A Gateway to Profit in the Grain Market

The allure of the grain market, with its vast potential for profit, has long enticed traders seeking to navigate its fluctuating tides. Among the diverse instruments that pave the way to success, wheat options trading emerges as a powerful tool for discerning investors. As a versatile strategy, it empowers traders to capitalize on the dynamic movements of wheat prices while managing and mitigating risks. Embark on an in-depth exploration of wheat options trading and uncover its intricacies, enabling you to harness its power and elevate your trading endeavors.

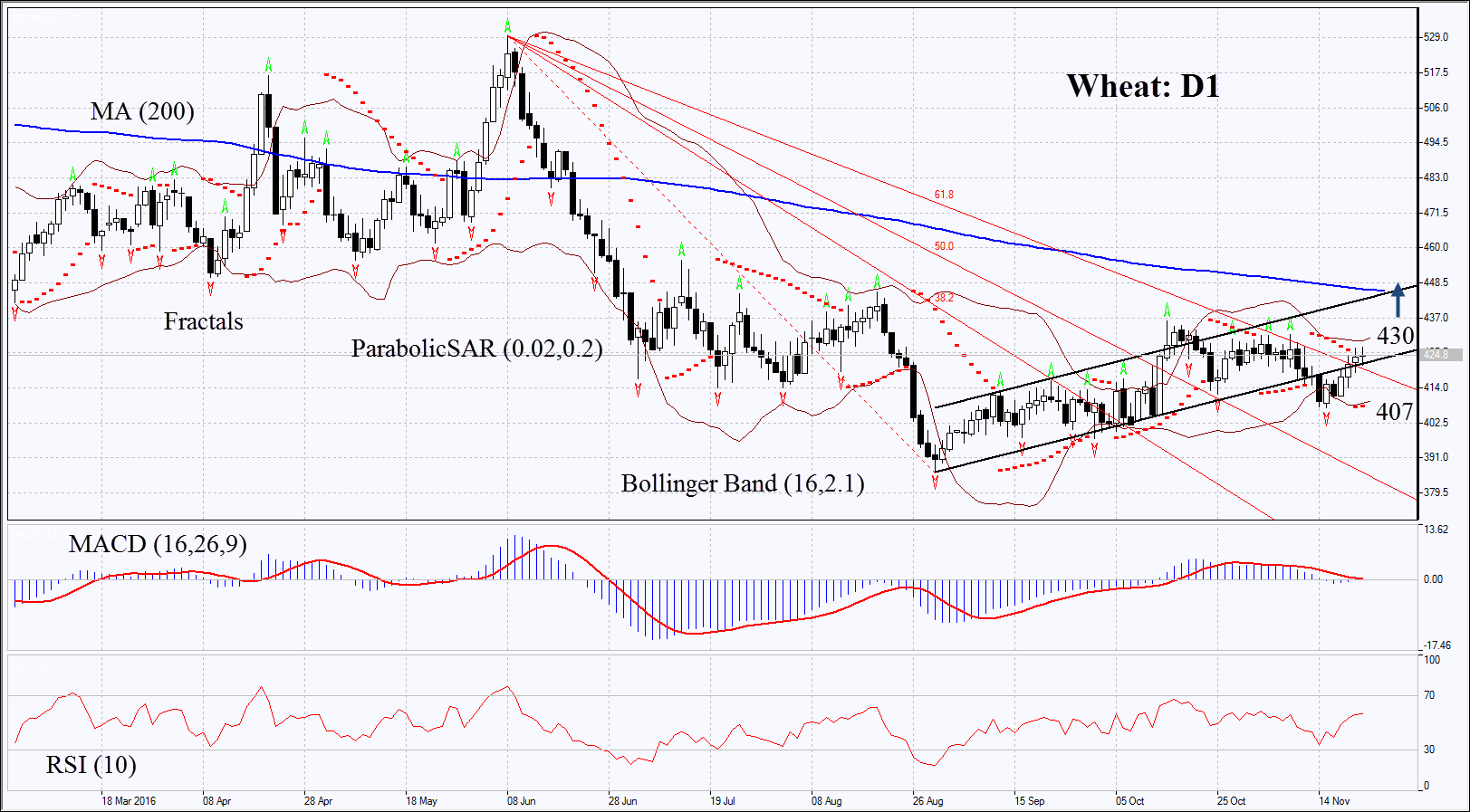

Image: www.ifcmarkets.com

Deciphering the Dynamics of Wheat Options

In the realm of financial instruments, options stand out as contracts that provide the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified timeframe. In wheat options trading, the underlying asset is the wheat futures contract, representing the agreement to buy or sell a specific quantity of wheat at a future date. Options confer the flexibility to navigate market volatility by hedging against price fluctuations or speculating on potential price movements. Buyers of options pay a premium to acquire this right, while sellers receive the premium in exchange for assuming the obligation to fulfill the contract if exercised.

