Traders seeking to enhance their profitability often turn to technical analysis, the study of historical price movements to forecast future trends. One of the most reliable technical patterns is the double top, a formation that signals a potential reversal in a stock’s upward trajectory. Understanding how to identify and trade a double top can open doors to lucrative opportunities in the financial markets.

Image: howtotradeblog.com

What is a Double Top?

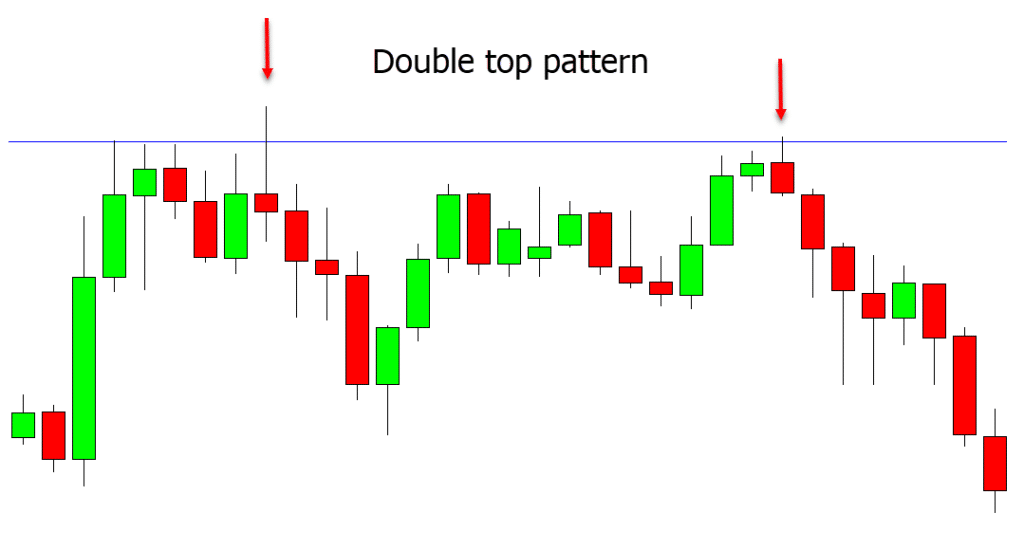

A double top is a bearish chart pattern consisting of two successive peaks of approximately equal height, separated by a trough. The peaks are typically formed within a specific time frame, ranging from several days to several weeks. The pattern is considered complete when the stock price breaks below the support level established by the trough between the two peaks.

Importance of Double Top Option Trading

Double tops are significant for option traders because they provide a high-probability setup for initiating bearish strategies. When a double top forms, it indicates that the upward momentum has become exhausted, and the stock is likely to experience a correction or reversal. This knowledge enables traders to position themselves to profit from the anticipated decline in the underlying asset’s price.

Steps to Trade a Double Top Option

-

Identify the Double Top Pattern: Monitor the stock’s price action closely to identify the formation of the two peaks and the connecting trough.

-

Confirm the Break of Support: Wait for the stock price to break below the support level established by the trough. This confirmation signals the validity of the double top pattern.

-

Choose the Option Strategy: Select an option strategy that aligns with your risk tolerance and trading goals. Common choices include selling a call option if you expect a modest decline or selling a put option if you anticipate a more pronounced correction.

-

Determine the Strike Price: Choose a strike price slightly below the lower peak of the double top for selling call options or slightly above the lower peak for selling put options.

-

Calculate Trade Parameters: Determine the number of options contracts to trade based on your analysis of the potential risk and reward. Consider factors such as volatility and time to expiration.

-

Monitor and Adjust: Monitor the option’s position closely and make adjustments as needed based on market conditions and price action.

Image: stockmarketsguides.com

Double Top Option Trading

Image: www.pinterest.co.uk

Conclusion

Mastering the art of trading double tops in options can provide substantial advantages for traders. By recognizing this bearish chart pattern and executing well-structured trades, you can increase your chances of success in the financial markets. Remember, thorough research, a disciplined approach, and sound risk management are crucial to navigating the complexities of option trading.