In the labyrinthine world of finance, options trading often elicits a sense of awe and mystique. However, this complex financial instrument can be a lucrative endeavor for those armed with the right knowledge. One platform that has democratized options trading is Robinhood, a user-friendly app that has captivated millions of investors. Understanding the intricacies of options trading on Robinhood, particularly concepts such as bid, ask, mark, and open interest, is crucial to navigating this market effectively.

Image: www.youtube.com

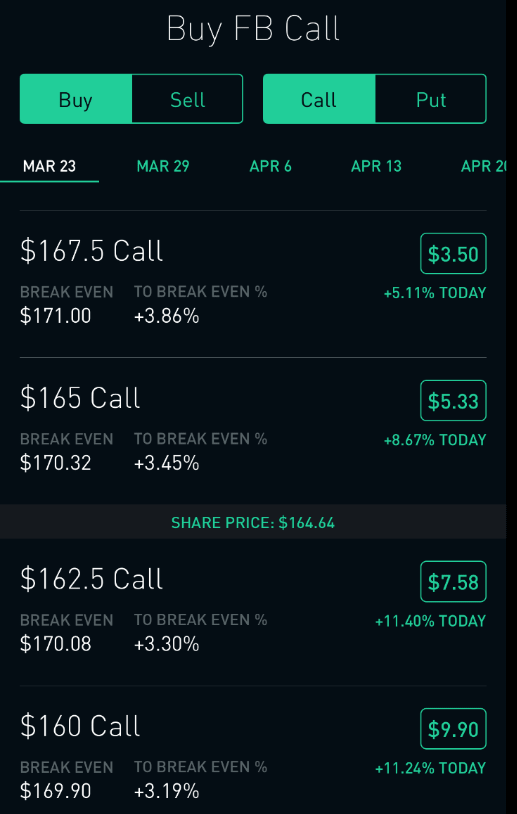

Options, in essence, grant you the right, but not the obligation, to buy or sell an underlying asset at a specified price (strike price) on or before a predetermined date (expiration date). Robinhood’s intuitive platform makes it easy to execute options trades, but comprehending the terminology is paramount.

The Bid-Ask Spread: A Balancing Act

The bid-ask spread, a pivotal concept in options trading, refers to the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). This spread reflects the market’s sentiment and is crucial in determining the potential profitability of a trade. A wide bid-ask spread indicates low liquidity, making it more challenging to fill orders at your desired price. Conversely, a narrow spread suggests high liquidity and facilitated order execution.

Understanding how the bid-ask spread impacts trading strategies is essential. If you believe an option’s value will increase, you’ll want to place a buy order above the current bid price. On the other hand, if you anticipate a decline, you’ll need to place a sell order below the ask price. The bid-ask spread plays a role in profitability, as you’ll need to factor in the spread when calculating your potential gains or losses.

Mark Price: A Snapshot of Value

The mark price, another crucial element in options trading, represents the theoretical fair value of an option. Robinhood calculates this price using a proprietary model that considers various factors, including the underlying asset’s price, the strike price, the time to expiration, and market volatility. The mark price provides an estimate of what the option should be worth in a theoretically perfect market. However, it’s important to note that the actual market price may deviate from the mark price due to factors such as supply and demand.

Open Interest: A Measure of Market Sentiment

Open interest represents the total number of open contracts for a particular option. It provides insights into the market sentiment and the level of activity surrounding an option. High open interest indicates that there are numerous outstanding contracts for that option, suggesting strong market interest. Conversely, low open interest indicates a lack of interest and potential liquidity issues.

Monitoring open interest can be particularly valuable when combined with other indicators. For instance, a sudden increase in open interest alongside a rising underlying asset price could signal a bullish trend, while a decline in open interest combined with a falling underlying asset price could indicate a bearish outlook.

Image: www.makeupera.com

Options Trading Robinhood Bid Ask Mark Open Interest

Image: www.youtube.com

Conclusion

Bid, ask, mark, and open interest are fundamental concepts that underpin options trading on Robinhood. Understanding these concepts will provide you with a solid foundation to navigate this complex financial landscape. By carefully considering these factors, you can make informed trading decisions, increase your chances of success, and capitalize on the opportunities presented by the options market.