For investors seeking to enhance their returns and manage risks effectively, option trading offers a dynamic avenue to explore. As one of India’s leading financial institutions, ICICI Bank provides a comprehensive platform for investors to engage in option trading. This article delves into the intricacies of ICICI option trading, providing a detailed exploration of its concepts, strategies, and practical implications.

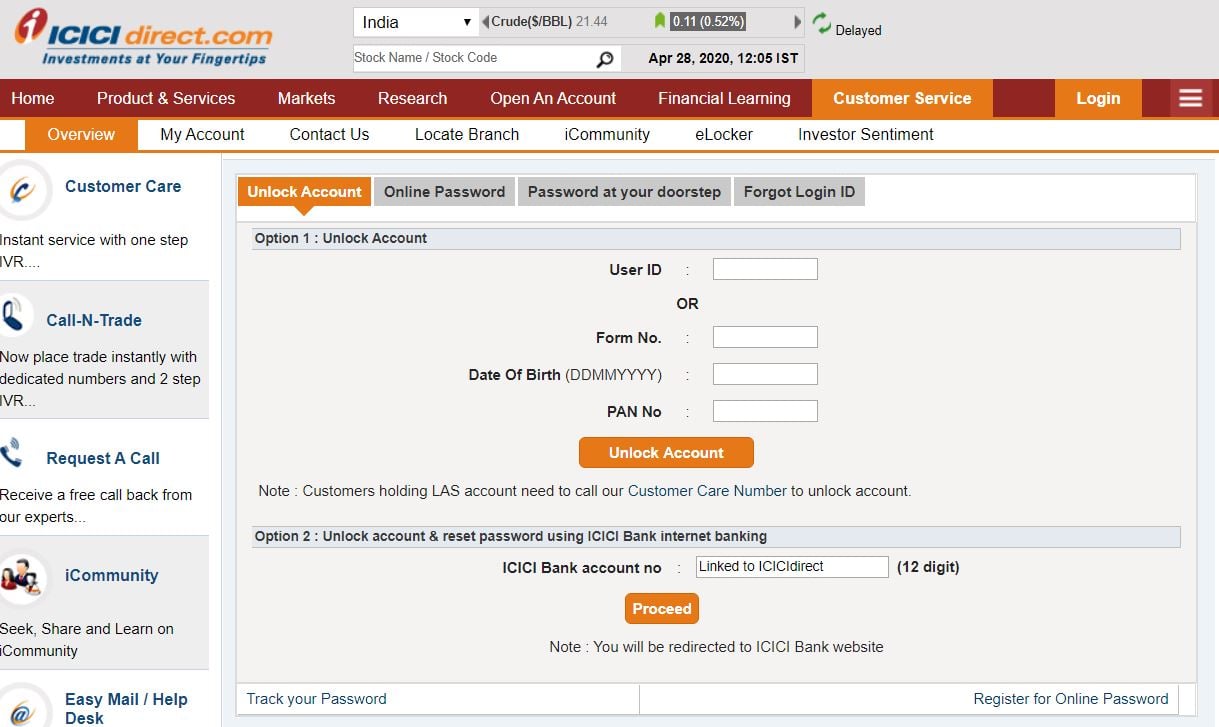

Image: www.youtube.com

Understanding ICICI Option Trading

Option trading involves the buying and selling of option contracts, which grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a pre-determined price (strike price) within a specific time frame. Options can be either call options, which give the buyer the right to buy the underlying asset, or put options, which offer the right to sell the underlying asset.

ICICI Bank facilitates option trading in various asset classes, including equity stocks, indices, and commodities. The bank provides a user-friendly trading platform that enables investors to efficiently execute option strategies and monitor their positions.

Types of Options:

Call Options: Give the buyer the right to buy a specified number of shares of an underlying asset at a specified strike price on or before a certain date. It allows them to profit from upward movements in the underlying asset’s price.

Put Options: Grant the buyer the right to sell a specified number of shares of an underlying asset at a specified strike price on or before a certain date. It enables them to profit from downward swings in the asset’s price.

Understanding Core Concepts

Strike Price: The pre-defined price at which an option contract can be exercised.

Expiry Date: The date on which the option contract expires.

Premium: The price paid to purchase an option contract, which includes the time value and intrinsic value.

Time Value: The amount of premium that represents the potential for the underlying asset’s price to fluctuate before the expiration date.

Intrinsic Value: The difference between the underlying asset’s current price and the strike price.

