Introduction

In the realm of investing, stock options have emerged as a powerful vehicle for financial growth. For investors seeking exposure to the dynamic entertainment industry, Netflix’s stock options offer a compelling opportunity to participate in the company’s ongoing success.

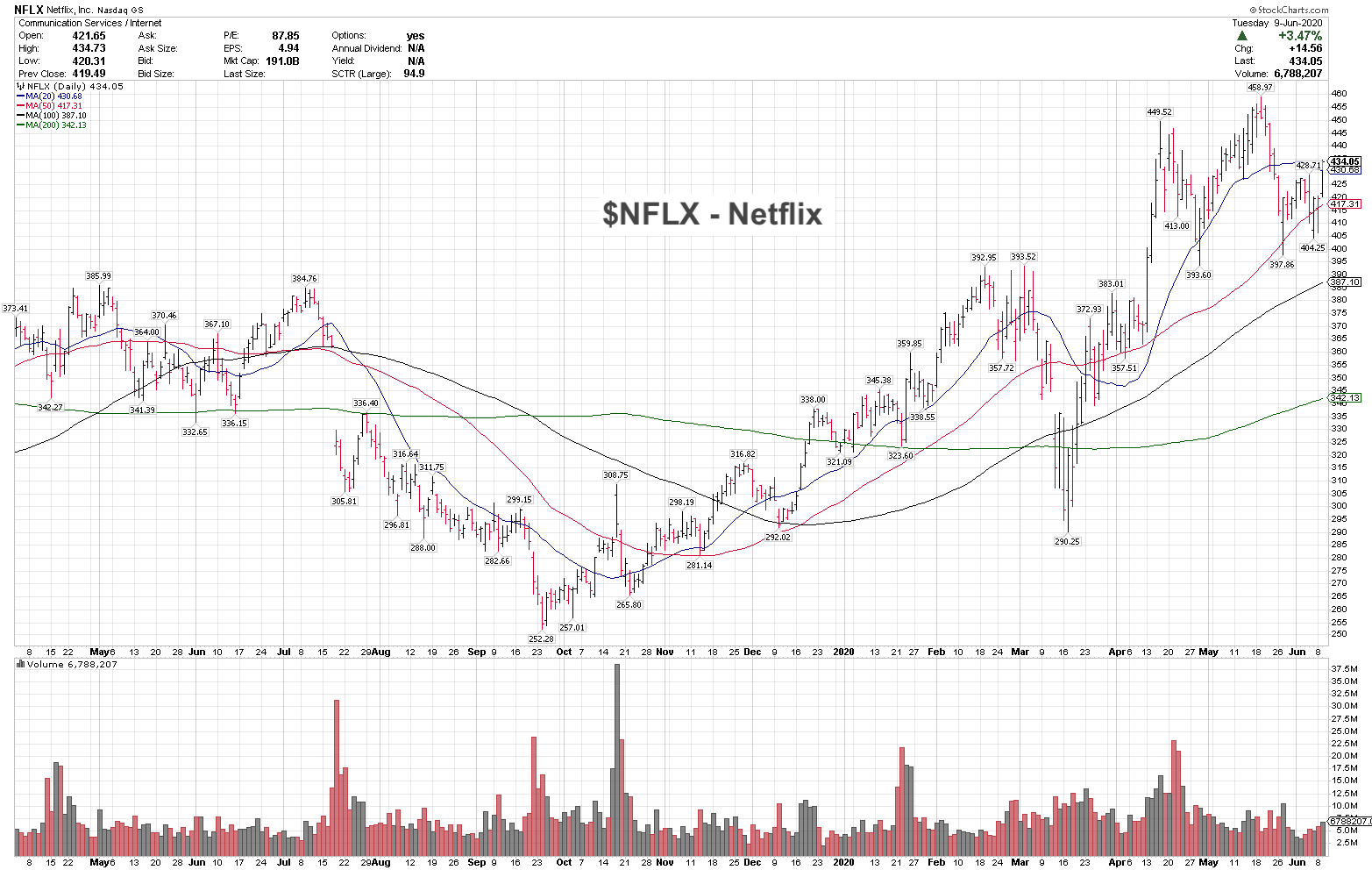

Image: www.seeitmarket.com

Netflix stock options have gained significant prominence in recent years due to the company’s meteoric rise. As a testament to its dominance in the streaming landscape, Netflix boasts over 209 million paid subscribers worldwide and is continually expanding its global reach.

Understanding Netflix Stock Options

To delve into the intricacies of Netflix stock options, it is essential to understand their fundamental nature. Stock options confer the right, but not the obligation, to buy or sell a specific number of shares at a predefined price on or before a particular date.

