**Introduction**

As a seasoned trader, I vividly recall the adrenaline rush of my first foray into the exhilarating world of grain options trading at the Chicago Board of Trade (CBT). The bustling trading floor, the cacophony of voices, and the palpable sense of anticipation were intoxicating. However, navigating the complexities of trading hours and market nuances proved to be an equally captivating challenge.

Image: cozosen.web.fc2.com

In this comprehensive guide, we will delve deep into the intricacies of grain options trading hours at the CBT, providing you with the knowledge and insights necessary to make informed decisions and optimize your trading strategies. Grain options offer an array of opportunities for both seasoned professionals and aspiring traders, and understanding the nuances of trading hours is paramount to maximizing your potential.

**Trading Hours for Grain Options at the CBT**

The Chicago Board of Trade (CBT) offers a wide range of grain options contracts, including those for corn, soybeans, wheat, and oats. These contracts are traded during specific trading hours, which vary depending on the underlying grain.

- Corn: 8:30 AM CST – 1:15 PM CST

- Soybeans: 8:30 AM CST – 1:15 PM CST

- Wheat: 9:00 AM CST – 1:15 PM CST

- Oats: 9:00 AM CST – 1:15 PM CST

It is crucial to note that these trading hours are subject to change during holidays or other special events. Always refer to the official CBT website for the most up-to-date information.

**Trading Sessions**

Grain options trading at the CBT is divided into three distinct trading sessions:

- Pre-Open Session: 7:20 AM CST – 8:30 AM CST. This session allows traders to enter and modify orders before the official start of trading hours.

- Regular Trading Session: 8:30 AM CST – 1:15 PM CST. This is the main trading session during which most trades occur.

- Post-Close Session: 1:15 PM CST – 1:45 PM CST. This session allows traders to close out positions or adjust orders after the regular trading session has ended.

Understanding these trading sessions is essential for planning your trading strategies and managing your positions effectively.

**Types of Grain Options Contracts**

The CBT offers two main types of grain options contracts:

- Call Options: Give the buyer the right, but not the obligation, to buy the underlying grain at a specified price (strike price) on or before the expiration date.

- Put Options: Give the buyer the right, but not the obligation, to sell the underlying grain at a specified price (strike price) on or before the expiration date.

Traders can choose from a variety of strike prices and expiration dates to tailor their strategies.

1.jpeg)

Image: www.dailymarketminute.com

**Additional Tips and Expert Advice**

To enhance your success in grain options trading at the CBT, consider the following tips and expert advice:

- Research the Grain Markets: Stay informed about global grain supply and demand dynamics, as well as factors that influence prices, such as weather conditions, geopolitical events, and economic indicators.

- Manage Your Risk: Use stop-loss orders and other risk management techniques to limit potential losses. Understand the concept of time decay and its impact on option premiums.

- Take Advantage of Trading Tools: Utilize the CBT’s online trading platform, mobile apps, and other tools to monitor the markets, place orders, and stay connected on the go.

- Educate Yourself: Attend industry events, read books and articles, and seek guidance from experienced traders or brokers to continuously enhance your knowledge and skills.

**FAQs**

Q: What is the minimum trading unit for grain options at the CBT?

A: The minimum trading unit is 1 contract, which represents 5,000 bushels of grain.

Q: What are the expiration dates for grain options contracts at the CBT?

A: Expiration dates vary depending on the underlying grain and contract type, but they typically range from monthly to quarterly.

Q: What is the last trading day for grain options contracts at the CBT?

A: The last trading day for a grain options contract is typically two business days before the expiration date.