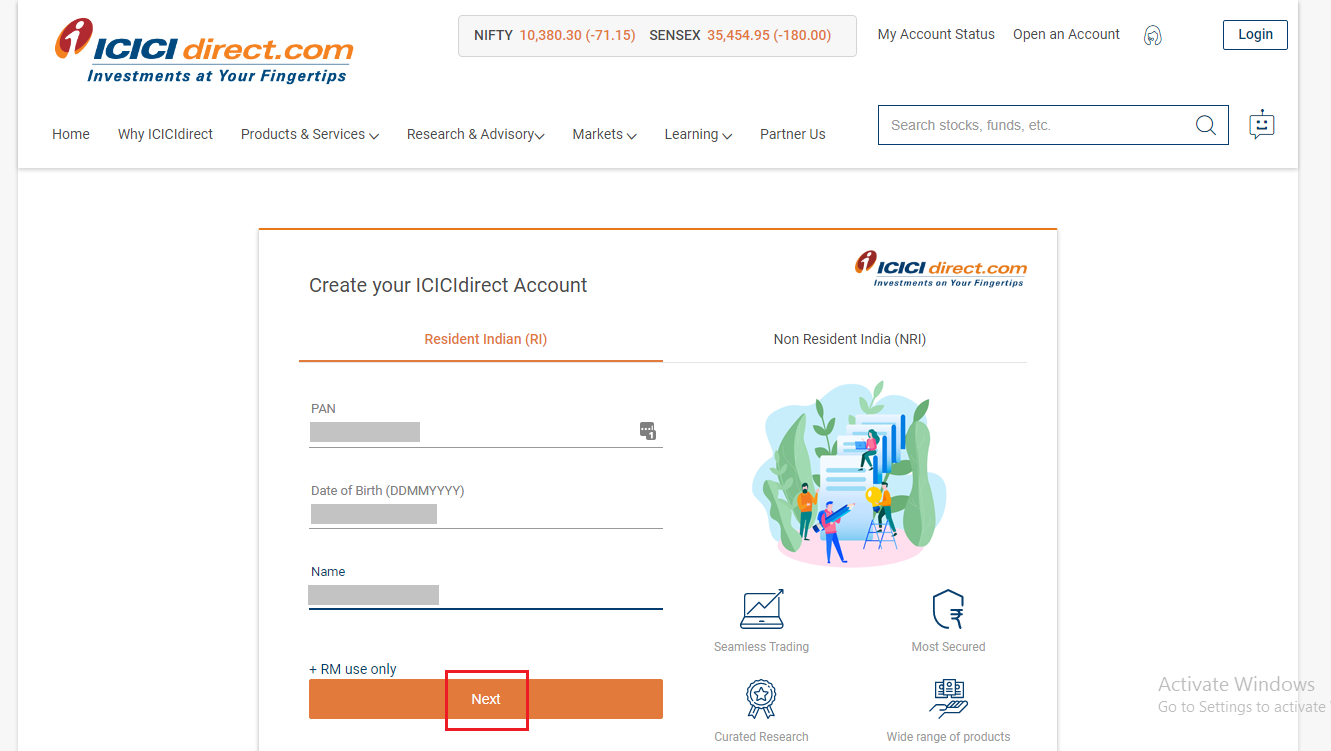

Image: www.chittorgarh.com

Benefits of Option Trading

- Enhanced Returns: Options offer the potential for significant returns, especially when the price of the underlying asset moves in a favorable direction.

- Risk Management: Options can be used to hedge against potential losses by mitigating risks associated with downside market movements.

- Income Generation: By selling or writing options, investors can generate income from option premiums, irrespective of the direction of the underlying asset’s price.

- Speculation: Option trading provides a platform for speculative investments, allowing traders to make educated bets on the future price direction of an underlying asset.

Strategies

Covered Call: A conservative strategy where an investor selling a call option while also owning the underlying asset. It aims to generate income while limiting potential upside gains.

Protective Put: An investor buys a put option as insurance against potential losses in the underlying asset. It serves as a downside protection strategy.

Bull Call Spread: This strategy involves buying a lower-strike call option and selling a higher-strike call option, aiming to capture a rise in the underlying asset’s price while limiting the potential loss.

Bear Put Spread: Similar to the bull call spread, it involves buying a lower-strike put option and selling a higher-strike put option to profit from a decrease in the underlying asset’s price.

Choosing the Right Strategy

Selecting an appropriate option strategy depends on the investor’s risk tolerance, investment goals, and market outlook. Factors to consider include the underlying asset’s volatility, trend, and expected price movement. It is crucial for investors to conduct thorough research and understand the potential risks and rewards involved.

Market Outlook

In recent times, the demand for option trading in India has surged due to increased volatility in the markets and growing investor awareness. ICICI Bank has played a significant role in facilitating this growth by offering a comprehensive range of options trading products and services. As the market evolves, it is expected that option trading will continue to gain prominence as an effective tool for managing risk and maximizing returns.

Icici Option Trading

Image: learn.quicko.com

Tips for Success

- Stay Informed: Regularly monitor market conditions and analyze fundamental and technical factors affecting the underlying asset’s price movement.

- Manage Risk: Carefully assess your risk tolerance and invest only what you can afford to lose. Employ risk management techniques such as stop-loss orders.

- Practice Discipline: Adhere to your trading plan and avoid making impulsive decisions.