultaneously selling a call option at a strike price above current levels, you create a price “collar” that limits your potential losses and profits.

Expert Insights and Actionable Tips

- Consider your risk tolerance: Options trading involves both potential gains and losses. Determine your appetite for risk and trade within your financial means.

- Study historical patterns: Analyze SPY’s historical price charts and market conditions to identify potential trading opportunities.

- Utilize technical analysis: Technical indicators, such as moving averages and support/resistance levels, can provide valuable insights into price trends.

- Manage your emotions: Trading can be an emotional rollercoaster. Stay disciplined and avoid impulsive decisions based on fear or greed.

- Seek professional advice: If unsure, consult a qualified financial advisor who can guide you through the complexities of options trading.

Conclusion

Options trading for SPY offers a powerful means of capitalizing on market movements and hedging against risk. By understanding the various strategies available and employing sound risk management principles, you can unlock the potential of this potent investment tool. Remember, thorough research, a clear understanding of the risks involved, and a disciplined approach are key to successful options trading. Embrace the opportunities it presents and navigate the market confidently, empowering yourself to reach your financial goals.

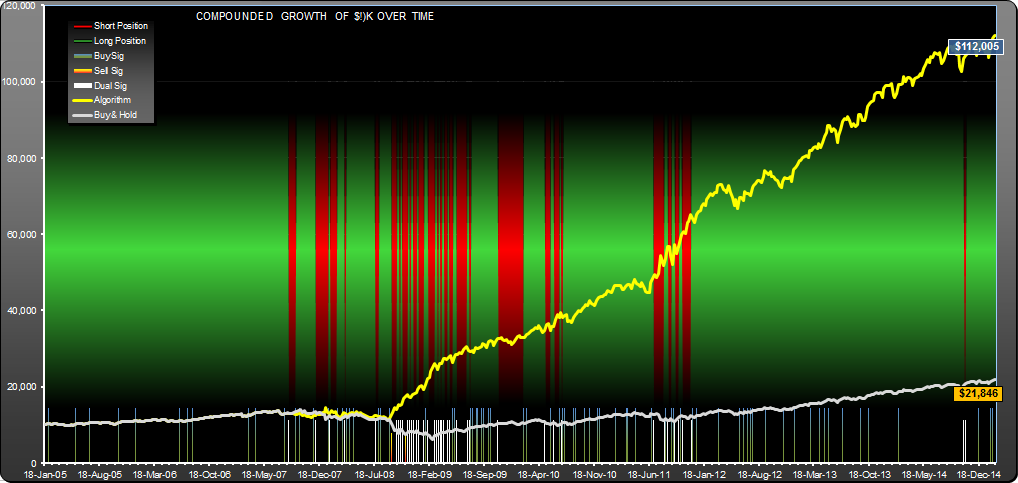

Image: www.signalsolver.com

Options Trading Strategies Spy

Image: simplykesil.weebly.com