Netflix offers two primary types of stock options: incentive stock options (ISOs) and non-qualified stock options (NSOs). ISOs are typically granted to employees and provide tax benefits, while NSOs are often used for external parties, such as consultants and contractors.

Types of Netflix Stock Options

- Incentive Stock Options (ISOs): ISOs are granted to employees and offer tax benefits. The proceeds from exercising ISOs are taxed as capital gains rather than as ordinary income, potentially reducing the tax burden.

- Non-Qualified Stock Options (NSOs): NSOs are typically granted to external parties and do not offer tax benefits. The proceeds from exercising NSOs are taxed as ordinary income, which can lead to higher tax liability.

Key Features of Netflix Stock Options

- Exercise Price: This is the price at which the holder can buy or sell the underlying shares.

- Expiration Date: The date on or before which the option can be exercised.

- Vesting Period: The timeframe over which the option gradually becomes exercisable, typically to ensure employee retention.

- Strike Price: The price at which the underlying shares can be bought (for calls) or sold (for puts) if the option is exercised.

Image: www.barrons.com

Benefits of Trading Netflix Stock Options

Trading Netflix stock options offers several potential benefits for investors. Options provide flexibility, as investors can choose to buy or sell the underlying shares based on market conditions.

- **Leverage:** Options offer the potential for magnified returns compared to investing directly in the underlying shares.

- **Limited Risk:** Options allow investors to limit their potential losses to the premium paid for the option.

- **Hedging:** Investors can use options to hedge against potential downturns in the stock market or to protect their existing investments.

- **Income Generation:** Options can be used to generate income through option strategies such as selling covered calls or writing cash-secured puts.

Risks of Trading Netflix Stock Options

As with any investment, trading Netflix stock options also carries inherent risks. It is crucial to be aware of these risks before participating in options trading.

- **Unlimited Profit Potential:** While options offer limited risk to the option seller, the potential profit for the option buyer is theoretically unlimited.

- **Time Decay:** Options have a limited lifespan, and their value decays over time. This decay can lead to losses for option holders who do not exercise or sell their options before they expire.

- **Market Volatility:** The value of options is heavily influenced by market volatility. Significant market swings can lead to rapid price fluctuations in options, potentially resulting in substantial gains or losses.

- **Complexity:** Options trading can be complex and requires a comprehensive understanding of the underlying principles and strategies.

Tips for Trading Netflix Stock Options

Successfully trading Netflix stock options requires a combination of knowledge, skill, and strategy. Here are some tips to help you navigate the options market:

- **Educate Yourself:** Thoroughly research and understand the concepts and mechanics of options trading.

- **Set Realistic Goals:** Set clear and achievable goals for your options trading. Do not expect to become a millionaire overnight.

- **Manage Your Risk:** Determine your risk tolerance and allocate your capital accordingly. Never risk more than you can afford to lose.

- **Use a Trading Platform:** Consider using a reputable trading platform that offers robust tools and resources for options trading.

- **Consider an Option Analyzer:** Utilize option analyzers to assess the potential risks and rewards of different option strategies.

FAQs on Netflix Stock Options

- Q: What is the difference between a call option and a put option?

- A: A call option gives the holder the right to buy the underlying shares at the strike price, while a put option gives the holder the right to sell the underlying shares at the strike price.

- Q: What factors influence the price of Netflix stock options?

- A: The price of Netflix stock options is influenced by factors such as the underlying stock price, market volatility, time to expiration, and interest rates.

- Q: What is the best strategy for trading Netflix stock options?

- A: The best strategy depends on individual risk tolerance, investment goals, and market conditions. However, popular strategies include selling covered calls, writing cash-secured puts, and vertical spreads.

Netflix Stock Options Trading

![1: Netflix Stocks Prices [2] | Download Scientific Diagram](https://www.researchgate.net/profile/Koffi-Enakoutsa/publication/339710414/figure/fig1/AS:865541304614921@1583372536789/Netflix-Stocks-Prices-2_Q640.jpg)

Image: www.researchgate.net

Conclusion

Trading Netflix stock options presents an exciting opportunity for investors to participate in the growth of the entertainment industry giant. By understanding the nuances of options trading, managing risk effectively, and employing sound strategies, investors can harness the potential of Netflix stock options to achieve financial success.

If you are interested in exploring the world of Netflix stock options trading, remember to proceed with caution, educate yourself thoroughly, and seek guidance from experienced professionals when necessary. The path to successful options trading is paved with knowledge, discipline, and a keen understanding of the risks involved.