Introduction

Options trading has emerged as a multifaceted investment strategy that grants individuals the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified period. As a result, this dynamic financial instrument has gained immense popularity among seasoned traders and novice investors alike. However, the complexities surrounding the taxation of options trading often leave many scratching their heads. In this comprehensive guide, we delve into the intricacies of service tax on options trading, unlocking a deeper understanding of its implications for investors.

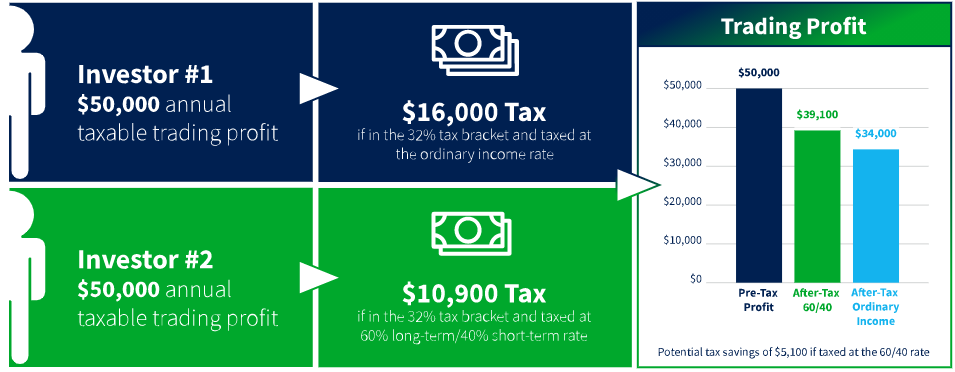

Image: c1.bats.com

Demystifying Service Tax on Options Trading

Service tax, a type of indirect tax levied on various services rendered in India, including the trading of options, is applicable to both domestic and foreign investors. The tax rate for options trading currently stands at 18%. It is essential to note that service tax is not payable on the premium received for selling an option. Instead, it is levied on the premium paid when purchasing an option contract.

Understanding the Taxability of Different Options Strategies

To fully grasp the impact of service tax on options trading, it is crucial to examine how it affects various trading strategies. Here’s a closer look at the taxability of common options strategies:

Buying Options

When an investor purchases a call or put option, the service tax is levied on the premium paid at the time of acquisition. This tax is applicable regardless of whether the option is exercised or expires worthless.

Image: www.angelone.in

Selling Options

Unlike buying options, the premium received when selling an option is not subject to service tax. However, if the option is exercised, the seller may be liable to pay service tax on the difference between the strike price and the market price of the underlying asset at the time of exercise.

Covered Call Writing

In covered call writing, an investor sells a call option on an underlying asset they own. In this scenario, service tax is applicable on the premium received from selling the call option.

Navigating the Service Tax Labyrinth: Practical Tips for Investors

To ensure seamless compliance with service tax regulations and maximize the efficiency of their options trading endeavors, investors should consider the following practical tips:

-

Maintain Accurate Records: Vigilantly track all options trading transactions, including the date of acquisition, premium paid, strike price, and other relevant details. This meticulous record-keeping will streamline the process of calculating and paying service tax.

-

Leverage Technology: Utilize tax software or online platforms designed specifically for options trading. These tools can automate calculations, generate reports, and facilitate timely tax payments, enhancing accuracy and efficiency.

-

Seek Professional Guidance: When dealing with complex tax matters, consulting a knowledgeable accountant or tax advisor is highly recommended. They possess the expertise to decipher tax regulations and provide personalized guidance, ensuring that your options trading activities are fully compliant with the law.

Service Tax On Options Trading

Image: www.forbes.com

Conclusion

Service tax on options trading is a crucial aspect that all investors must comprehend to make informed decisions and ensure compliance with regulations. By delving into the nuances of taxability for various options strategies and implementing practical tips, investors can successfully navigate the complexities of service tax, maximizing their returns and minimizing any potential tax-related pitfalls. As options trading continues to evolve, staying abreast of the latest developments in taxation is essential to adapt to the ever-changing regulatory landscape.