How to Unlock the Power of Options Trading on Robinhood: A Comprehensive Guide

Image: www.makeuseof.com

Introduction

In the world of finance, options trading offers a tantalizing realm of possibilities for the savvy investor. Embarking on this journey requires a broker that not only meets your trading needs but also provides a seamless and intuitive platform. Enter Robinhood, the trailblazing investment app that has democratized trading for millions of users. If you’re eager to unlock the potential of options trading on Robinhood, this comprehensive guide will guide you through every step of the process.

Understanding Options Trading

As a starting point, let’s dissect the fundamentals of options trading. Simply put, options are financial contracts that grant you the right, but not the obligation, to buy (call option) or sell (put option) a specific underlying asset at a predetermined price (strike price) by a certain date (expiration date). This flexibility provides you with numerous strategies to leverage market movements and potentially amplify your profits.

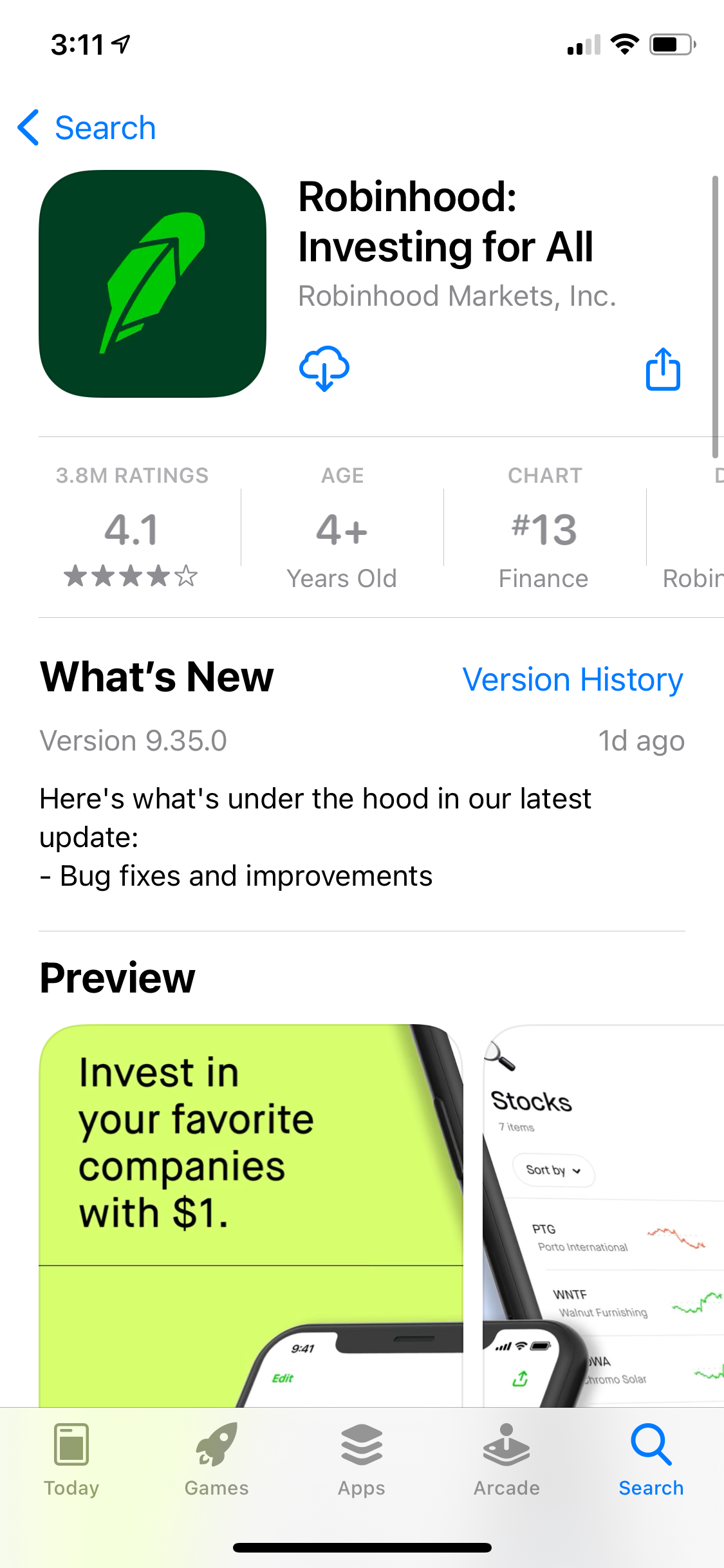

Robinhood’s Options Trading Platform

Robinhood has earned its reputation by offering a user-friendly platform that simplifies complex concepts for novice traders. Their options trading tools are no exception. The platform boasts an intuitive design, making it easy to navigate and execute trades seamlessly. Whether you’re a seasoned pro or a trading neophyte, Robinhood caters to your every need.

How to Activate Options Trading

Before you can dive into the thrilling world of options trading, you must activate the feature on your Robinhood account. Here’s how to do it in a few simple steps:

-

Eligibility Check: Ensure your account has been open for at least 90 days and meets the minimum balance and experience requirements set by Robinhood.

-

Online Application: Head to the Robinhood website or app and complete the options trading application form. Provide accurate information about your investment goals, trading experience, and risk tolerance.

-

Approval and Review: Once submitted, Robinhood will review your application and notify you of the approval decision via email. Carefully read the approval notice, as it contains important information about options trading.

-

Knowledge Assessment: Before you can commence live trading, Robinhood requires you to pass an options knowledge assessment. This ensures your understanding of the inherent risks and potential rewards of options trading.

Trading Options on Robinhood

With options trading approved, you’re now ready to explore the myriad of strategies available. Here are a few examples to whet your appetite:

-

Covered Call: Generate income by selling a call option on stocks you own, giving others the right to buy them at a specified price.

-

Protective Put: Protect your portfolio from downside risk by purchasing a put option on assets you hold, giving you the right to sell them at a predetermined price.

-

Bullish Spread: Capitalize on rising prices by buying a call option and simultaneously selling a call option with a higher strike price.

Expert Insights

Join market maestro Mark Cuban, who advises novice options traders to start small and gradually increase their positions as they gain experience. Value investor Warren Buffett stresses the importance of thorough research and understanding the company behind the option you’re trading.

Conclusion

Activating options trading on Robinhood is a gateway to a world of possibilities and potential profits. By embracing the step-by-step process outlined in this guide, you can unlock the full spectrum of options trading strategies and empower yourself to make informed financial decisions. Remember, trading options involves inherent risks, so approach it with prudence and a deep understanding of the market. May your options journey be filled with success and financial prosperity.

Image: www.youtube.com

How To Turn On Option Trading Robinhood

Image: www.youtube.com