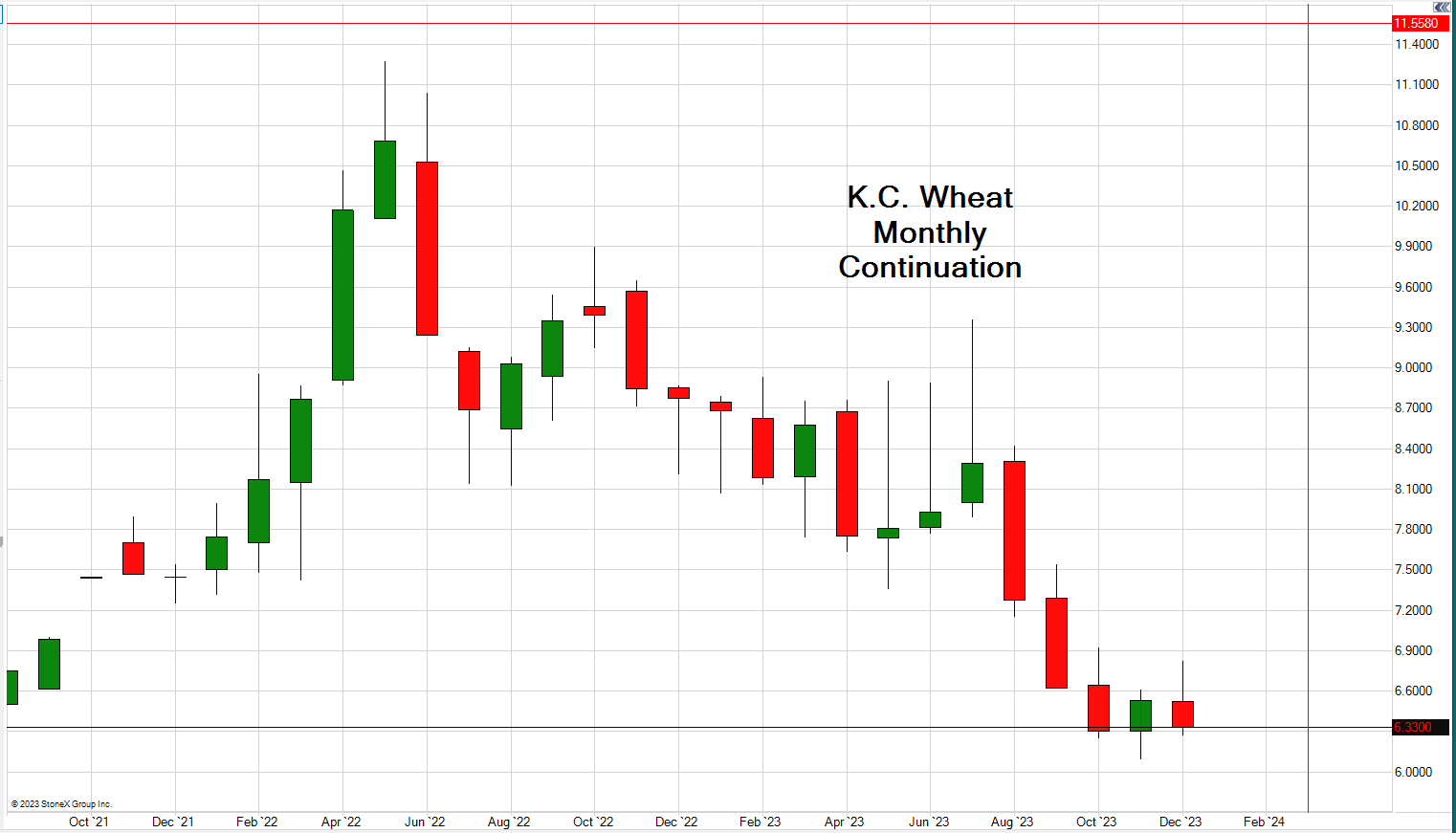

Trading Hours Grain Options Cbt

Image: jimwyckoff.com

**Conclusion**

Understanding grain options trading hours at the Chicago Board of Trade is fundamental for success in this dynamic and lucrative market. By adhering to the trading hours, comprehending the different trading sessions, and utilizing expert advice, you can enhance your trading strategies and maximize your potential returns.

Are you ready to delve into the exhilarating world of grain options trading at the CBT? Embrace the challenge, educate yourself, and seize the opportunities that await you.