Navigating the Anatomy of Wheat Options

Wheat options, like their counterparts in other markets, possess distinct characteristics that shape their trading dynamics. Primarily, options are classified into two fundamental categories: calls and puts. Call options grant the buyer the right to purchase wheat futures at the strike price on or before the expiration date. Inversely, put options confer the right to sell wheat futures at the strike price. The strike price represents the predetermined price at which the option can be exercised, determining the potential profit or loss for traders. Furthermore, each option contract represents a specific quantity of wheat futures, typically 5,000 bushels for wheat options, standardizing the trading unit.

Exploring the Applications of Wheat Options

The versatility of wheat options extends to a diverse range of trading strategies, catering to the varying risk appetites and objectives of market participants. Hedging, a cornerstone of risk management, employs options to protect against adverse price movements. Speculation, on the other hand, leverages options to capitalize on anticipated price fluctuations. Whether seeking to minimize losses or maximize gains, wheat options provide a flexible framework for executing tailored trading strategies.

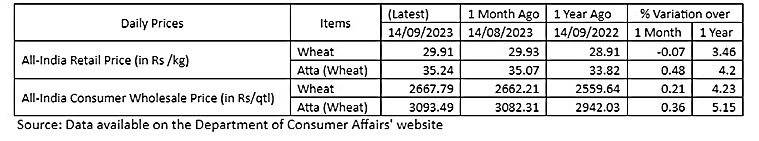

Image: indianexpress.com

Expert Insights and Time-Tested Tips

As you navigate the intricacies of wheat options trading, harnessing the wisdom of experienced traders can prove invaluable. Seasoned professionals emphasize the significance of thorough research and analysis. By delving into historical data, market trends, and fundamental factors influencing wheat prices, traders can make informed decisions and optimize their trading outcomes. Additionally, managing risk is paramount. Employing appropriate position sizing and stop-loss orders helps mitigate potential losses and preserve capital.

Wheat Options Trading

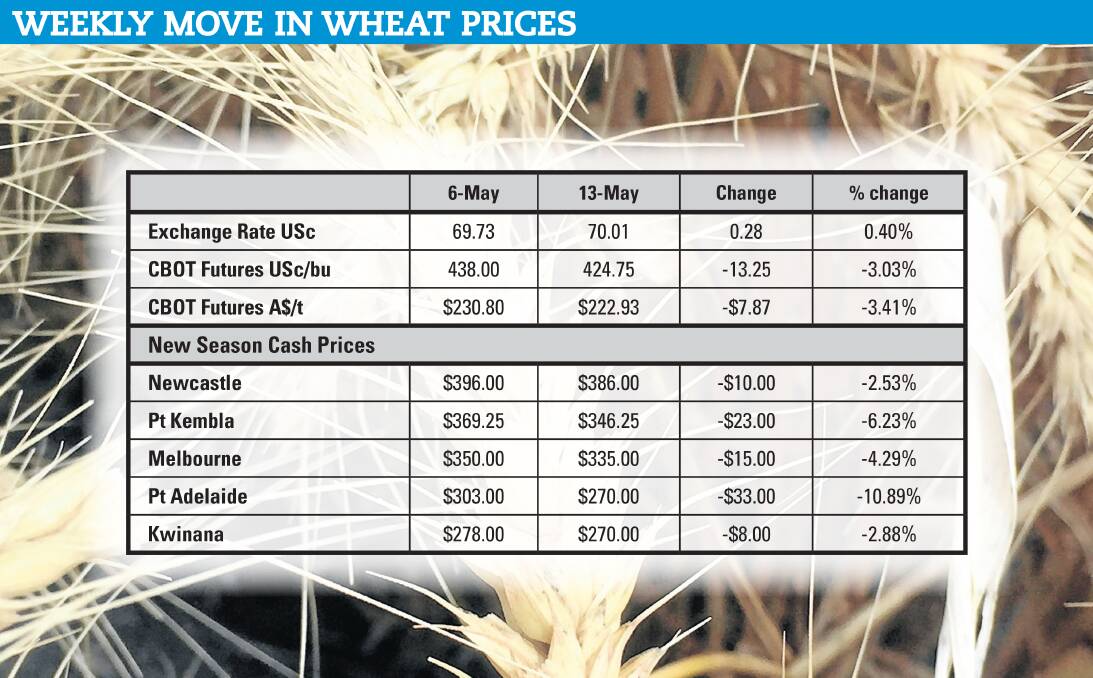

Image: www.farmonline.com.au

A Comprehensive FAQ on Wheat Options

Q: What are the key differences between call and put options in wheat trading?

A: Call options convey the right to buy wheat futures, while put options confer the right to sell wheat futures at the strike price.

Q: How does the strike price impact the potential profit or loss in wheat options trading?

A: The strike price determines the price at which the option can be exercised. Options with a strike price below (for calls) or above (for puts) the current market price have the potential for profit if the market moves in the anticipated direction.

Q: Can you provide a real-life example of how wheat options can be used in hedging?

A: Suppose a farmer expects to harvest wheat in the future, and they are concerned about potential price declines. They can purchase a call option with a strike price above the current market price. If prices fall below the strike price, the option provides the farmer with the right to buy wheat futures at a higher price, mitigating their potential losses.